- United States

- /

- Leisure

- /

- NasdaqGS:AOUT

Market Cool On American Outdoor Brands, Inc.'s (NASDAQ:AOUT) Revenues

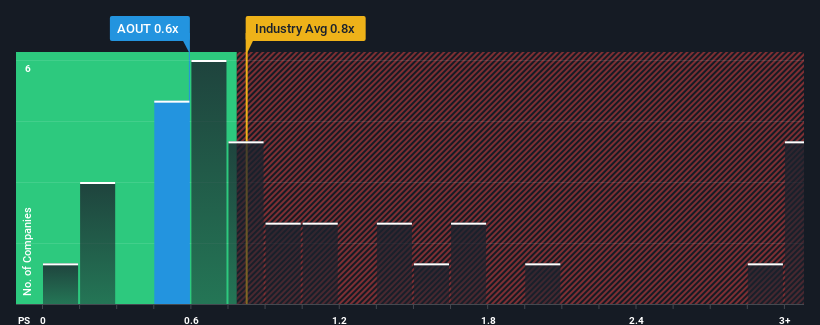

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Leisure industry in the United States, you could be forgiven for feeling indifferent about American Outdoor Brands, Inc.'s (NASDAQ:AOUT) P/S ratio of 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for American Outdoor Brands

How American Outdoor Brands Has Been Performing

American Outdoor Brands certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think American Outdoor Brands' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like American Outdoor Brands' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 5.2% gain to the company's revenues. Still, lamentably revenue has fallen 27% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 2.3% as estimated by the sole analyst watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 1.1%, that would be a solid result.

Despite the marginal growth, we find it odd that American Outdoor Brands is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From American Outdoor Brands' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of American Outdoor Brands' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for American Outdoor Brands that you should be aware of.

If these risks are making you reconsider your opinion on American Outdoor Brands, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AOUT

American Outdoor Brands

Provides outdoor products and accessories for rugged outdoor enthusiasts in the United States and internationally.

Flawless balance sheet minimal.