- United States

- /

- Metals and Mining

- /

- OTCPK:TMRC

3 Promising US Penny Stocks With Over $20M Market Cap

Reviewed by Simply Wall St

Amid a backdrop of tech selloffs and rising Treasury yields, the U.S. stock market has been experiencing notable volatility, reflecting investor concerns over interest rate trajectories following stronger-than-expected job data. Despite these broader market fluctuations, penny stocks continue to capture investor interest, particularly those that represent smaller or newer companies with potential for growth. While the term "penny stocks" may seem outdated, these investments can still offer valuable opportunities when backed by solid financial health and strategic growth plans.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.88M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.87B | ★★★★☆☆ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.7257 | $11.18M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.77M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.20 | $97.06M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.37 | $24.3M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.45 | $368.38M | ★★★★☆☆ |

Click here to see the full list of 728 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Fathom Holdings (NasdaqCM:FTHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fathom Holdings Inc. operates a real estate services platform in the United States, offering integrated residential brokerage, mortgage, title, and insurance services with a market cap of $35.74 million.

Operations: The company's revenue is primarily generated from its Real Estate Brokerage segment at $296.43 million, followed by Mortgage at $10.72 million, Technology at $4.15 million, and Corporate and Other Services at $6.22 million.

Market Cap: $35.74M

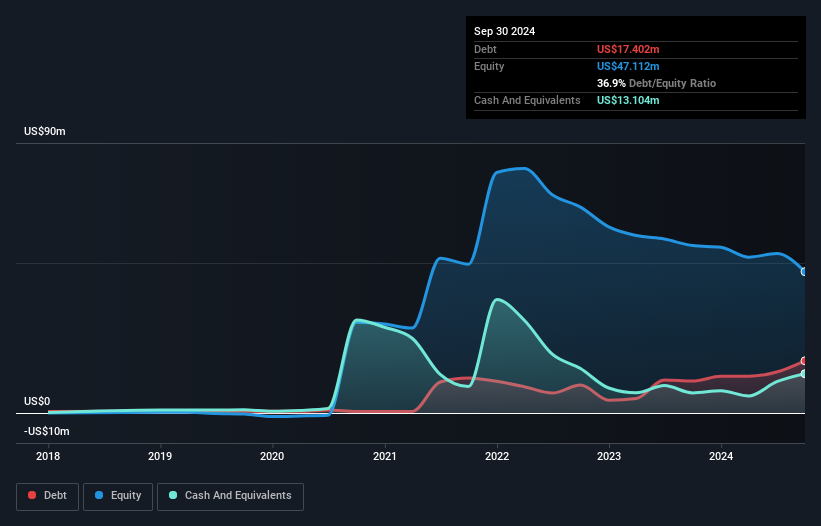

Fathom Holdings, with a market cap of US$35.74 million, is navigating challenges typical for penny stocks, such as recent shareholder dilution and ongoing unprofitability with a negative return on equity of -50.48%. Despite this, the company has maintained stable weekly volatility and possesses sufficient short-term assets to cover liabilities. Recent strategic leadership changes aim to bolster revenue generation and operational efficiency across its real estate services platform. While Fathom's revenue from core segments like Real Estate Brokerage remains substantial at US$296.43 million, it continues to face hurdles in achieving profitability within the next three years amidst fluctuating earnings reports.

- Unlock comprehensive insights into our analysis of Fathom Holdings stock in this financial health report.

- Explore Fathom Holdings' analyst forecasts in our growth report.

GEE Group (NYSEAM:JOB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GEE Group Inc. offers human resources solutions in the United States and has a market cap of $25.99 million.

Operations: The company generates revenue through Industrial Staffing Services, contributing $9.55 million, and Professional Staffing Services, which accounts for $106.94 million.

Market Cap: $25.99M

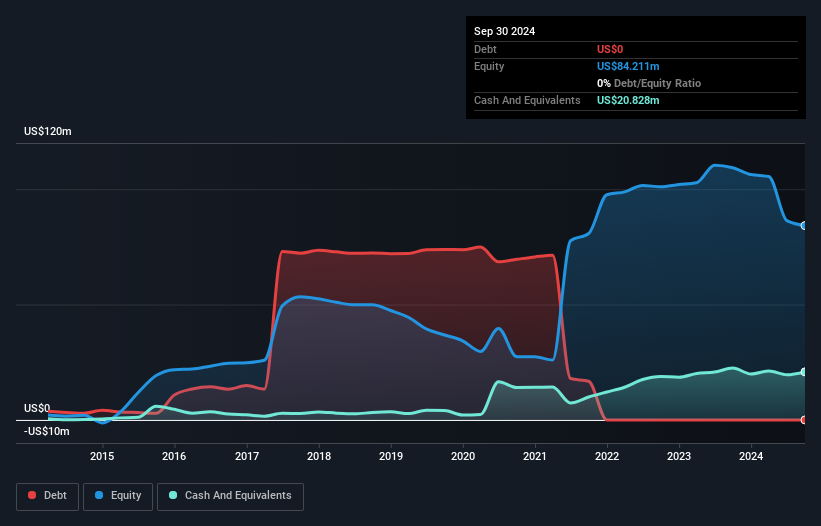

GEE Group, with a market cap of US$25.99 million, faces typical penny stock challenges such as unprofitability and declining revenues. Despite reporting a net loss of US$24.1 million for the full year ending September 2024, the company has managed to reduce its debt significantly over five years and maintain a stable weekly volatility of 11%. The management team is experienced with an average tenure of 6.6 years, enhancing operational stability. GEE Group's short-term assets (US$35.4 million) comfortably exceed both short-term and long-term liabilities, providing some financial resilience amidst ongoing revenue pressures in staffing services.

- Click here to discover the nuances of GEE Group with our detailed analytical financial health report.

- Gain insights into GEE Group's past trends and performance with our report on the company's historical track record.

Texas Mineral Resources (OTCPK:TMRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Texas Mineral Resources Corp. is engaged in the acquisition, exploration, and development of mineral properties in the United States with a market capitalization of $23.22 million.

Operations: Currently, there are no reported revenue segments for Texas Mineral Resources Corp.

Market Cap: $23.22M

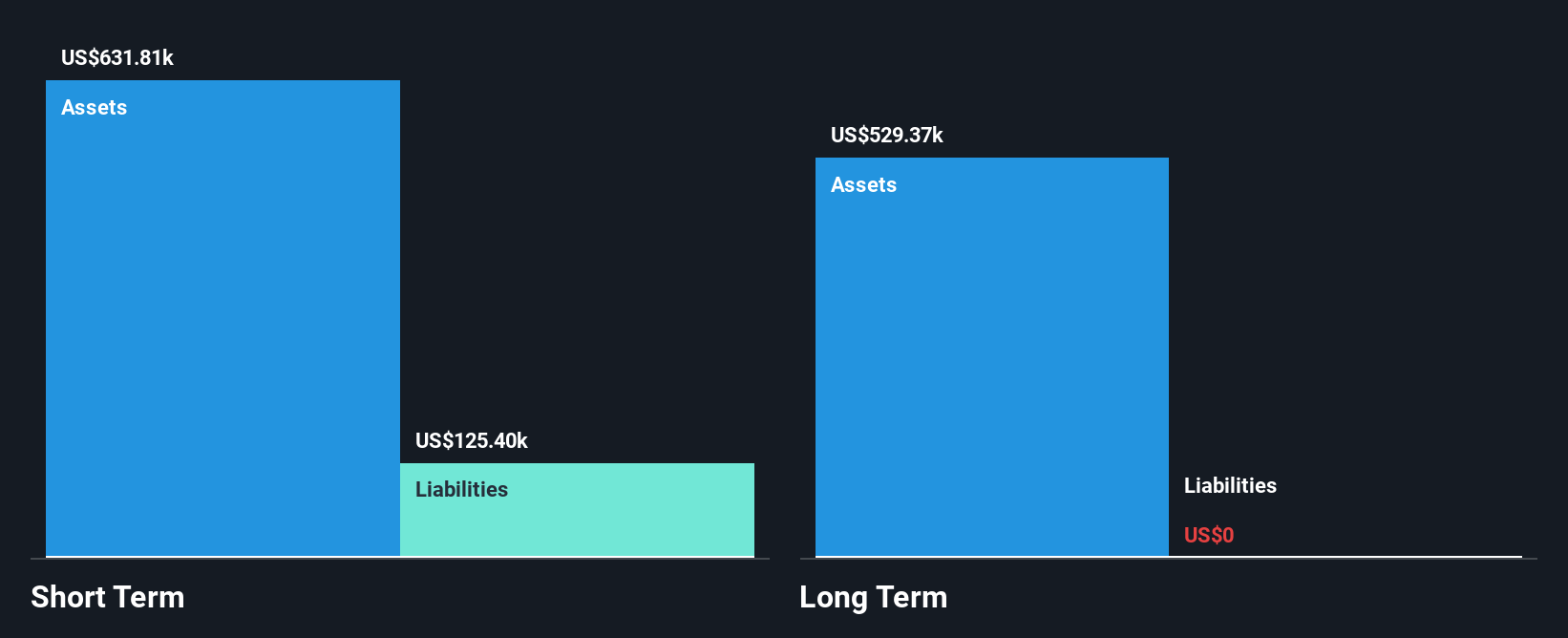

Texas Mineral Resources Corp., with a market cap of US$23.22 million, is pre-revenue and currently unprofitable, reporting a net loss of US$0.83 million for the year ending August 2024. The company recently entered a non-binding letter of intent with Steeple Rock Holding Company to explore mining ventures in New Mexico and Arizona, although there are no assurances this will result in definitive agreements or successful projects. Despite having no debt and seasoned board members averaging 10.9 years in tenure, the company's financial stability is challenged by less than one year of cash runway and ongoing auditor concerns about its ability to continue as a going concern.

- Click here and access our complete financial health analysis report to understand the dynamics of Texas Mineral Resources.

- Understand Texas Mineral Resources' track record by examining our performance history report.

Where To Now?

- Investigate our full lineup of 728 US Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Mineral Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TMRC

Texas Mineral Resources

Acquires, explores, and develops mineral properties in the United States.

Excellent balance sheet slight.

Market Insights

Community Narratives