- United States

- /

- Commercial Services

- /

- NYSE:WCN

Here's Why Waste Connections (NYSE:WCN) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Waste Connections (NYSE:WCN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Waste Connections with the means to add long-term value to shareholders.

See our latest analysis for Waste Connections

How Quickly Is Waste Connections Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Waste Connections managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

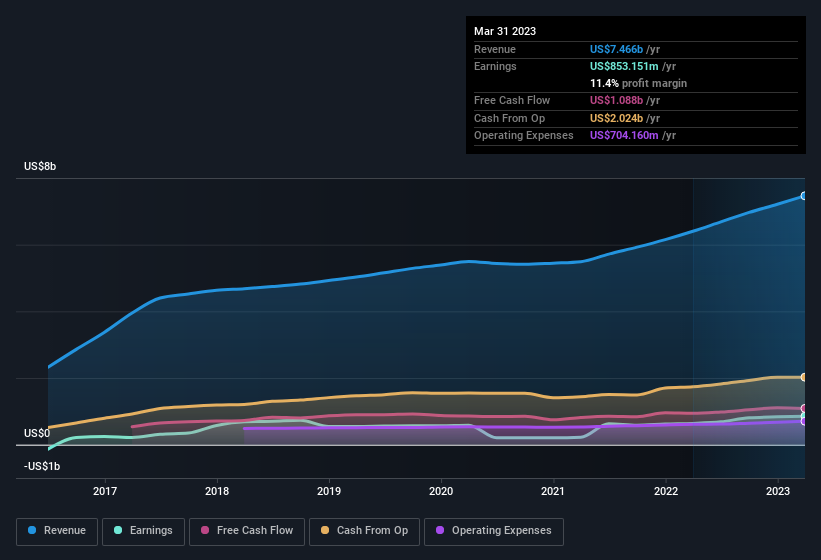

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Waste Connections achieved similar EBIT margins to last year, revenue grew by a solid 17% to US$7.5b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Waste Connections.

Are Waste Connections Insiders Aligned With All Shareholders?

Owing to the size of Waste Connections, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth US$112m. We note that this amounts to 0.3% of the company, which may be small owing to the sheer size of Waste Connections but it's still worth mentioning. This should still be a great incentive for management to maximise shareholder value.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Waste Connections, with market caps over US$8.0b, is about US$12m.

The CEO of Waste Connections only received US$1.6m in total compensation for the year ending December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Waste Connections Worth Keeping An Eye On?

As previously touched on, Waste Connections is a growing business, which is encouraging. The growth of EPS may be the eye-catching headline for Waste Connections, but there's more to bring joy for shareholders. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. You should always think about risks though. Case in point, we've spotted 2 warning signs for Waste Connections you should be aware of.

Although Waste Connections certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Waste Connections, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waste Connections might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WCN

Waste Connections

Provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives