- United States

- /

- Commercial Services

- /

- NYSE:PRSU

Viad (NYSE:VVI) Has Debt But No Earnings; Should You Worry?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Viad Corp (NYSE:VVI) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Viad

How Much Debt Does Viad Carry?

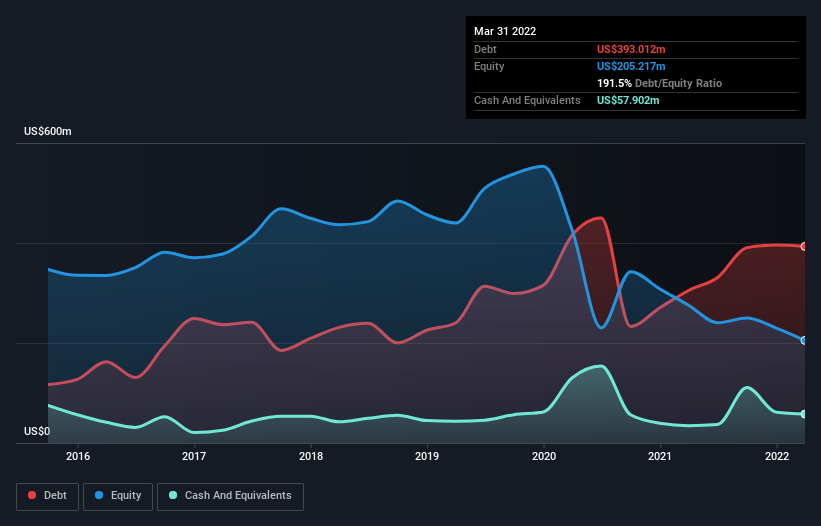

As you can see below, at the end of March 2022, Viad had US$393.0m of debt, up from US$305.0m a year ago. Click the image for more detail. On the flip side, it has US$57.9m in cash leading to net debt of about US$335.1m.

How Strong Is Viad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Viad had liabilities of US$214.3m due within 12 months and liabilities of US$640.0m due beyond that. Offsetting this, it had US$57.9m in cash and US$96.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$699.5m.

When you consider that this deficiency exceeds the company's US$606.2m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Viad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Viad reported revenue of US$656m, which is a gain of 338%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

Caveat Emptor

Despite the top line growth, Viad still had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at US$44m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through US$48m in negative free cash flow over the last year. That means it's on the risky side of things. For riskier companies like Viad I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRSU

Pursuit Attractions and Hospitality

An attraction and hospitality company, owns and operates hospitality destinations in the United States, Canada, and Iceland.

Proven track record with moderate growth potential.