- United States

- /

- Commercial Services

- /

- NYSE:VLTO

Veralto (NYSE:VLTO) Declares US$0.11 Per Share Quarterly Dividend

Reviewed by Simply Wall St

Veralto (NYSE:VLTO) recently affirmed its commitment to shareholder value through the declaration of a $0.11 per share dividend, payable on April 30, 2025. Despite this positive dividend news, the company's shares saw a 1.1% decline over the past week. This movement aligns with the broader market dynamics, as the Dow Jones and other indices were also under pressure due to tech stock sell-offs and ongoing tariff anxieties. These market-wide concerns, particularly those surrounding tariffs affecting North American growth, may have impacted investor sentiment towards Veralto, contributing to the stock's performance for the week. Although there was no significant earnings news from Veralto during this time, the lack of additional company-specific developments means its price action is likely reflecting broader market trends, which saw an overall market decline of 1.9%. This broader context helps explain the slight drop in Veralto's stock price during the period.

Dig deeper into the specifics of Veralto here with our thorough analysis report.

Over the last year, Veralto delivered a total shareholder return of 11.40%, underperforming the US Commercial Services industry return of 14.9%, and the broader US market, which returned 13.1%. This period saw several key developments potentially influencing the company's performance. A 22% increase in dividends announced in December 2024 demanded attention, underscoring Veralto's commitment to returning value to shareholders.

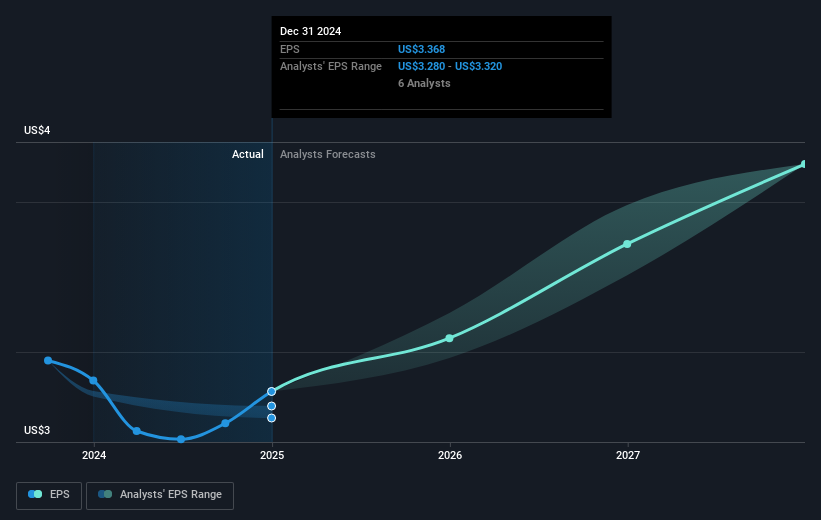

Meanwhile, Veralto's earnings results in February 2025 highlighted solid growth, with full-year sales reaching US$5.19 billion, up from US$5.02 billion the previous year. Additionally, October 2024 saw Veralto exploring acquisitions, showing its strong financial flexibility and proactive approach to growth. However, despite these positive signals, Veralto's slower earnings and revenue growth relative to both its industry and the market may have limited upside potential for investors during this period.

- Learn how Veralto's intrinsic value compares to its market price with our detailed valuation report.

- Assess the downside scenarios for Veralto with our risk evaluation.

- Invested in Veralto? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLTO

Veralto

Provides water analytics, water treatment, marking and coding, and packaging and color solutions worldwide.

Mediocre balance sheet and slightly overvalued.