- United States

- /

- Commercial Services

- /

- NYSE:VLTO

A Fresh Look at Veralto (VLTO) Valuation as Investors Eye Recent Stock Movement

Reviewed by Kshitija Bhandaru

Veralto (VLTO) recently caught some investor attention with its latest price movement, prompting questions about whether a shift is underway for this US-based services provider. While there isn’t a headline-grabbing event behind the stock’s move, it is sometimes these quieter periods that leave the door open for new valuations to emerge. For investors trying to figure out their next steps, it is always worth pausing when the stock chart seems to flicker, even if the reasons aren't front and center in the news cycle.

Zooming out, Veralto’s past year has been a mixed bag. While the stock has managed a just under 5% gain since the start of the year, it’s still trading about 5% lower compared to this time last year. Short-term momentum was turning positive in the past three months, followed by some recent cooling in the last month. All this comes against a backdrop of steady annual revenue and net income growth, which is a detail that rarely escapes market notice.

After this year’s choppy ride, the question for investors is clear: Is this the chance to scoop up shares before growth returns, or is the current price already factoring in what comes next?

Most Popular Narrative: 8.8% Undervalued

According to the most widely followed narrative, Veralto is currently undervalued by nearly 9%, suggesting the stock price may not fully reflect the company’s future prospects or earnings profile.

Robust and accelerating demand for water reuse, analytics, and treatment solutions, driven by global water scarcity, rising regulatory pressure, and sustainability goals, is translating into strong volume sales growth across both industrial and municipal customers. This points to sustained revenue and margin expansion.

What if the current price is only telling half the story? The most popular narrative bases its optimistic fair value on a blend of ambitious growth expectations, margin upgrades, and premium profitability multiples that are rarely seen in this sector. Want to know exactly what those future projections look like, and why the street is split on whether to believe them? Dive in to find out what numbers are driving analysts to see upside as nearly baked in.

Result: Fair Value of $115.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in China and ongoing integration costs could undermine Veralto’s growth story and challenge the upbeat narrative some analysts endorse.

Find out about the key risks to this Veralto narrative.Another View: A Different Valuation Test

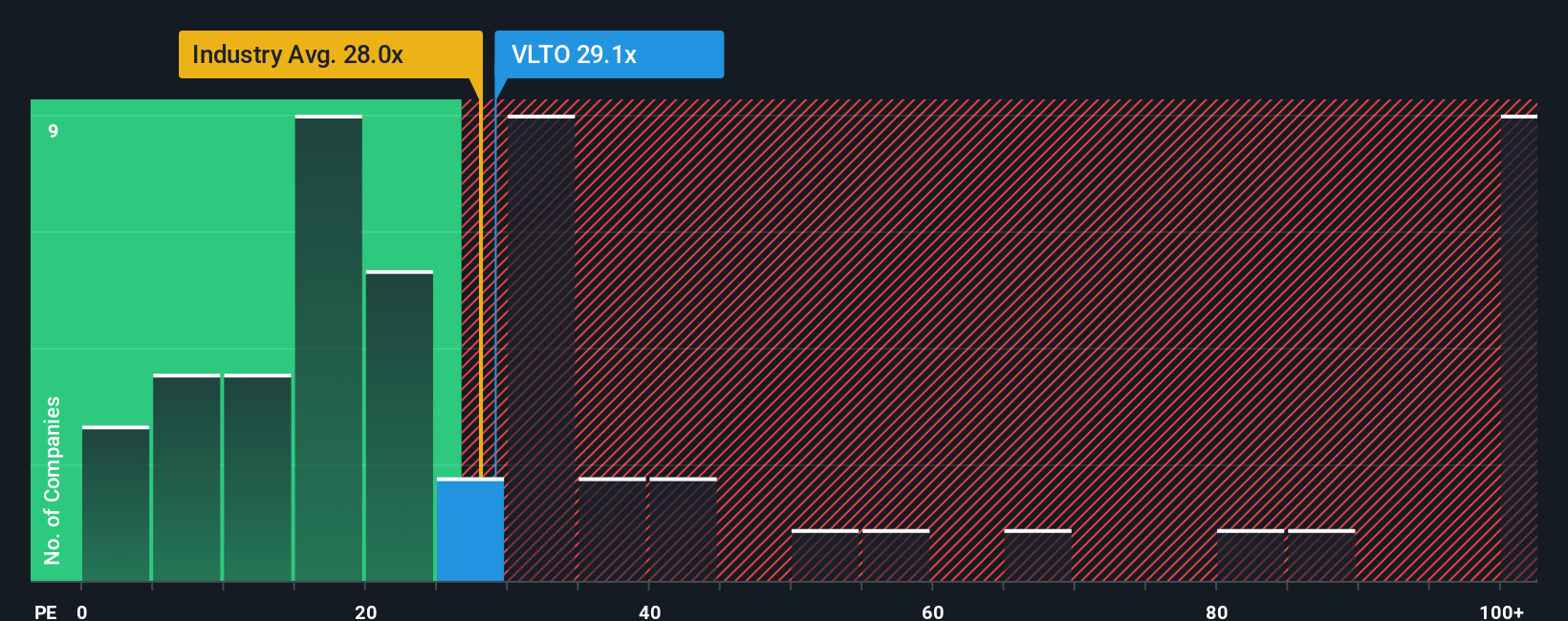

Looking at the market’s favored ratio for similar companies, Veralto actually trades at a richer valuation than the broader industry. This alternative method challenges the idea that the stock is an easy bargain. Which story should investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Veralto to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Veralto Narrative

If you see things differently or want to dig into the numbers on your own terms, it's easy to build your personal outlook in just a few minutes. Do it your way

A great starting point for your Veralto research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Open up a world of fresh opportunities by tapping into specialized lists designed to fuel your next great move. Don’t let your next winner slip by.

- Supercharge your hunt for undervalued gems with undervalued stocks based on cash flows, where cash flow fundamentals help reveal hidden deals others might miss.

- Position yourself for the next healthcare breakthrough by reviewing healthcare AI stocks, which spotlights companies at the forefront of AI-driven medical advances.

- Capture serious passive income potential by starting with dividend stocks with yields > 3% to identify stocks offering yields above 3% and long-term payout stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLTO

Veralto

Provides water analytics, water treatment, marking and coding, and packaging and color solutions worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives