- United States

- /

- Professional Services

- /

- NYSE:ULS

Siemens Partnership and Industrial Metaverse Validation Could Be a Game Changer for UL Solutions (ULS)

Reviewed by Sasha Jovanovic

- On September 23, 2025, Siemens announced that its industrial manufacturing software became the first to receive UL Solutions’ Verified Mark as part of UL Solutions' expansion into evaluation and verification services for industrial software and the industrial metaverse.

- This move marks UL Solutions' broader role as an independent verifier in digital manufacturing, highlighting the growing importance of third-party validation for advanced technologies in virtual industrial environments.

- We’ll consider how UL Solutions’ entry into industrial software verification and its Siemens partnership could shape its investment prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

UL Solutions Investment Narrative Recap

To believe in UL Solutions as a shareholder, you need to buy into its ability to grow by expanding verification and evaluation services into fast-evolving sectors like industrial software and the digital factory space. The news of Siemens' software being the first to receive a UL Verified Mark underscores UL Solutions’ push into third-party validation for advanced technologies. While this strengthens UL Solutions' position as a trusted partner for digital manufacturing, the most immediate catalyst, new testing facility expansions, remains the bigger short-term driver. The principal risk continues to be the impact of global macroeconomic uncertainty on industrial product demand, which could weigh on revenue stability; this news, while relevant to future opportunities, does not materially change that risk in the short term.

Among recent announcements, the opening of the company's Global Fire Science Center in Illinois stands out. While the Siemens partnership signals future growth in digital manufacturing, the center directly expands UL Solutions’ offering in safety testing and certification, supporting near-term revenue drivers that matter most for ongoing performance.

However, it’s important to keep a close eye on how persistent macroeconomic risks could affect customer budgets and project timelines, which investors should be aware of as...

Read the full narrative on UL Solutions (it's free!)

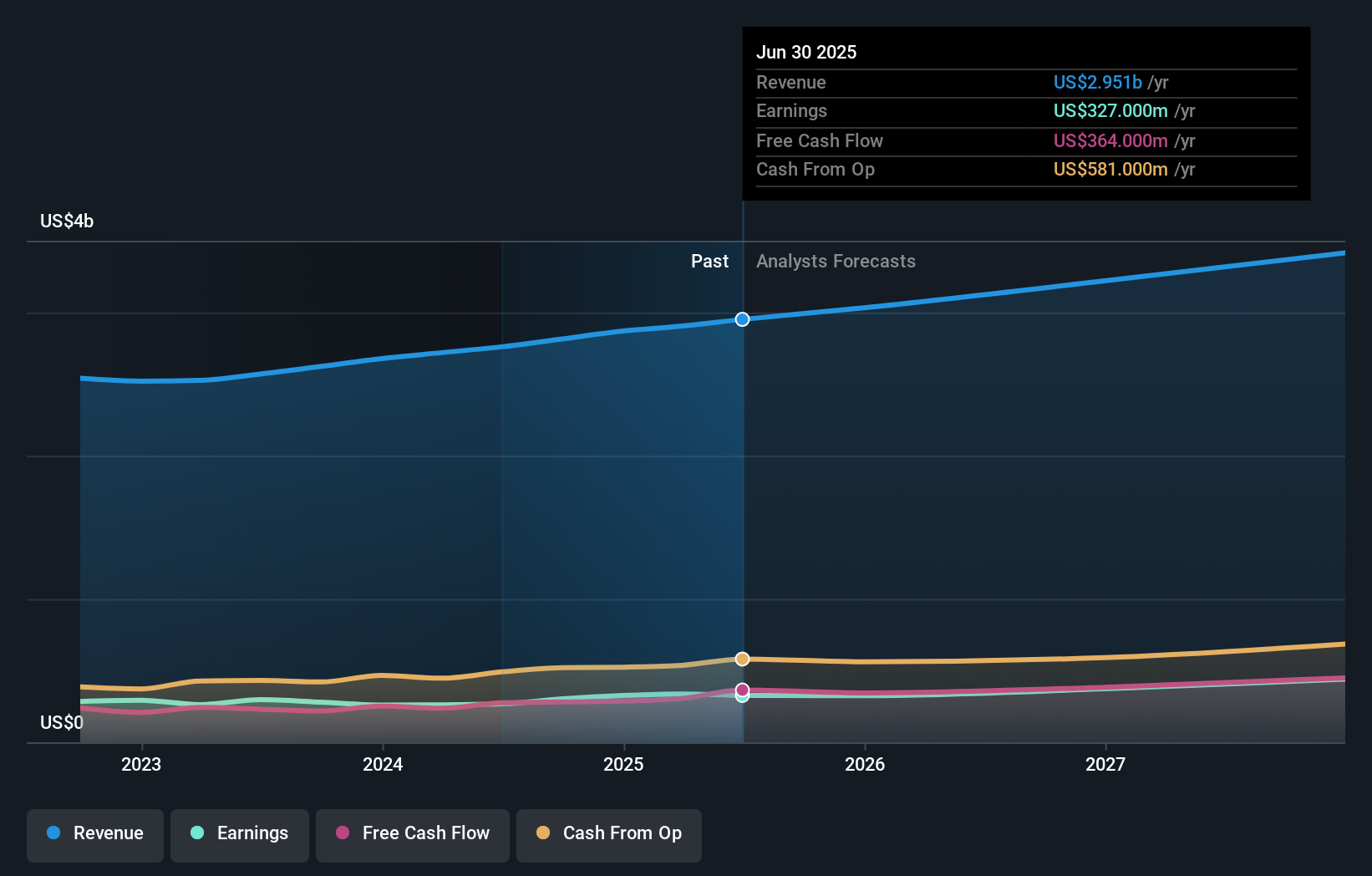

UL Solutions' narrative projects $3.5 billion revenue and $477.8 million earnings by 2028. This requires 6.1% yearly revenue growth and a $150.8 million increase in earnings from $327.0 million.

Uncover how UL Solutions' forecasts yield a $71.27 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for UL Solutions between US$68.27 and US$71.27, showing a narrow spread of views. While many see promise in new services like industrial software verification, ongoing uncertainty around industrial demand may affect future results, so consider multiple viewpoints before deciding.

Explore 2 other fair value estimates on UL Solutions - why the stock might be worth as much as $71.27!

Build Your Own UL Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UL Solutions research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free UL Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UL Solutions' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ULS

UL Solutions

Provides testing, inspection and certification, and related software and advisory services worldwide.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives