- United States

- /

- Professional Services

- /

- NYSE:TRU

TransUnion (TRU): Exploring Valuation as Fresh Investor Interest Lifts Shares Modestly

Reviewed by Simply Wall St

TransUnion (TRU) shares have edged slightly higher over the past day, gaining nearly 2%. The stock has risen 4% this month but remains down year-to-date. Investors might be weighing recent performance against longer-term results.

See our latest analysis for TransUnion.

TransUnion shares are showing signs of renewed interest, with momentum turning positive this month after a period of declines. However, the 1-year total shareholder return remains deep in negative territory. Recent price upticks suggest shifting sentiment around the company’s future growth and risk profile, but long-term returns still lag broader benchmarks.

If you’re curious about what else investors are tracking as momentum shifts, now is the time to broaden your search and uncover fast growing stocks with high insider ownership

With shares still well below their analyst price targets, TransUnion presents an intriguing dilemma for investors. Is the current discount a genuine buying opportunity, or has the market already factored in all future growth prospects?

Most Popular Narrative: 24.5% Undervalued

With TransUnion’s fair value set at $106.70 and its last close at $80.54, this narrative positions the stock as notably discounted. The stage is set for a turnaround based on a mix of growth projections and analyst assumptions that are yet to be fully reflected in the current price.

Strategic innovation investments, including AI, machine learning, and the roll-out of the global cloud-native OneTru platform, are driving efficiency, faster product launches, better cross-sell opportunities, and improved customer retention. These factors position TransUnion to grow earnings with higher operating leverage and net margins as technology transformation costs subside after 2025.

What’s behind this discounted price? Fast-rising profits, ambitious operating targets, and a technology transformation that could supercharge returns in coming years. Curious how bold these projections really are? Read on for the full story and see which numbers shape this valuation.

Result: Fair Value of $106.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures or delays in technology integration could derail projected growth and challenge the optimism surrounding TransUnion’s future earnings.

Find out about the key risks to this TransUnion narrative.

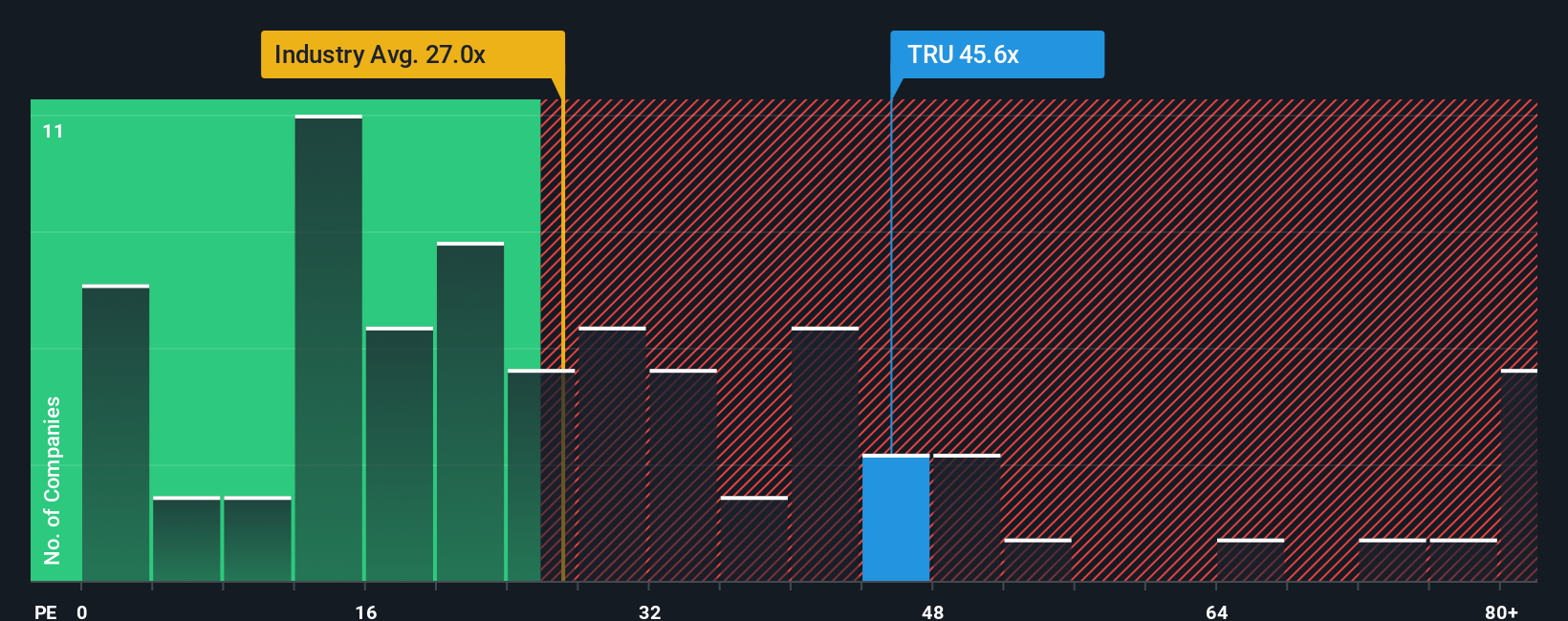

Another View: Multiple-Based Valuation Signals Risk

Looking at valuation through the lens of price-to-earnings, TransUnion's ratio sits at 37.2x. This is far higher than the US Professional Services industry average of 24.5x and the peer average of 26.8x. Even compared to the fair ratio of 31.5x, the stock appears expensive, highlighting a potential valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransUnion Narrative

If you see the story differently, or want to dig into the numbers yourself, it takes just a few minutes to craft your own narrative. Do it your way

A great starting point for your TransUnion research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for the obvious picks when there are standout opportunities just waiting to power up your portfolio. Get ahead before others catch on.

- Tap into the future by checking out these 28 quantum computing stocks companies making breakthroughs in quantum computing and real-world problem solving.

- Capture reliable income with these 16 dividend stocks with yields > 3%. Choose from businesses delivering strong yields above 3% and consistent payout histories.

- Seize the AI momentum through these 25 AI penny stocks and follow emerging leaders set to shape tomorrow’s industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransUnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRU

TransUnion

Operates as a global consumer credit reporting agency that provides risk and information solutions.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives