- United States

- /

- Professional Services

- /

- NYSE:TIXT

Is TELUS International (NYSE:TIXT) Still Undervalued After Its Recent Share Price Rally?

Reviewed by Simply Wall St

Most Popular Narrative: 0.7% Undervalued

According to the prevailing narrative, TELUS International (Cda) is considered slightly undervalued, with the current share price just below its estimated fair value based on analyst forecasts and future growth expectations.

"The accelerating enterprise adoption of AI, automation, and advanced digital solutions is driving demand for TELUS International's AI & Data Solutions and Digital Solutions portfolio. This supports long-term revenue growth and mix shift toward higher-margin services as proof-of-concept work transitions to large-scale enterprise deployments in 2026 and 2027."

Curious how these transformation trends might fuel a valuation surge? There is one powerful growth assumption behind this fair value that could change the game for TELUS International. Want to know which big future shift analysts expect to dramatically boost margins and propel earnings higher? Dive into the full narrative to uncover the numbers and drivers analysts believe justify today's price target.

Result: Fair Value of $4.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure and continued high client concentration could quickly dampen the optimism behind these bullish forecasts.

Find out about the key risks to this TELUS International (Cda) narrative.Another View: The SWS DCF Model

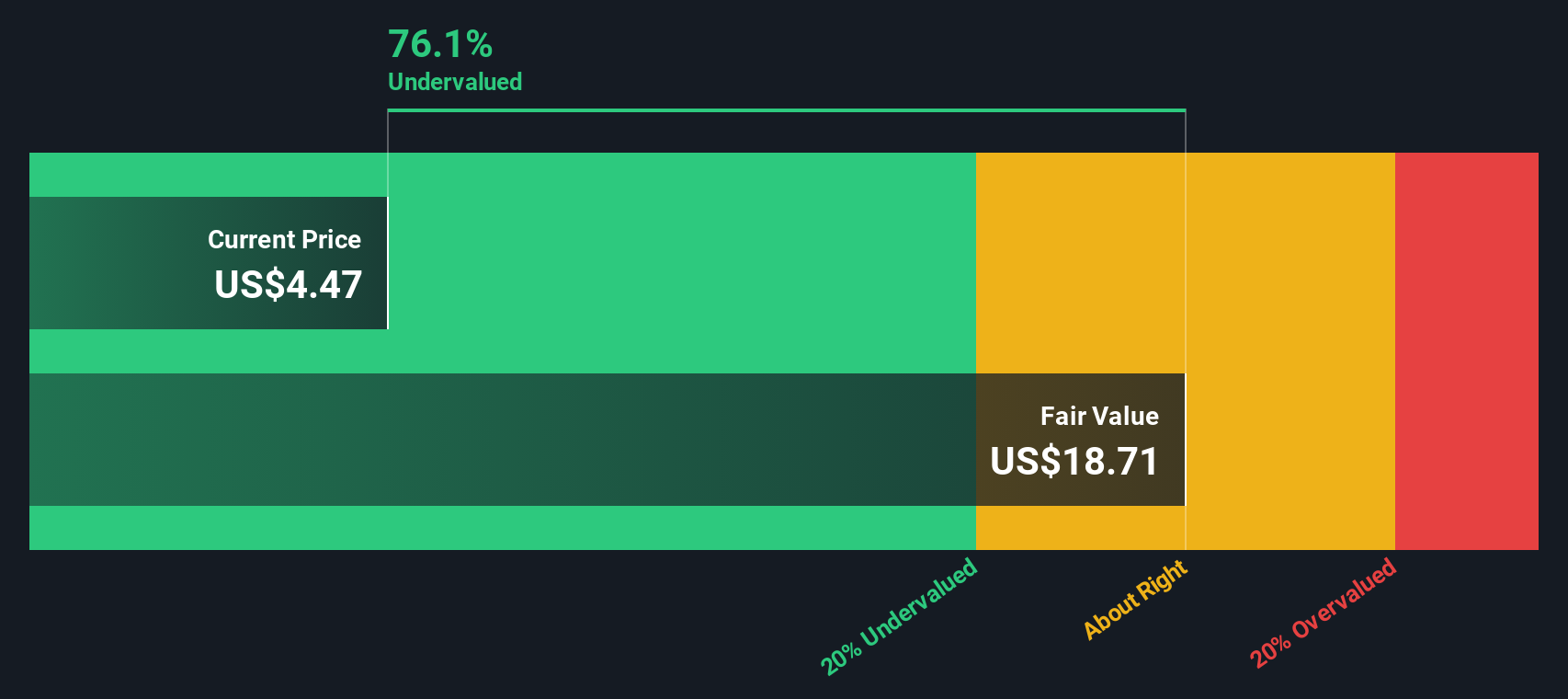

While analyst price targets suggest TELUS International is undervalued, our DCF model tells a similar story. The current share price is well below what we estimate as fair value. Does the DCF provide a more realistic picture, or is the market seeing risks the model cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TELUS International (Cda) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TELUS International (Cda) Narrative

If you see things differently, or simply want to dig into the numbers yourself, you can assemble your own narrative and reach your own conclusions in just a few minutes. Do it your way

A great starting point for your TELUS International (Cda) research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound for those who know where to look. Unlock the next breakout stock or hidden gem by targeting new trends and strong fundamentals with these hand-picked routes to smarter investing. Don’t let your strategy miss out on tomorrow’s potential winners.

- Spot early-stage tech disruptors ready to move by starting with penny stocks with strong financials and get ahead of the herd before everyone else catches on.

- Boost your portfolio’s resilience by tapping into companies offering consistent income with dividend stocks with yields > 3% and enjoy yields over 3%.

- Ride the momentum of machine learning innovation when you scan AI penny stocks for fast-moving leaders in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS International (Cda) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:TIXT

TELUS International (Cda)

Offers digital customer experience and digital solutions in the Asia-Pacific, the Central America, Europe, Africa, North America, the United Arab Emirates, and internationally.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives