- United States

- /

- Professional Services

- /

- NYSE:TIC

TIC Solutions (TIC) Valuation Check as UBS Industrials Conference Puts Strategy and Growth in Focus

Reviewed by Simply Wall St

TIC Solutions (TIC) is heading into the UBS Global Industrials and Transportation Conference in Florida, and investors are watching closely for fresh clues on strategy, end market demand, and capital allocation priorities.

See our latest analysis for TIC Solutions.

That backdrop matters because TIC Solutions’ share price return has slipped to $9.54 after a weak 1 month share price return of around 22 percent, suggesting sentiment has cooled even as investors look to this conference for fresh growth signals.

If this kind of industrial story has your attention, it might be worth scanning for other infrastructure linked names using aerospace and defense stocks as a starting point for ideas.

With revenue still growing fast but profits in the red and the share price lagging analyst targets, the real question now is whether TIC Solutions is mispriced value or if the market already sees future growth coming.

Most Popular Narrative Narrative: 31.4% Undervalued

With TIC Solutions closing at $9.54 against a narrative fair value of $13.90, the spotlight shifts to whether its ambitious growth path can stick.

The combination with NV5 significantly broadens Acuren's end market exposure (including faster growth verticals such as data centers and infrastructure) and enhances cross selling potential for turnkey, integrated inspection and engineering solutions, which is likely to drive higher future revenue and margin expansion.

Want to see what kind of revenue surge, margin rebuild, and future earnings multiple it takes to support that gap? You might be surprised by how aggressive the long term profit trajectory needs to be, and how confident the narrative is that investors will pay up for it.

Result: Fair Value of $13.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on smooth NV5 integration and rising margins, where any misstep or prolonged pressure could quickly challenge that optimistic narrative.

Find out about the key risks to this TIC Solutions narrative.

Another View: Market Ratios Flash a Caution Sign

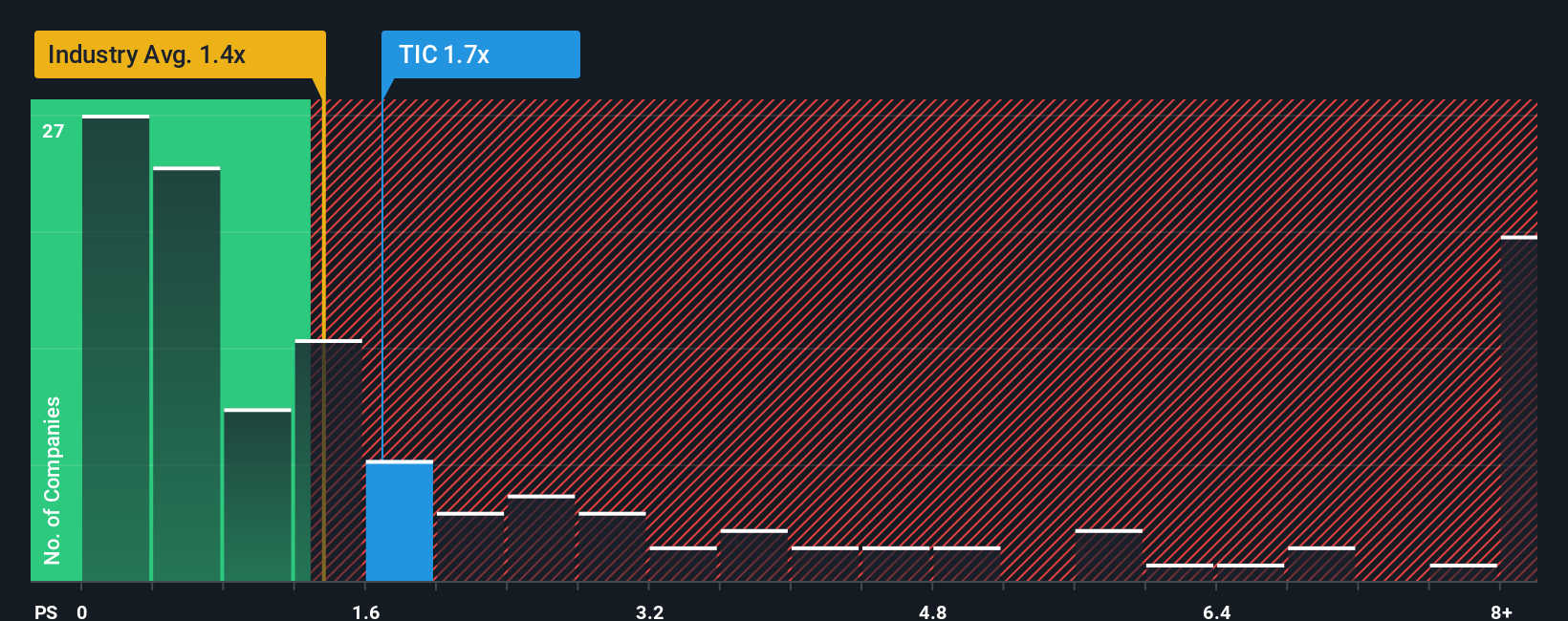

While the narrative fair value argues TIC Solutions is 31 percent undervalued, the price to sales lens is less generous, with the stock on 1.6 times sales versus 1.3 times for the US Professional Services industry, even though its fair ratio sits higher at 2.1 times.

That leaves TIC looking cheaper than peers at 2.2 times sales but still pricier than the wider sector. It is a mixed signal that hints at both upside and valuation risk if growth or margins stumble from here. Which camp are you in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TIC Solutions Narrative

If this story does not fully match your view or you would rather crunch the numbers yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your TIC Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning hand picked opportunities from our screeners so you are not relying on TIC Solutions alone.

- Capture potential mispricings by targeting companies flagged as undervalued through these 919 undervalued stocks based on cash flows and position yourself ahead of a possible sentiment shift.

- Ride powerful structural trends by focusing on innovators at the intersection of medicine and algorithms with these 30 healthcare AI stocks as they shape the next decade of growth.

- Boost your income strategy by filtering for reliable payouts using these 14 dividend stocks with yields > 3% so you are not leaving attractive yield opportunities on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TIC Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

TIC Solutions

Provides critical asset integrity services in North America.

High growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026