- United States

- /

- Professional Services

- /

- NYSE:TIC

Acuren (NYSE:TIC): Examining Valuation as Markets Reassess Growth and Integration Prospects

Reviewed by Simply Wall St

Acuren (NYSE:TIC) has landed on the radar of many investors this week, following recent market swings that have shifted sentiment around the stock. While there was no single headline catalyst driving the movement, the activity suggests that traders are weighing the company’s prospects against a changing industry landscape. When a company’s share price fluctuates without a clear catalyst, it usually prompts an extra layer of scrutiny. Is the market catching on to something, or is this just noise?

Over the past month, Acuren’s stock has gained an impressive 14%, providing some relief after a rougher start to the year, with shares still down 10% year to date. This degree of bounce-back hints at renewed momentum, which stands out compared to the relatively modest moves of the broader sector. Aside from these price shifts, recent performance metrics have shown considerable annual growth in revenue, although ongoing net losses continue to shape the company’s financial narrative.

The big question now is whether Acuren’s latest move creates a buying opportunity for investors looking for value, or if the current price already reflects expectations for the company’s future growth.

Most Popular Narrative: 23% Undervalued

Based on the most widely followed narrative, Acuren is seen as significantly undervalued with a fair value estimate about 23% above the current share price.

The combination with NV5 significantly broadens Acuren's end-market exposure (including faster-growth verticals such as data centers and infrastructure) and enhances cross-selling potential for turnkey, integrated inspection and engineering solutions. This is likely to drive higher future revenue and margin expansion.

Curious about the formula behind Acuren's high upside? There are bold profit milestones and aggressive margin moves at the heart of this narrative. Think you know how analysts arrived at a double-digit premium? The real story is in their eye-popping forecasts and the valuation logic hidden beneath the headlines.

Result: Fair Value of $14.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated debt from acquisitions and the risks of integrating NV5 could quickly undermine Acuren’s earnings targets if expected synergies fail to materialize as anticipated.

Find out about the key risks to this Acuren narrative.Another View: A Different Take on Acuren’s Valuation

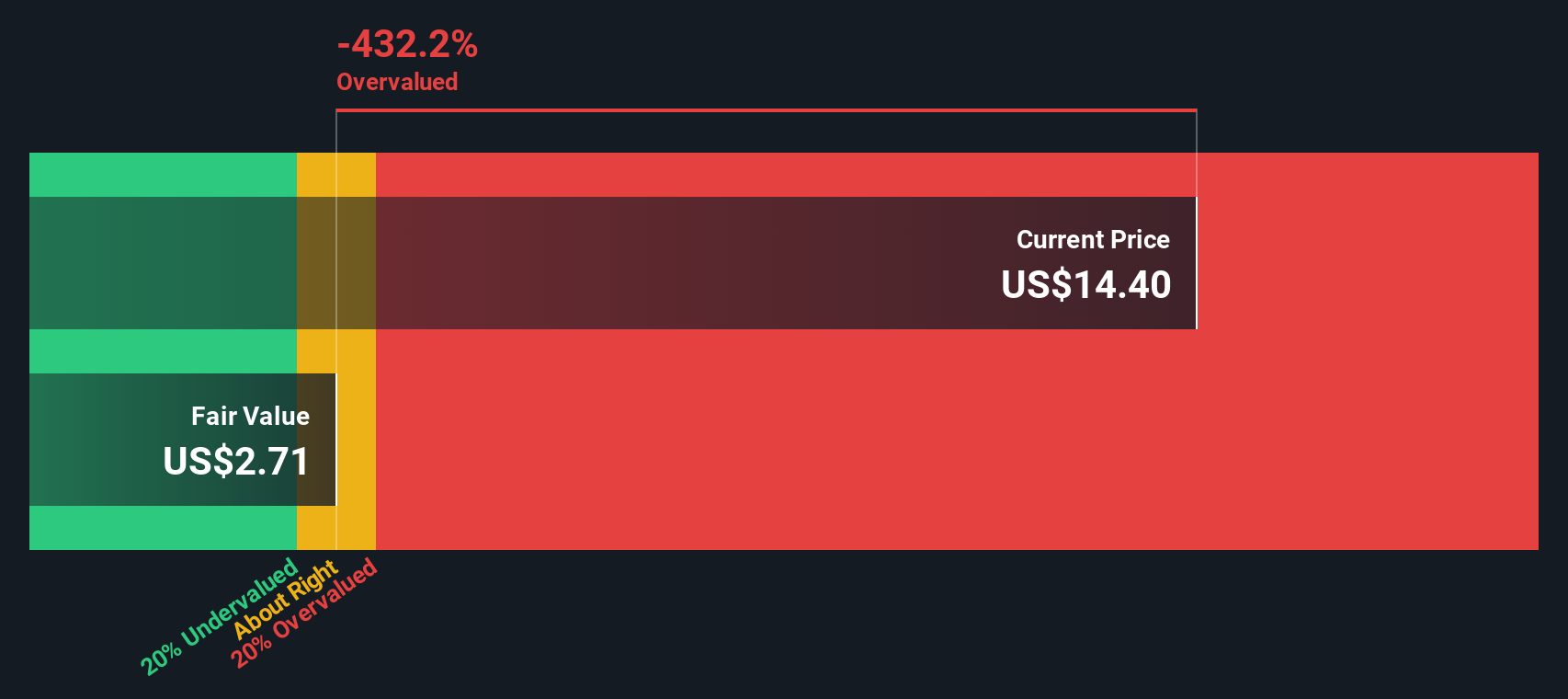

Switching gears, our DCF model actually offers a different perspective from the analyst consensus. This approach values Acuren based on its projected future cash flows, but surprisingly suggests the stock could be overvalued. Which model do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Acuren Narrative

If you see Acuren differently or want to dig into the details yourself, you can customize your own narrative in just a few minutes. Do it your way

A great starting point for your Acuren research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock unique opportunities beyond Acuren. The Simply Wall Street Screener highlights stocks that fit your strategy, so you never miss out on fresh market leaders.

- Snap up undervalued gems by using undervalued stocks based on cash flows to pinpoint companies with strong fundamentals trading at promising discounts.

- Stay ahead of the technology curve with AI penny stocks to spot tomorrow’s AI trailblazers already reshaping industries.

- Tap into steady income streams by searching for dividend stocks with yields > 3%, helping you identify shares with reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TIC

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives