- United States

- /

- Professional Services

- /

- NYSE:SOS

Here's Why We're A Bit Worried About SOS' (NYSE:SOS) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether SOS (NYSE:SOS) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for SOS

Does SOS Have A Long Cash Runway?

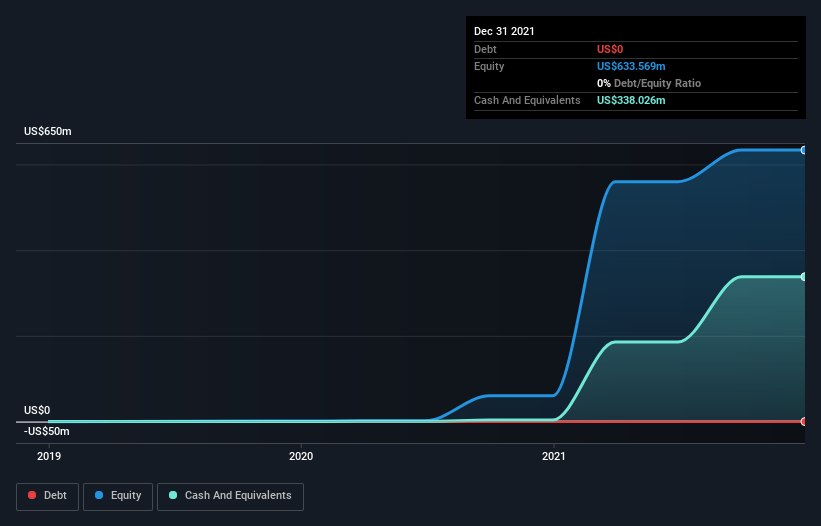

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2021, SOS had cash of US$338m and no debt. Importantly, its cash burn was US$252m over the trailing twelve months. That means it had a cash runway of around 16 months as of December 2021. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. Depicted below, you can see how its cash holdings have changed over time.

How Well Is SOS Growing?

One thing for shareholders to keep front in mind is that SOS increased its cash burn by 471% in the last twelve months. Given that operating revenue was up a stupendous 612% over the last year, there's a good chance the investment will pay off. Considering both these factors, we're not particularly excited by its growth profile. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how SOS is building its business over time.

How Hard Would It Be For SOS To Raise More Cash For Growth?

Even though it seems like SOS is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$143m, SOS' US$252m in cash burn equates to about 176% of its market value. That suggests the company may have some funding difficulties, and we'd be very wary of the stock.

So, Should We Worry About SOS' Cash Burn?

On this analysis of SOS' cash burn, we think its revenue growth was reassuring, while its cash burn relative to its market cap has us a bit worried. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for SOS (2 are a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SOS

SOS

Provides data mining and analysis services to corporate and individual members in the People’s Republic of China.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives