- United States

- /

- Commercial Services

- /

- NYSE:SCS

Steelcase (SCS): Evaluating Valuation Following a 54% Three-Month Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Steelcase.

While Steelcase’s impressive 54% share price return over the past three months has stolen the spotlight, momentum has really taken shape against a much bigger backdrop. The one-year total shareholder return stands at a robust 30%. What is truly remarkable is the three-year total return of 166%, indicating that long-term investors have been rewarded as the company’s prospects and risk profile have shifted for the better recently.

If Steelcase’s recent surge made you wonder what other opportunities are out there, now is a great time to broaden your investing universe and discover fast growing stocks with high insider ownership

But after such strong gains in a short span, is there still value left in Steelcase shares? Or is the recent rally simply reflecting expectations for continued growth? Could this be a buying opportunity, or is everything already priced in?

Most Popular Narrative: 4.4% Overvalued

According to the most prominent narrative from codabat, Steelcase’s current share price of $16.29 sits slightly above the narrative’s calculated intrinsic fair value of $15.60. This sets the stage for exploring whether current market optimism might be overextended, or if a different story is being told beneath the surface.

Based on sector-relative P/E analysis, Steelcase appears moderately undervalued. Using TTM EPS of $1.04 and applying the furniture industry average P/E multiple of 15x, the intrinsic fair value equals $15.60 per share. Key Assumptions: Normalized P/E: 15x (furniture industry median). EPS sustainability: Current $1.04 TTM earnings maintainable. Sector convergence: SCS multiple should align with furniture peers. Cyclical recovery: Office furniture demand stabilization expected.

Curious which critical financial levers and cyclical assumptions are behind this number? There is a unique mix of industry alignment and financial consistency driving the narrative’s fair value. The full analysis reveals which business forces shape that number and how a sector-wide rebound could tip the balance. Do not miss the main quantitative trigger that could spark a major price move from here.

Result: Fair Value of $15.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure or a slow office real estate recovery could quickly challenge this fair value narrative and shift market sentiment on Steelcase’s prospects.

Find out about the key risks to this Steelcase narrative.

Another View: Deep Discount or Caution Signal?

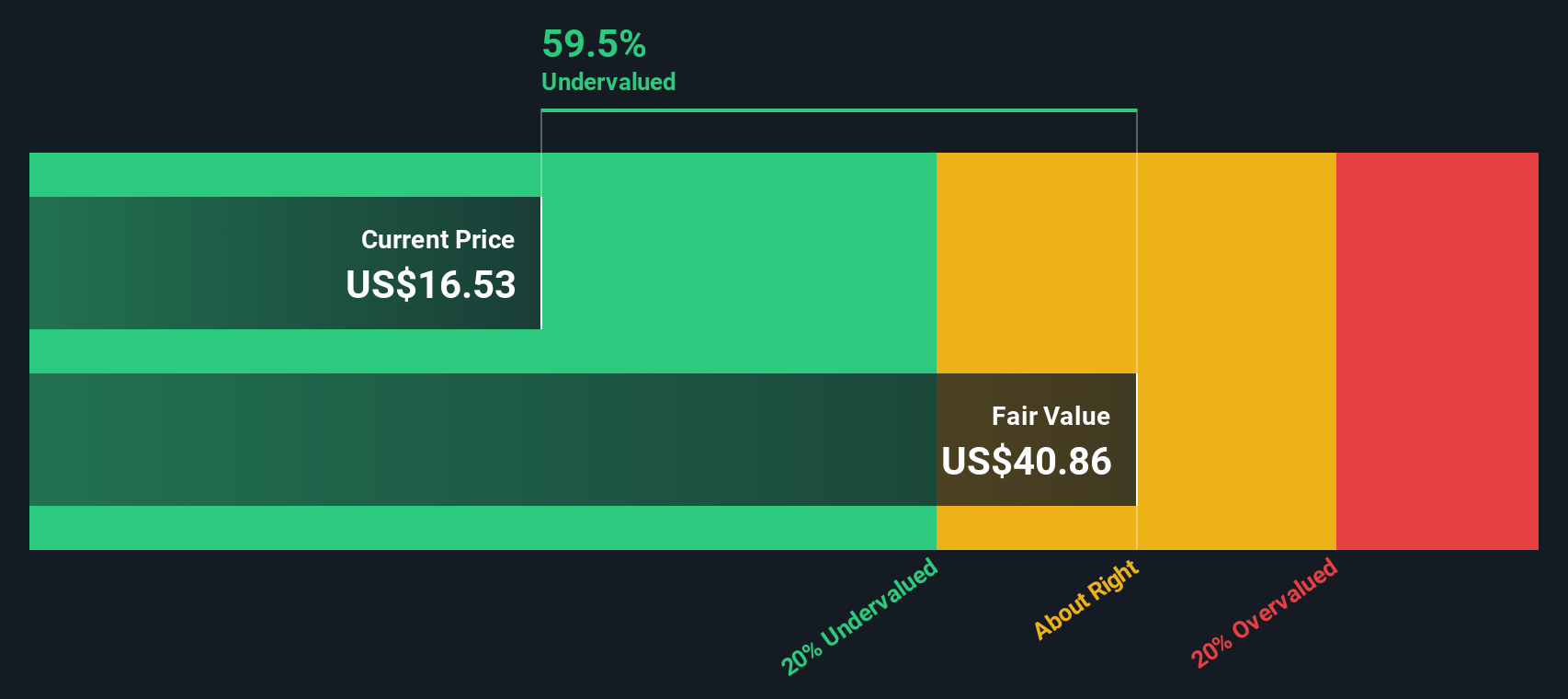

Taking a different approach, our DCF model suggests Steelcase shares are dramatically undervalued, trading more than 60% below its estimated fair value of $40.80. This signals a potentially significant upside; however, does such a wide gap signal opportunity, or is the market pricing in hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Steelcase Narrative

If you see things differently or would rather dig into the numbers yourself, you can develop your own narrative perspective in just a few minutes. Do it your way

A great starting point for your Steelcase research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Strengthen your portfolio by exploring unique opportunities beyond Steelcase. Don’t miss the chance to get ahead with smart stock picks tailored for tomorrow’s trends.

- Zero in on companies with high yields and resilient business models using these 19 dividend stocks with yields > 3% for reliable income potential.

- Seize the opportunity to ride the artificial intelligence wave by finding the hottest innovators through these 24 AI penny stocks.

- Target seriously undervalued stocks based on future cash flows by checking out these 892 undervalued stocks based on cash flows, and uncover hidden gems the market has overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCS

Steelcase

Provides a portfolio of furniture and architectural products and services in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives