- United States

- /

- Commercial Services

- /

- NYSE:ROL

The Bull Case For Rollins (ROL) Could Change Following JPMorgan Highlight of AI Efficiency Investments

Reviewed by Sasha Jovanovic

- Recently, JPMorgan initiated coverage on Rollins, Inc., highlighting strong organic growth, successful acquisitions, and significant investments in AI-driven efficiency enhancements within its pest control operations.

- One analyst upwardly revised earnings estimates for fiscal 2025, reinforcing increasing investor optimism around Rollins’ momentum and recurring revenue base.

- We’ll explore how JPMorgan’s focus on Rollins’ AI and technology investments could influence its long-term investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Rollins Investment Narrative Recap

To invest in Rollins, shareholders must have confidence in the company’s ability to deliver steady, recurring revenue growth through its leading pest control services, supported by acquisitions and advances in operational efficiency. JPMorgan’s recent initiation of coverage and mention of Rollins’ AI investments affirms optimism in the current growth story, but the announcement does not materially alter the near-term catalyst of integrating recent acquisitions or the key risk of margin pressure due to higher costs.

Most relevant to this momentum, Rollins recently completed its acquisition of Saela Pest Control, anticipated to add up to US$50 million in revenue for 2025 and expected to enhance earnings. This transaction aligns with the ongoing focus on expanding market share through M&A and could be influential as recurring revenue stability remains a fundamental catalyst for the business.

By contrast, investors should stay alert to the risk of rising operational costs that could pressure profit margins if not managed carefully...

Read the full narrative on Rollins (it's free!)

Rollins is projected to reach $4.6 billion in revenue and $686.0 million in earnings by 2028. This outlook assumes annual revenue growth of 8.8% and an earnings increase of $196.7 million from current earnings of $489.3 million.

Uncover how Rollins' forecasts yield a $59.67 fair value, in line with its current price.

Exploring Other Perspectives

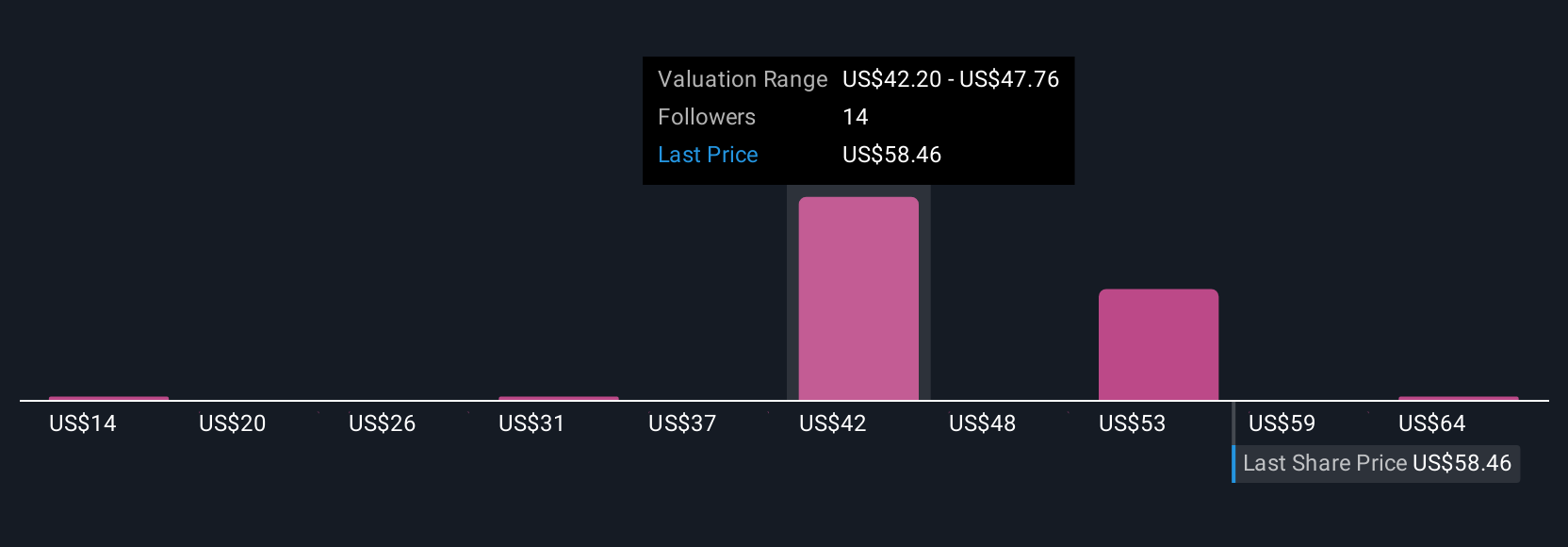

Five fair value estimates from the Simply Wall St Community for Rollins range widely, from as low as US$14.40 up to US$72.00. While these opinions differ, many remain focused on the impact of recent acquisitions to drive growth, highlighting the need to weigh multiple viewpoints when considering Rollins’ outlook.

Explore 5 other fair value estimates on Rollins - why the stock might be worth less than half the current price!

Build Your Own Rollins Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rollins research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Rollins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rollins' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives