- United States

- /

- Commercial Services

- /

- NYSE:ROL

Rollins (NYSE:ROL) Reports Increased Quarterly Earnings With US$105 Million Net Income

Reviewed by Simply Wall St

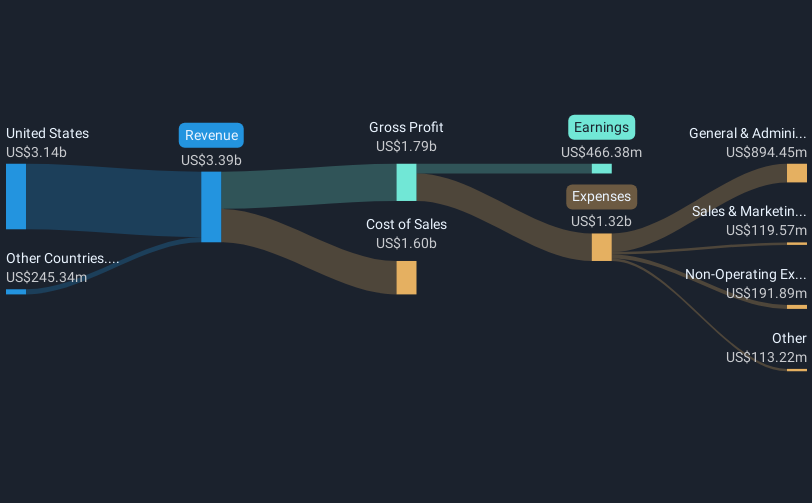

Rollins (NYSE:ROL) showcased a robust performance in the first quarter of 2025, reporting a net income increase to USD 105 million and a rise in EPS to USD 0.22. Alongside this, the declaration of a regular quarterly dividend added a positive outlook for shareholders. These developments occurred as broader market indices like the Dow Jones climbed amid bullish sentiment, driven by strong earnings and expectations of tariff changes. As Rollins's stock price advanced 13% over the last quarter, its gains may form part of a positive sector sentiment, reflecting the broader market's upward movement.

Buy, Hold or Sell Rollins? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

The recent news of Rollins's increased net income and EPS, alongside the dividend declaration, aligns well with its efforts to expand its commercial division and modernize operations. These initiatives are anticipated to bolster revenue growth, especially as Rollins enhances its sales force by over 15%. Over the last five years, the company's total shareholder return, including share price and dividends, was 118.26%. This return reflects a strong long-term performance, showcasing resilience and growth.

Over the past year, Rollins outperformed the US Commercial Services industry, which had a return of 13.5%. However, the increase in sales and marketing expenses, driven by investments in personnel, could pressure margins if not met with corresponding revenue growth. Analysts project earnings to rise to US$673.5 million by 2028, assuming profit margins expand and back-office improvements materialize into operational efficiency gains. With the current share price of US$55.66, Rollins is trading above the consensus price target of US$51.21, aligning with analysts' view that the company is fairly priced.

Our expertly prepared valuation report Rollins implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROL

Rollins

Through its subsidiaries, provides pest and wildlife control services to residential and commercial customers in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives