- United States

- /

- Logistics

- /

- NYSE:UPS

Discover 3 Top Dividend Stocks On US Exchange

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with the S&P 500 and Nasdaq making gains while the Dow faces consecutive losses, investors are keenly observing economic indicators and corporate earnings to gauge future trends. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to navigate market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.74% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.12% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.49% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.09% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.68% | ★★★★★★ |

| Farmers National Banc (NasdaqCM:FMNB) | 4.91% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.80% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.85% | ★★★★★★ |

Click here to see the full list of 171 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ChoiceOne Financial Services, Inc. is a bank holding company for ChoiceOne Bank, offering banking services to corporations, partnerships, and individuals in Michigan with a market cap of $278.11 million.

Operations: ChoiceOne Financial Services, Inc. generates its revenue through providing a range of banking services to corporate entities, partnerships, and individual clients in Michigan.

Dividend Yield: 3.2%

ChoiceOne Financial Services has demonstrated consistent dividend reliability, with stable and growing payouts over the past decade. The recent dividend of US$0.27 per share marks a slight increase from last year, supported by a low payout ratio of 33.9%, indicating sustainability. Despite trading at a discount to its estimated fair value, the dividend yield of 3.19% is below top-tier levels in the US market. Recent earnings growth further supports its capacity to maintain dividends.

- Click here to discover the nuances of ChoiceOne Financial Services with our detailed analytical dividend report.

- The analysis detailed in our ChoiceOne Financial Services valuation report hints at an deflated share price compared to its estimated value.

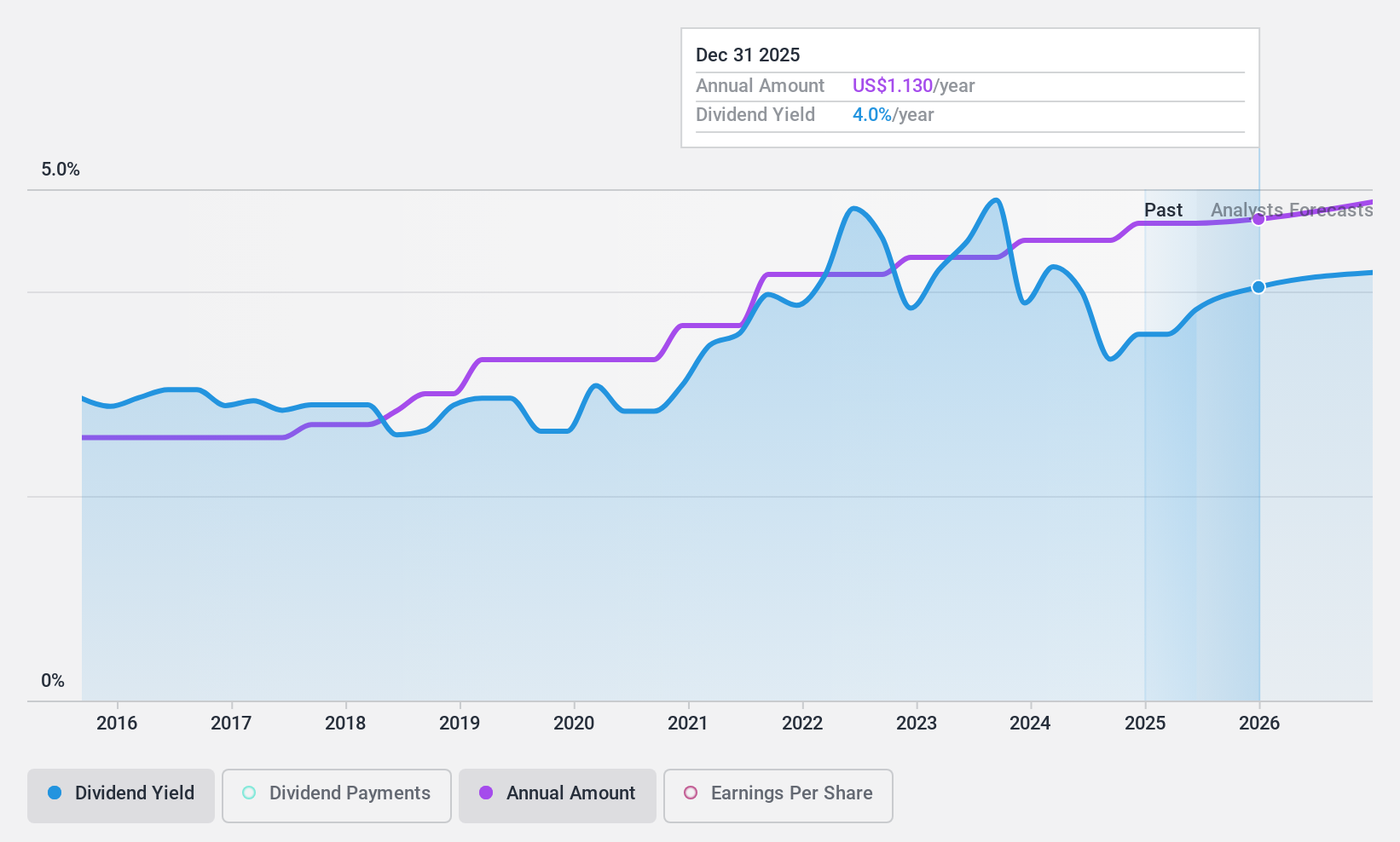

Robert Half (NYSE:RHI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Robert Half Inc. offers talent solutions and business consulting services across multiple continents, with a market cap of approximately $6.91 billion.

Operations: Robert Half Inc.'s revenue segments include Contract Talent Solutions at $3.90 billion, Protiviti at $1.93 billion, and Permanent Placement Talent Solutions at $500.67 million.

Dividend Yield: 3.1%

Robert Half's dividends are reliably covered by earnings and cash flows, with a payout ratio of 75.2% and a cash payout ratio of 59.4%. The dividend yield of 3.08% is stable but below top-tier levels in the US market. Despite trading at nearly half its estimated fair value, recent earnings have declined, with Q3 net income dropping to US$65.45 million from US$95.55 million last year, impacting overall dividend attractiveness amidst ongoing share buybacks totaling over $1.54 billion since 2018.

- Dive into the specifics of Robert Half here with our thorough dividend report.

- The valuation report we've compiled suggests that Robert Half's current price could be quite moderate.

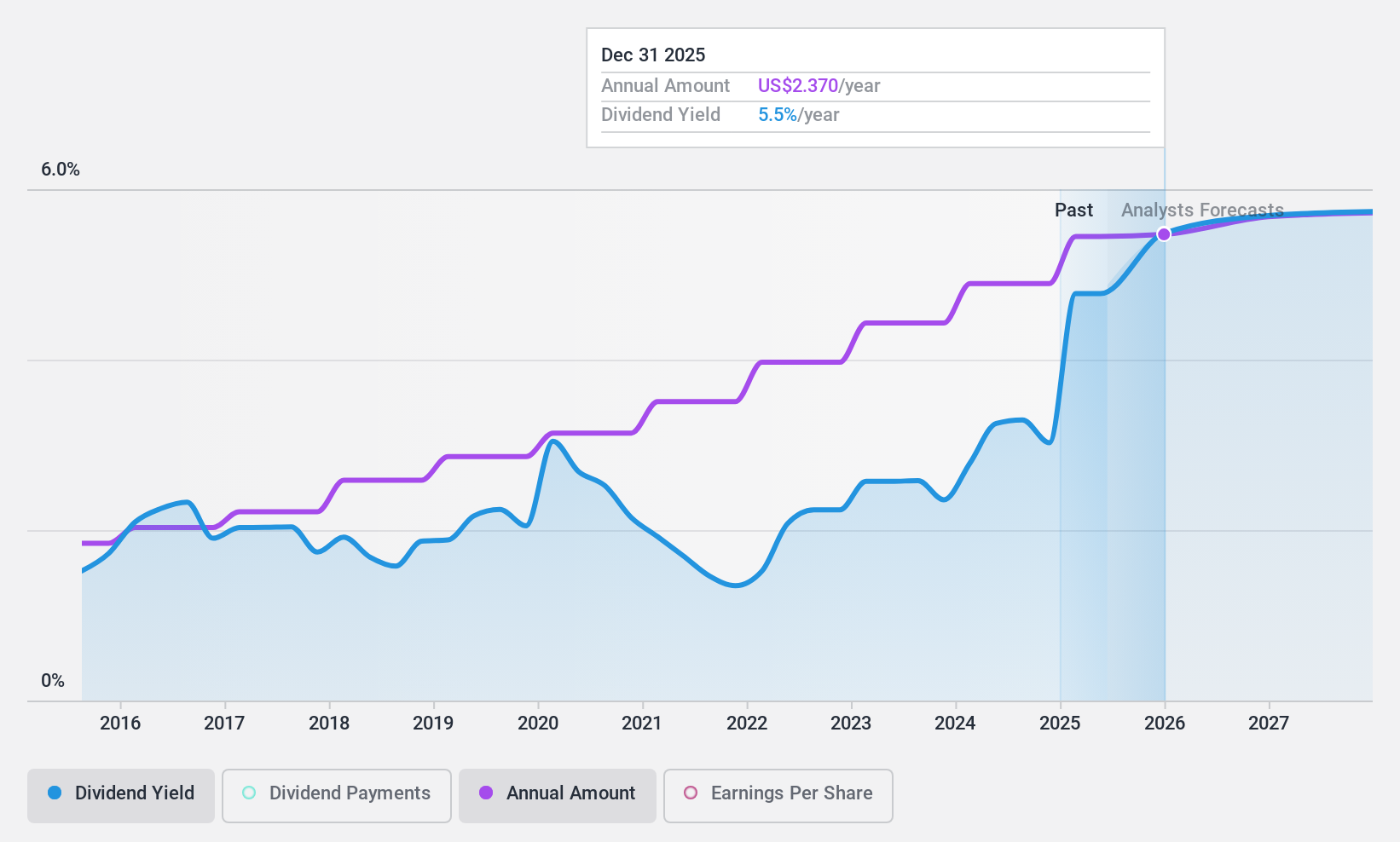

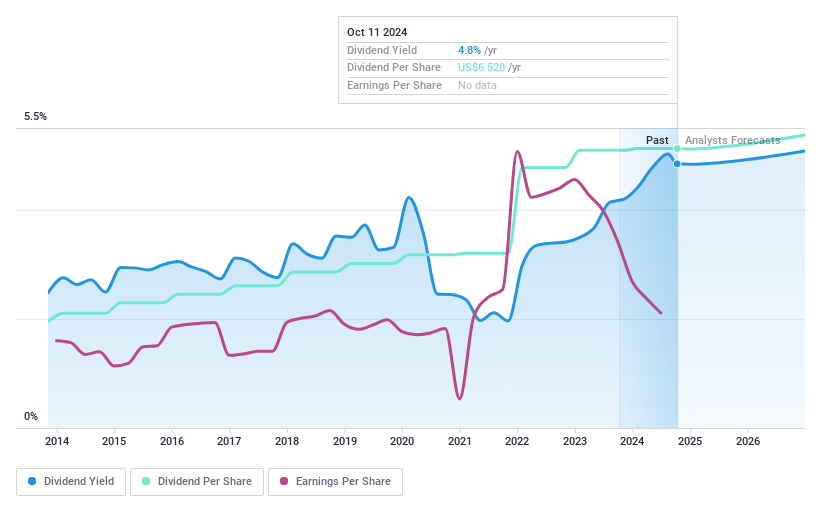

United Parcel Service (NYSE:UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery company offering transportation, delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services with a market cap of approximately $112.56 billion.

Operations: United Parcel Service, Inc. generates revenue through its diverse offerings in transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services.

Dividend Yield: 4.7%

United Parcel Service's dividends have been consistently stable and growing over the past decade, with payments expected to reach US$5.4 billion in 2024. However, the dividend yield of 4.71% is not well supported by earnings or cash flows due to high payout ratios exceeding 98%. Recent earnings showed improvement with Q3 net income rising to US$1.54 billion, but legal challenges and a high debt level could impact financial flexibility for future dividend sustainability.

- Take a closer look at United Parcel Service's potential here in our dividend report.

- Our expertly prepared valuation report United Parcel Service implies its share price may be lower than expected.

Summing It All Up

- Investigate our full lineup of 171 Top US Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery company, provides transportation and delivery, distribution, contract logistics, ocean freight, airfreight, customs brokerage, and insurance services.

Adequate balance sheet average dividend payer.