- United States

- /

- Professional Services

- /

- NYSE:PL

Why Planet Labs (PL) Is Up 24.2% After Expanding Satellite Capacity and Opening Berlin Facility

Reviewed by Sasha Jovanovic

- Planet Labs PBC has shipped its latest Pelican-5 and Pelican-6 satellites, along with 36 SuperDove satellites, to Vandenberg Space Force Base in California ahead of the upcoming Transporter-15 SpaceX launch, and also announced plans to expand its satellite manufacturing capacity with a new facility in Berlin, Germany.

- This expansion follows major contracts with the German government and NATO, positioning Planet Labs to meet growing European demand and enhance its real-time global monitoring capabilities.

- We'll assess how the new Berlin facility and increased satellite capacity may influence Planet Labs’ growth outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Planet Labs PBC Investment Narrative Recap

Belief in Planet Labs hinges on the potential for Earth observation data to become a critical backbone for industries and governments, with rapid satellite deployment seen as key to expanding high-value, recurring revenues. The latest manufacturing expansion and upcoming SpaceX launch directly relate to the company's most important catalyst, scaling satellite capacity to secure larger, longer-term contracts, but also accentuate the risk of escalating capital expenses tightening cash flow before new business is realized. Balanced attention to customer mix and disciplined spending remain essential as Planet Labs grows.

Of all recent announcements, the unveiling and shipment of Pelican-5 and Pelican-6, together with 36 SuperDove satellites, stand out for their immediate relevance to enhancing imagery capacity and shortening data turnaround times. This operational boost ties directly to Planet’s push to offer advanced solutions, aiming for stronger margins and more stable revenue, but also tests the company’s ability to pace capital investments with sustainable returns.

However, despite these growth moves, investors should be aware that rising capital investment could quickly pressure short-term financial health if new contracts or...

Read the full narrative on Planet Labs PBC (it's free!)

Planet Labs PBC's narrative projects $409.3 million revenue and $29.2 million earnings by 2028. This requires 17.8% yearly revenue growth and a $135.7 million earnings increase from -$106.5 million.

Uncover how Planet Labs PBC's forecasts yield a $9.23 fair value, a 38% downside to its current price.

Exploring Other Perspectives

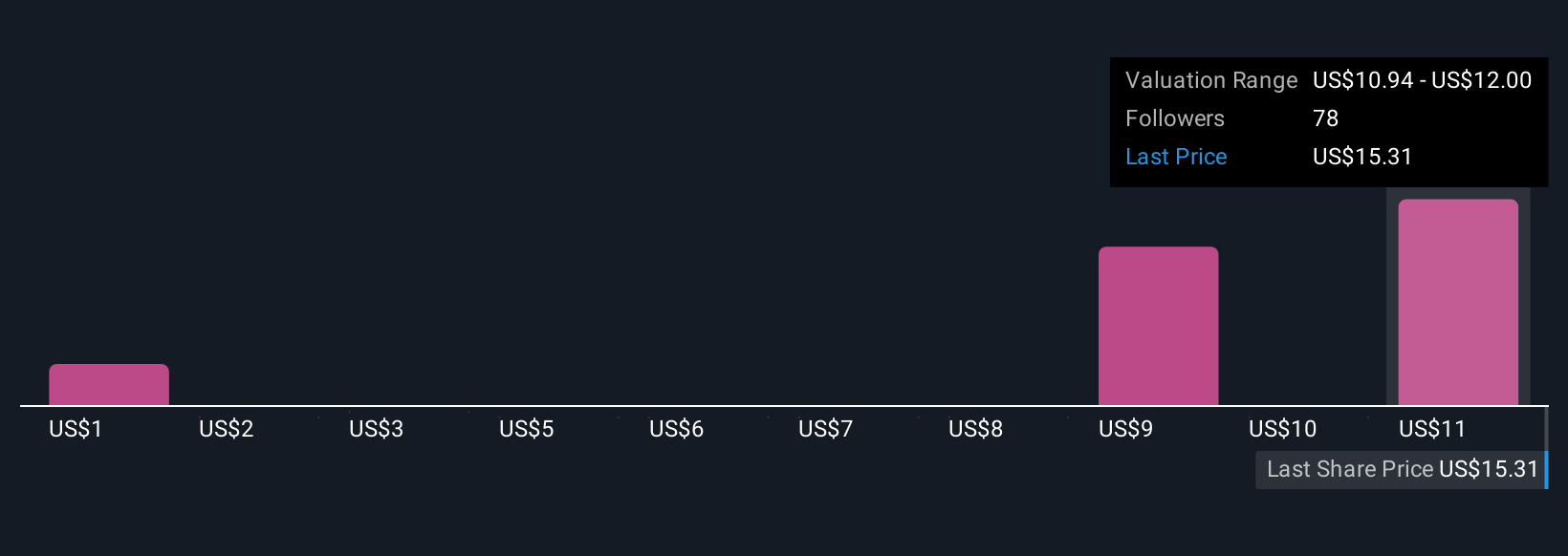

Eleven Simply Wall St Community members set PL's fair value between US$1.36 and US$12. While satellite deployment is driving contract wins, some participants highlight the risk of capital outlays outpacing near-term returns. Explore what others are projecting.

Explore 11 other fair value estimates on Planet Labs PBC - why the stock might be worth less than half the current price!

Build Your Own Planet Labs PBC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Labs PBC research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Labs PBC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Labs PBC's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026