- United States

- /

- Professional Services

- /

- NYSE:PL

Can Planet Labs’ Stunning 574% Rally Continue After Q1 2025 Earnings Shock?

Reviewed by Bailey Pemberton

If you’ve been scanning the market lately, you might have caught Planet Labs PBC’s name climbing toward the top of the gainers’ lists. With the stock closing at $15.24, a jaw-dropping 574.3% return over the past year stands out. That’s not just a quick spike. In just the past 30 days, shares have more than doubled, surging 133.4%. Even the last week alone saw an uptick of 19.2%. These kinds of numbers don’t just happen by accident. Investors are tuning in, recalibrating their risk appetites, and clearly betting on the company’s growth story. Recent momentum in the sector and growing interest in satellite data analytics may be shifting perceptions around Planet Labs’ long-term prospects.

With a value score of 0 out of 6, though, there’s more to consider before hopping on board. No major undervaluation flags are popping up right now using standard metrics, but that’s not the full story. Let’s break down how Planet Labs stacks up against traditional valuation checks. Before you decide to jump in (or cash out), I’ll share a surprisingly effective way to think about what this stock is truly worth at the end of the article.

Planet Labs PBC scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Planet Labs PBC Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company’s future expected cash flows and then discounting them back to today’s value using a required rate of return. This method helps estimate what the business might be worth if bought outright for all its future potential profits.

For Planet Labs PBC, the latest twelve months’ Free Cash Flow came in at $33.36 Million. Analysts predict that in 2028, Free Cash Flow could reach $21.62 Million, with projections for the next ten years largely based on extrapolated trends rather than concrete analyst estimates after five years. These numbers provide a way to look beyond current headlines and into the business’s earning potential over time.

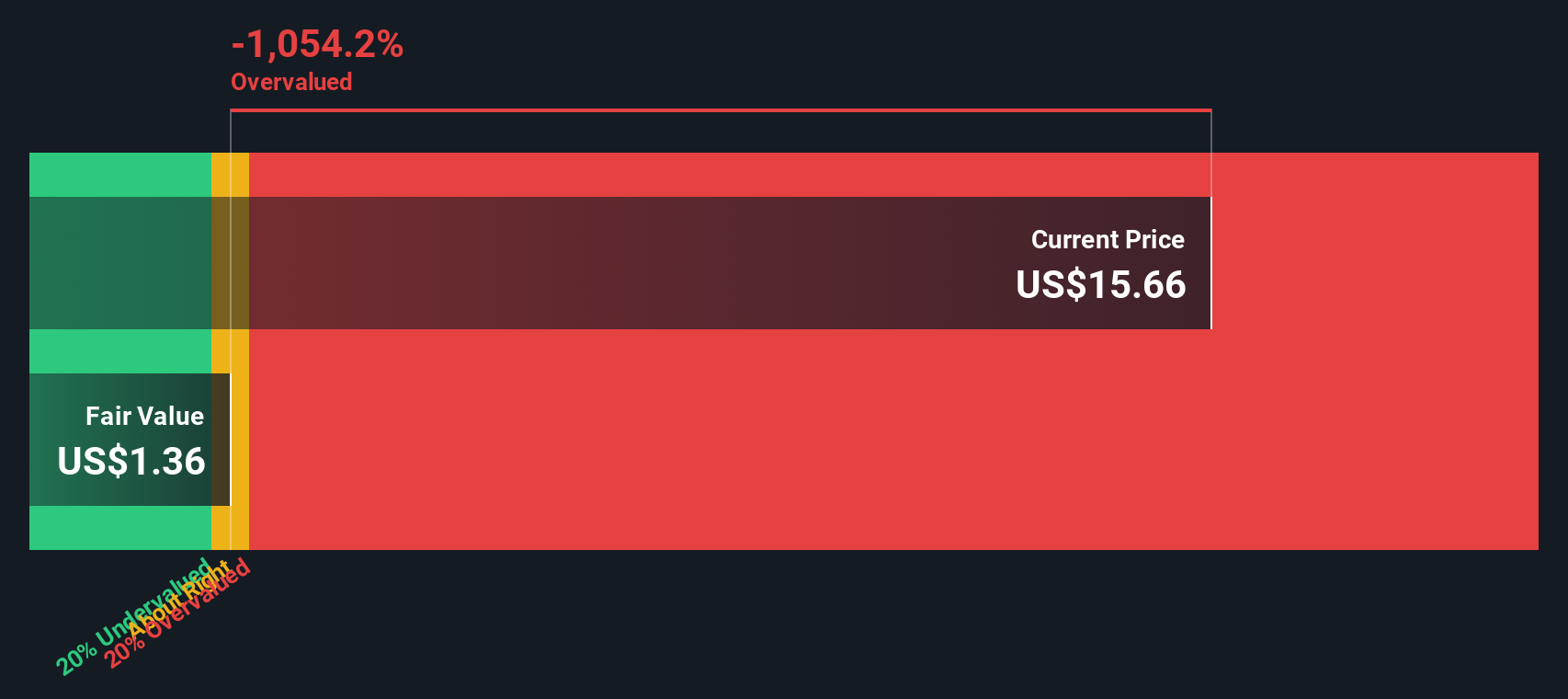

After running the projections through the DCF formula, the resulting estimated intrinsic value of the stock is $1.36 per share. With the latest closing price at $15.24, the model suggests that Planet Labs is 1020.3% overvalued compared to its underlying cash flow forecast.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Planet Labs PBC may be overvalued by 1020.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Planet Labs PBC Price vs Sales

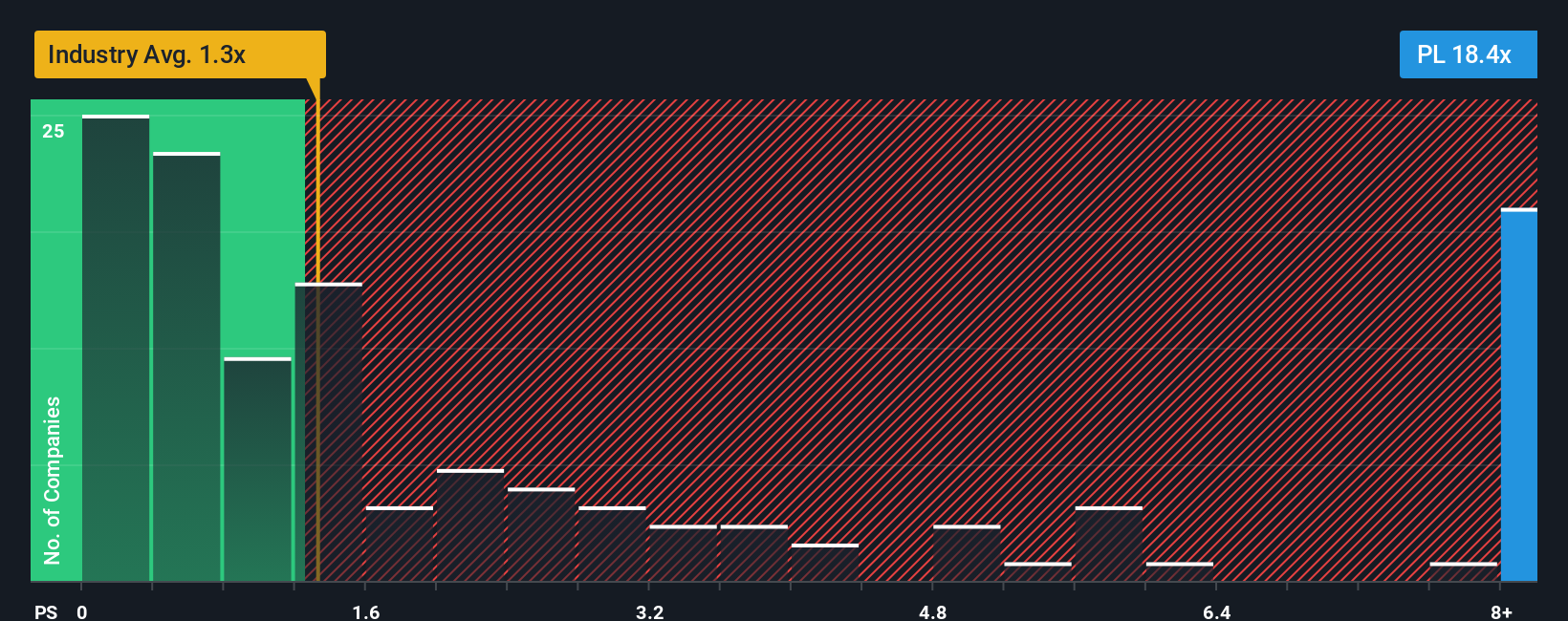

The price-to-sales (P/S) ratio is often the go-to valuation tool for companies that are early in their growth journey, especially when profits are inconsistent or negative. For fast-growing firms like Planet Labs PBC, revenues tend to be more stable and relevant than profits, making P/S a more meaningful yardstick for comparison.

What qualifies as a “normal” or “fair” P/S ratio depends on how quickly a company is growing its top line and how much risk investors are willing to stomach. High-growth, exciting prospects tend to command higher P/S multiples, while mature or riskier companies usually trade at lower ones. For context, Planet Labs’ current P/S ratio is 17.88x, which is dramatically higher than the industry average of 1.35x and the average among its peers at 0.82x.

This is where Simply Wall St’s “Fair Ratio” comes in. Instead of just comparing Planet Labs to its industry or peers, the Fair Ratio is tailored to the company’s own profile, taking into account earnings growth, profit margins, industry trends, market capitalization, and its unique risks. In this case, the proprietary Fair Ratio for Planet Labs is 4.13x, which acts as a more holistic benchmark than any single comparison point.

With a current P/S ratio of 17.88x versus a Fair Ratio of 4.13x, Planet Labs is priced well above where you might reasonably expect when all things are considered. This makes the stock look steep relative to its fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Planet Labs PBC Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal explanation for why you believe a company like Planet Labs PBC is worth what it’s worth, tying its story, such as satellite leadership, emerging industry trends, or partnership wins, directly to financial forecasts and a fair value estimate.

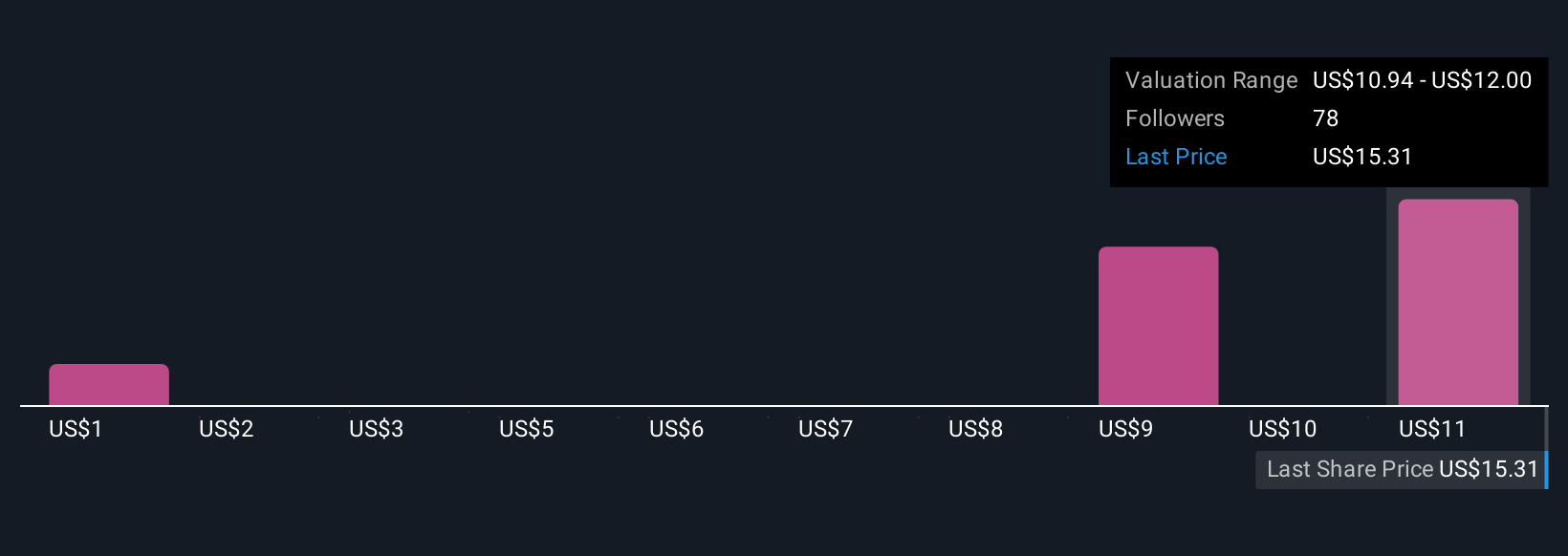

Unlike rigid valuation models, Narratives allow you to anchor your assumptions (future revenue, profit margins, growth rates) in real events and outlooks. This lets you compare your perspective to others and see how your view stacks up. Narratives are easy to use and available to everyone on Simply Wall St’s Community page, helping millions of investors make decisions grounded in both hard numbers and their own understanding of the business.

With Narratives, you’re empowered to decide whether Planet Labs is a buy or sell by comparing your calculated Fair Value to the current share price. You can update your thesis as soon as new information like contracts or earnings is announced. For example, one investor might see rapid government contracts and project a Fair Value of $11.31, while another sees competitive risks and estimates just $4.50. This illustrates how your story can change the “right” price to pay.

Do you think there's more to the story for Planet Labs PBC? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PL

Planet Labs PBC

Engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives