- United States

- /

- Commercial Services

- /

- NYSE:PBI

Can Pitney Bowes' (PBI) Revenue Miss Reveal Deeper Challenges for Its Core Business Model?

Reviewed by Simply Wall St

- Pitney Bowes recently reported a 5.7% year-over-year revenue decline, missing analysts' expectations, and issued full-year revenue guidance below consensus estimates.

- The shortfall in both quarterly performance and future outlook raises questions about the company's ability to offset ongoing headwinds in its legacy business segments.

- We'll now consider how disappointing revenue guidance could influence Pitney Bowes' investment narrative and future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Pitney Bowes Investment Narrative Recap

To be a shareholder in Pitney Bowes today, you need to believe in the company’s ability to transition from legacy mailing services to digital and technology-enabled logistics while managing industry headwinds and competition. The recent revenue miss and lowered outlook could weigh heavily on near-term sentiment, especially as the most immediate catalyst has been ongoing SaaS shipping growth, while persistent revenue losses remain the biggest risk. The latest news calls into question how quickly new streams can offset declines, but the company’s margin and earnings turnaround softens the blow for now.

Among recent developments, the increased share buyback authorization stands out given today’s disappointing revenue update. By expanding its buyback program to US$400 million, Pitney Bowes underscores its focus on returning capital to shareholders, which may help support share value and confidence despite top-line weakness. Investors watching for margin expansion and improved profitability will view these capital returns as supportive, if underlying business trends can stabilize.

By contrast, the persistent pressure facing the core mailing business is a risk investors should be aware of as...

Read the full narrative on Pitney Bowes (it's free!)

Pitney Bowes' outlook projects $1.9 billion in revenue and $348.2 million in earnings by 2028. This reflects an annual revenue decline of 2.1% and an increase in earnings of $202.3 million from the current $145.9 million level.

Uncover how Pitney Bowes' forecasts yield a $17.00 fair value, a 44% upside to its current price.

Exploring Other Perspectives

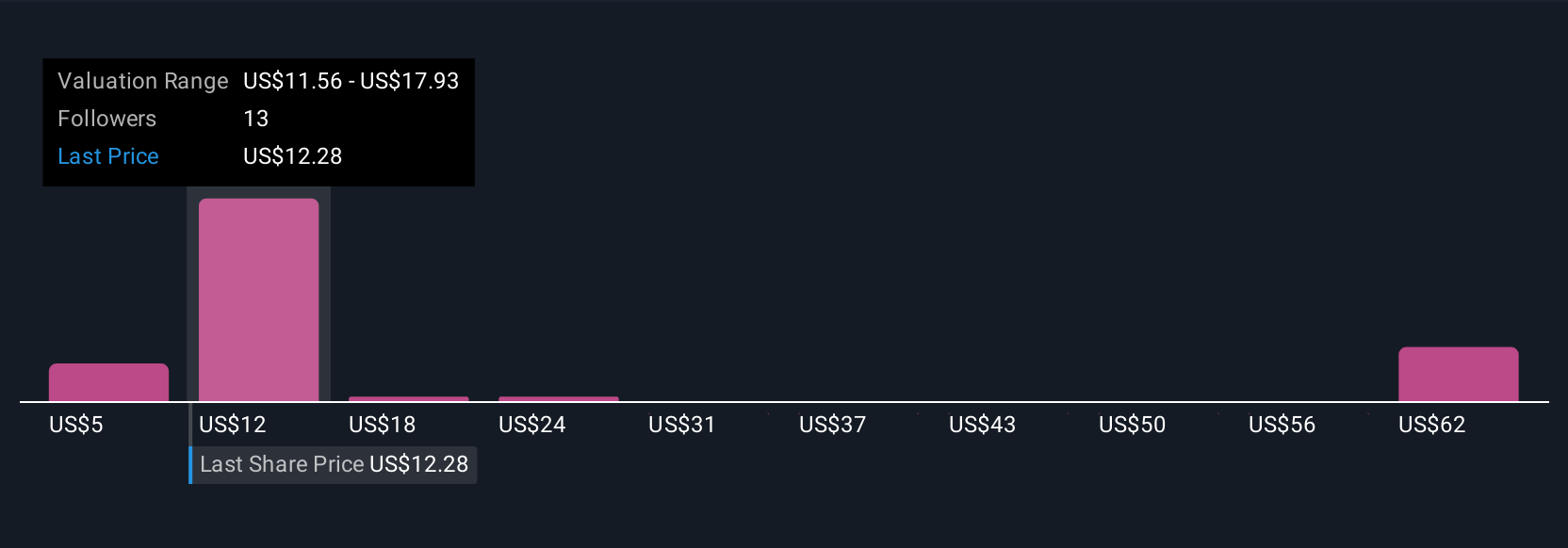

Ten fair value estimates from the Simply Wall St Community range from as low as US$5.20 to as high as US$67.54, covering nearly every threshold between. As SaaS shipping gains momentum, those differing market views highlight how much remains at stake for Pitney Bowes’ shift away from its legacy business.

Explore 10 other fair value estimates on Pitney Bowes - why the stock might be worth less than half the current price!

Build Your Own Pitney Bowes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pitney Bowes research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pitney Bowes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pitney Bowes' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBI

Pitney Bowes

Operates as a technology-driven company that provides SaaS shipping solutions, mailing innovation, and financial services to small businesses, large enterprises, and government entities around the world.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives