- United States

- /

- Professional Services

- /

- NYSE:NSP

Insperity (NSP) Is Down 23.3% After Slashing Guidance Amid Elevated Healthcare Costs and New UHC Deal

Reviewed by Sasha Jovanovic

- Insperity recently reported a third-quarter loss and significantly reduced its full-year earnings guidance, attributing the shortfall mainly to higher-than-expected healthcare costs and persistent profitability challenges.

- An important development is Insperity’s new multi-year agreement with UnitedHealthcare, which introduces risk transfer measures aimed at mitigating future benefits costs and supporting a recovery in earnings in 2026.

- We’ll examine how Insperity’s surprise loss and renewed focus on healthcare cost controls affect its mid-term investment outlook and growth drivers.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Insperity Investment Narrative Recap

For shareholders to stay committed to Insperity, belief in the company's long-term ability to manage rising employee benefits and healthcare costs, while launching new HR technology offerings, is critical. The recent earnings miss meaningfully highlights healthcare inflation as the biggest short-term risk, while Insperity’s progress on HRScale remains the primary growth catalyst; however, the surprise loss does not directly impact the HRScale rollout, which still serves as a central part of the mid-term outlook.

Among recent announcements, Insperity’s new multi-year risk transfer agreement with UnitedHealthcare stands out, aiming to address the very cost pressures that drove recent losses. This development is timely for investors monitoring if Insperity can balance cost control with expansion initiatives like HRScale, especially as profitability remains under pressure.

By contrast, one risk investors should not overlook is Insperity’s concentrated reliance on a single insurance partner, as future contract terms with UnitedHealthcare may...

Read the full narrative on Insperity (it's free!)

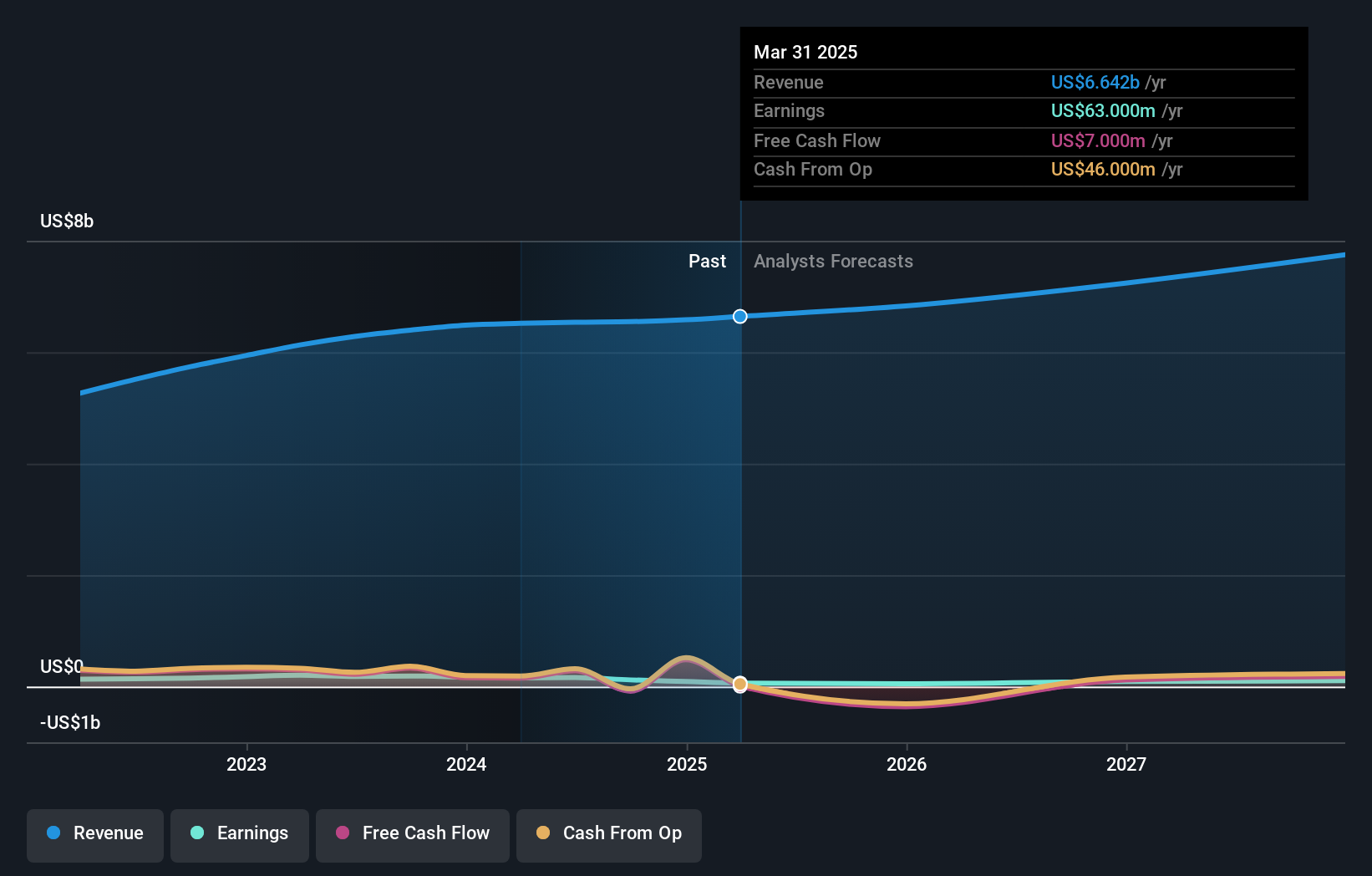

Insperity's outlook anticipates $7.7 billion in revenue and $109.6 million in earnings by 2028. This reflects a 5.0% annual revenue growth rate and a $69.6 million increase in earnings from the current $40.0 million basis.

Uncover how Insperity's forecasts yield a $49.00 fair value, a 45% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community posted two fair value estimates ranging from US$49 to US$176.99, reflecting wide dispersion ahead of recent results. Unpredictable increases in healthcare costs continue to challenge profitability, making it even more important to consider various viewpoints.

Explore 2 other fair value estimates on Insperity - why the stock might be worth just $49.00!

Build Your Own Insperity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Insperity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insperity's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives