- United States

- /

- Professional Services

- /

- NYSE:NSP

Insperity (NSP): Evaluating Valuation After Recent Share Price Slide

Reviewed by Simply Wall St

Insperity (NSP) shares have been under pressure lately, continuing a slide seen over the past month. Investors are taking stock of the pullback as they consider how recent trends might signal new opportunities or further downside ahead.

See our latest analysis for Insperity.

This sharp sell-off continues a broader downtrend for Insperity, with momentum steadily fading over the past year. Despite occasional hints of recovery, the stock’s year-to-date share price return of -56.52% and three-year total shareholder return of -68.96% reflect both recent volatility and heightened investor caution around growth prospects and risk profile.

If you’re weighing where else compelling opportunities might be emerging, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below recent analyst price targets but ongoing caution about Insperity’s outlook, the question remains: is the market undervaluing the company, or does the stock already reflect all future growth potential?

Most Popular Narrative: 33% Undervalued

Insperity's last close of $32.83 stands well below the fair value implied by the consensus narrative, setting up a story of deep disconnect between expectations and the current price.

Launching HRScale with Workday and expanding AI-driven HR offerings positions Insperity for higher revenue growth and scalable margin improvements in the mid-market segment. Rising HR compliance complexity and increased SMB formation boost ongoing demand for bundled services, supporting long-term client growth and sustainable recurring revenue.

Curious about the bold projections that drive this big gap? Analysts are betting on rapid earnings acceleration, margin recovery, and a future multiple that could surprise even seasoned investors. Only by digging into the numbers will the full rationale behind this valuation become clear.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent healthcare cost inflation or setbacks in Insperity’s new tech partnerships could quickly undermine the current optimism around margin recovery and growth.

Find out about the key risks to this Insperity narrative.

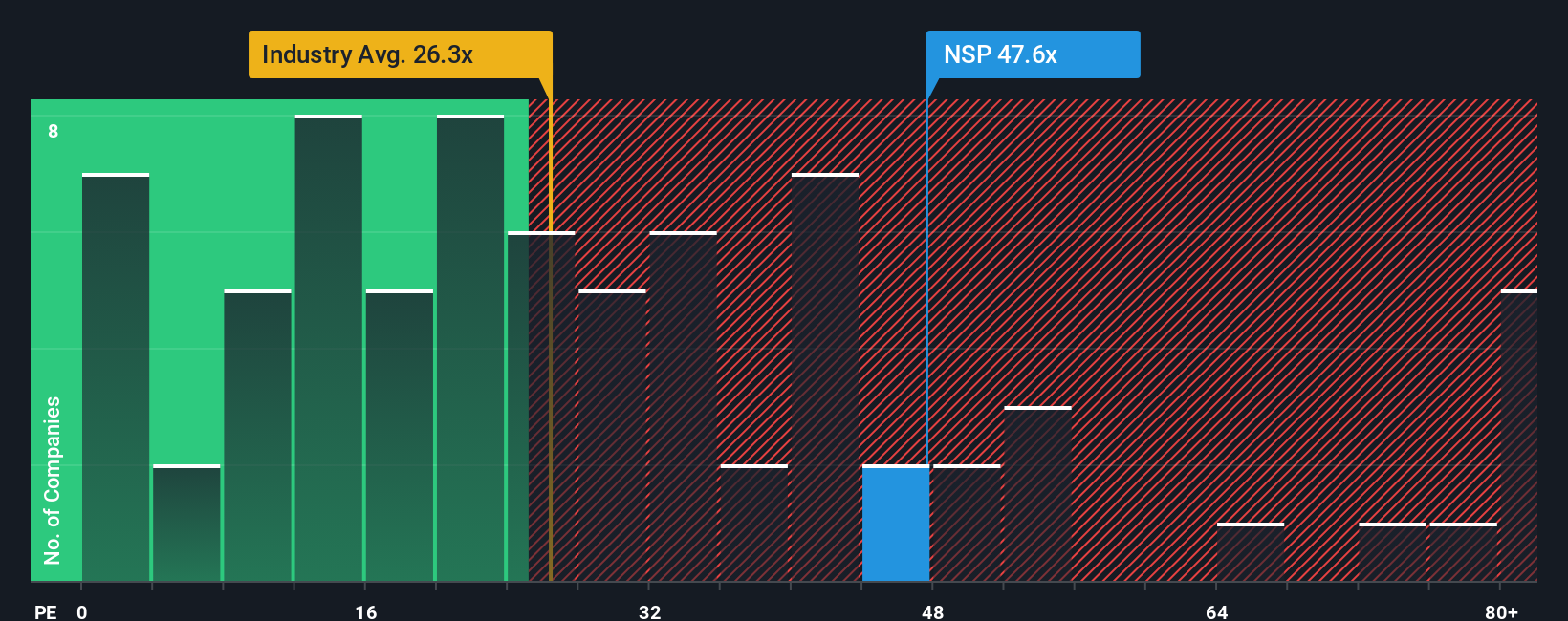

Another View: High Price Ratios Raise Questions

Looking from a different angle, Insperity’s share price stands out as expensive compared to many peers. Its price-to-earnings ratio of 72.8x is much higher than the US Professional Services industry average of 24.4x and even well above its own fair ratio of 61.1x. This premium suggests investors are still paying up for future potential, despite recent declines. Does this premium reflect a true opportunity, or could valuation risk still be lurking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insperity Narrative

If the consensus narrative doesn’t match your own assessment or you want to dive deeper into the numbers firsthand, you can easily craft your own perspective on Insperity in just a few minutes. Do it your way

A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for missing out. Seize today’s best opportunities before the crowd catches on! Use these hand-picked tools to find stocks that match your unique strategy.

- Boost your portfolio’s growth potential by targeting high-yield companies with these 16 dividend stocks with yields > 3% offering consistent returns above 3%.

- Pinpoint the most promising undervalued shares quickly with these 872 undervalued stocks based on cash flows and position yourself ahead of the value curve.

- Be early in the fast-moving world of artificial intelligence by acting on these 24 AI penny stocks loaded with strong growth momentum and innovative edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives