- United States

- /

- Professional Services

- /

- NYSE:NSP

If You Had Bought Insperity (NYSE:NSP) Stock Five Years Ago, You Could Pocket A 706% Gain Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Insperity, Inc. (NYSE:NSP) shares for the last five years, while they gained 706%. This just goes to show the value creation that some businesses can achieve. In the last week the share price is up 3.1%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for Insperity

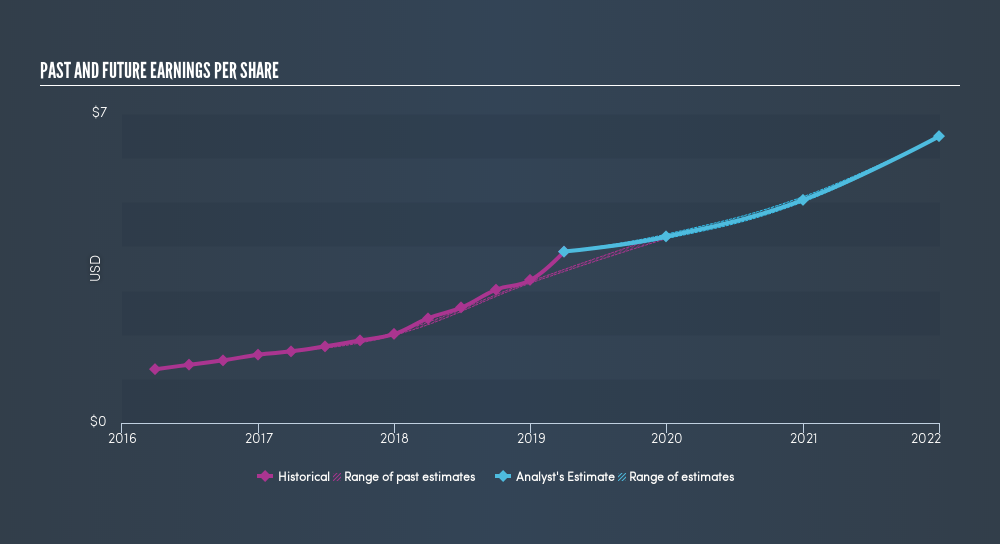

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Insperity managed to grow its earnings per share at 48% a year. This EPS growth is reasonably close to the 52% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

We know that Insperity has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Insperity, it has a TSR of 837% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Insperity has rewarded shareholders with a total shareholder return of 37% in the last twelve months. That's including the dividend. Having said that, the five-year TSR of 56% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:NSP

Insperity

Engages in the provision of human resources (HR) and business solutions to improve business performance for small and medium-sized businesses primarily in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives