- United States

- /

- Commercial Services

- /

- NYSE:MSA

A Fresh Look at MSA Safety’s (MSA) Valuation Following New CFO Appointment

Reviewed by Simply Wall St

If you follow MSA Safety (NYSE:MSA), the recent leadership shakeup is something you probably noticed. The company just announced that Julie A. Beck, who previously held CFO roles at Terex Corp. and Nova Chemicals, will be stepping in as Chief Financial Officer and Senior Vice President later this month. Investors know that bringing in a CFO with a track record for driving transformation and disciplined growth can set the tone for a company’s next chapter. The timing of this appointment is particularly interesting for those eyeing the stock.

MSA Safety shares have shown only modest movement over the past year, ending up almost flat even as its peers have posted wider swings. The company has seen solid returns over the past three years, but in the past month alone, the stock dipped slightly, while momentum has picked up over the past quarter. The CFO transition comes at a time when MSA’s revenue and net income growth remain steady, and leaders are clearly hoping that Ms. Beck’s experience navigating complex global businesses can unlock new value.

With this new financial leadership, some are wondering if the market is still underestimating MSA Safety’s growth story, or if the stock’s price already reflects everything investors need to know about its future.

Most Popular Narrative: 8.3% Undervalued

According to community narrative, MSA Safety is currently considered undervalued by 8.3% based on analyst consensus about its future earnings growth and profitability drivers.

Robust growth in connected safety solutions (such as MSA+ and ALTAIR io 4) reflects increasing customer adoption of advanced, cloud-connected worker technologies. This trend is driven by heightened workplace safety requirements and industrial digitization, and it positions MSA for above-average revenue and margin expansion, as these premium products command higher prices.

Want to know what’s really fueling this bullish valuation? The analysts behind this narrative hinge their projections on a handful of ambitious numbers. The true catalyst is buried in their bold assumptions. Can you guess what's driving that compelling price target? There’s one number you don’t want to miss.

Result: Fair Value of $191.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting cost pressures from tariffs and currency shifts, as well as weaker demand in core products, could quickly undermine these bullish expectations.

Find out about the key risks to this MSA Safety narrative.Another View: SWS DCF Model

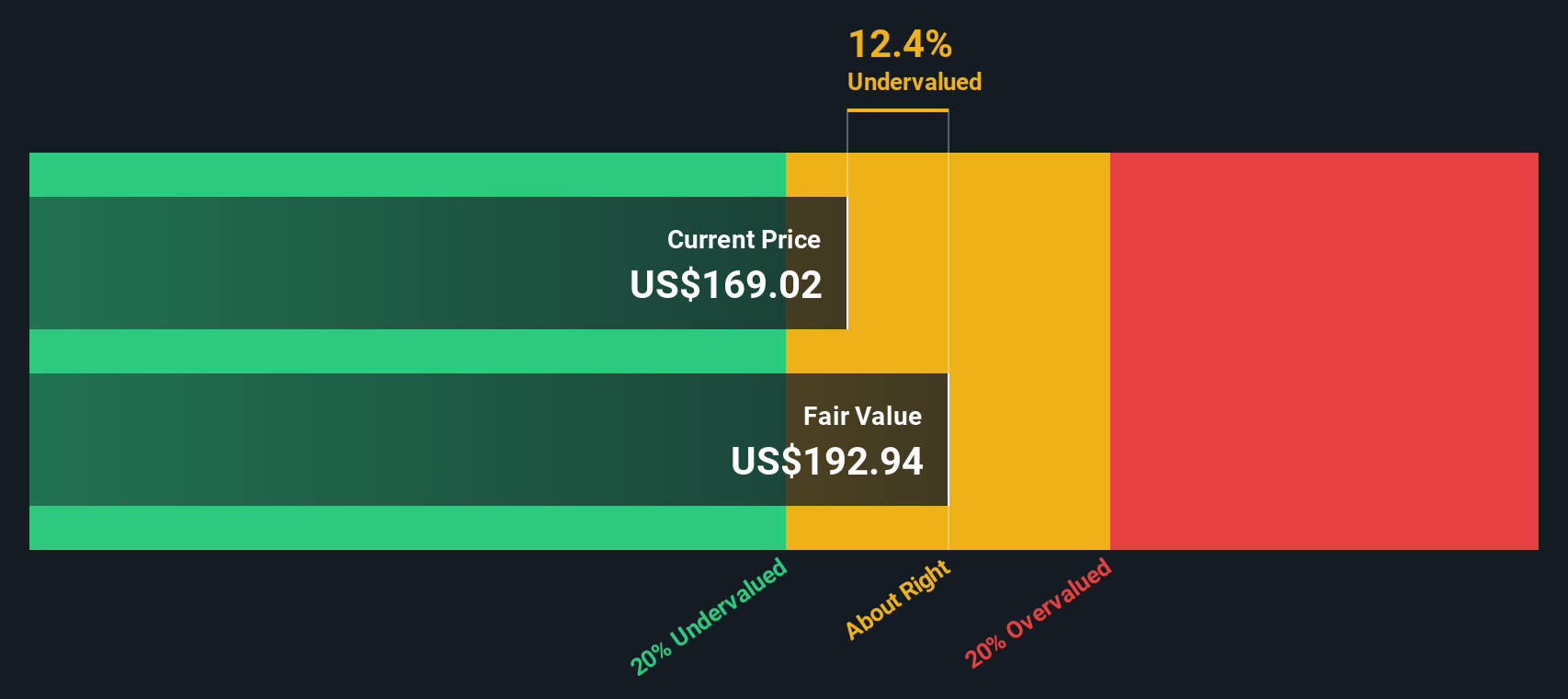

Taking a different approach, our DCF model also points to MSA Safety as undervalued at current prices. While it uses cash flow projections instead of analyst estimates, will the numbers hold up in the real world?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own MSA Safety Narrative

If you have a different take on MSA Safety’s outlook or want to dig into the raw numbers yourself, you can shape your own perspective and narrative in just a few minutes. do it your way.

A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Staying ahead means actively searching for fresh opportunities. Don’t let the next standout stock slip past you. Use these powerful tools on Simply Wall Street to spot new leaders and long-term winners.

- Unlock income potential by scanning for companies offering dividend stocks with yields > 3%. Build a portfolio that turns market moves into regular cash flow.

- Spot the next tech disruptors by checking out AI penny stocks and position yourself early in the artificial intelligence wave reshaping every industry.

- Secure long-term value by hunting for undervalued stocks based on cash flows. Stack the odds in your favor with stocks whose fundamentals outpace their price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSA

MSA Safety

Develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives