- United States

- /

- Commercial Services

- /

- NYSE:MEG

Montrose Environmental Group (MEG): Assessing Valuation as Analysts Boost Forecasts After EPA Regulatory Shift

Reviewed by Kshitija Bhandaru

Montrose Environmental Group (MEG) has caught the eye of many investors after analysts have raised their earnings estimates for the next quarter and full year, fueling a sense of optimism around the stock. The main driver behind this confidence appears to be the company’s central role in helping chemical manufacturers nationwide meet new environmental standards. As the EPA’s recently finalized Hazardous Organic NESHAP MACT rule introduces stricter controls and looming compliance deadlines, Montrose’s pipeline of projects has expanded as deadlines approach and demand for specialized compliance support intensifies.

Looking at the bigger picture, this wave of positive sentiment has translated into stronger share price momentum for Montrose Environmental Group over the past several months. After a challenging year, the stock has managed to rebound, climbing nearly 33% in the past three months and rising more than 54% year-to-date. Still, the longer-term view is mixed, with a three-year decline but a solid five-year return. This suggests that investors may be reassessing the company’s potential as regulatory-driven opportunities increase.

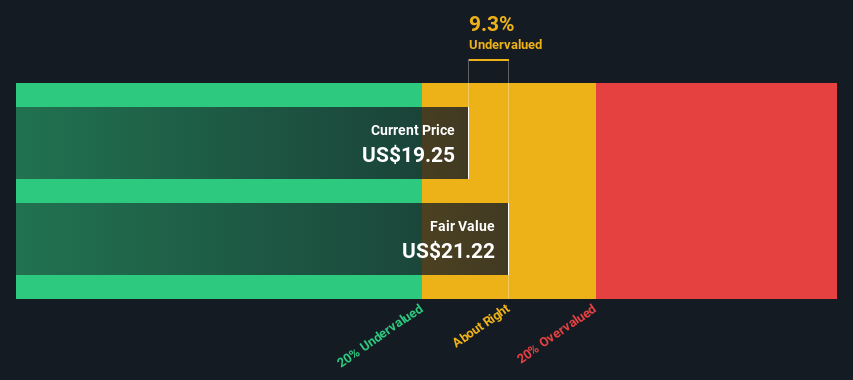

With all this recent optimism around earnings and regulatory tailwinds, it is fair to wonder whether Montrose Environmental Group is trading at a discount to its true potential, or if the market has already priced in the promise of future growth.

Most Popular Narrative: 6.1% Undervalued

According to the most widely followed narrative, Montrose Environmental Group is considered to be trading below its fair value, with analysts projecting a 6.1% discount compared to their calculated fair value. This conclusion is based on expectations of improved margins, continued demand for environmental services, and future earnings growth.

Ongoing global investment in climate change mitigation and adaptation, coupled with increased regulatory requirements at state, local, and international levels regardless of US federal shifts, is sustaining robust demand for Montrose's measurement, monitoring, and remediation services. This is driving recurring revenue growth and supporting the company's guidance for organic revenue expansion in the 7 to 9%+ range. Rising corporate ESG mandates across industries are pushing clients to prioritize long-term compliance, monitoring, and risk mitigation. This translates into increased contract wins, exceptionally high client retention (96%+), and a larger wallet share per client for Montrose, positively impacting revenue stability and earnings visibility.

What is fueling this narrative's optimism? The heart of the story is an aggressive bet on growth rates, margin performance, and a long-term profit picture that could shake up how you value the company. Want insight into the precise targets and how experts arrive at this undervaluation? Get the numbers and the full analyst playbook behind this narrative's fair value projection.

Result: Fair Value of $30.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stronger margins depend partly on episodic emergency projects, and a pause in acquisitions could limit Montrose’s long-term growth if these trends continue.

Find out about the key risks to this Montrose Environmental Group narrative.Another View: SWS DCF Model

For a different perspective, the SWS DCF model approaches Montrose Environmental Group’s valuation by estimating the company's future cash flows instead of focusing on market multiples. This method also finds the shares undervalued. Could both models be missing something? Or is there a consensus forming on value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Montrose Environmental Group Narrative

If you find yourself unconvinced by these viewpoints or simply want to draw your own conclusions, you can shape your own interpretation with just a few clicks. Do it your way.

A great starting point for your Montrose Environmental Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let a single stock limit your upside. Plug into powerful investment themes with hand-picked ideas designed to help you level up your portfolio.

- Supercharge your income strategy by accessing stocks offering strong yields and attractive growth through our dividend stocks with yields > 3%.

- Catch the next wave in technology by spotting trailblazers in artificial intelligence with an edge when you start your search with AI penny stocks.

- Unlock deeply discounted companies that may be poised for a rebound by filtering for value opportunities using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MEG

Montrose Environmental Group

Operates as an environmental services company in the United States, Canada, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives