- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WBTN

Exploring 3 Promising Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.1%, yet it remains up by 9.1% over the past year with earnings anticipated to grow by 14% per annum in the coming years. In this context, identifying small-cap stocks with insider action can offer unique opportunities for investors seeking potential value plays amidst fluctuating market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.3x | 2.9x | 46.36% | ★★★★★☆ |

| Barrett Business Services | 20.5x | 0.9x | 47.52% | ★★★★☆☆ |

| S&T Bancorp | 10.6x | 3.7x | 43.82% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 28.05% | ★★★★☆☆ |

| Niagen Bioscience | 56.7x | 7.4x | 25.01% | ★★★☆☆☆ |

| Columbus McKinnon | 50.3x | 0.5x | 36.71% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -45.54% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.5x | -2855.89% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 0.9x | 7.96% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -417.89% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

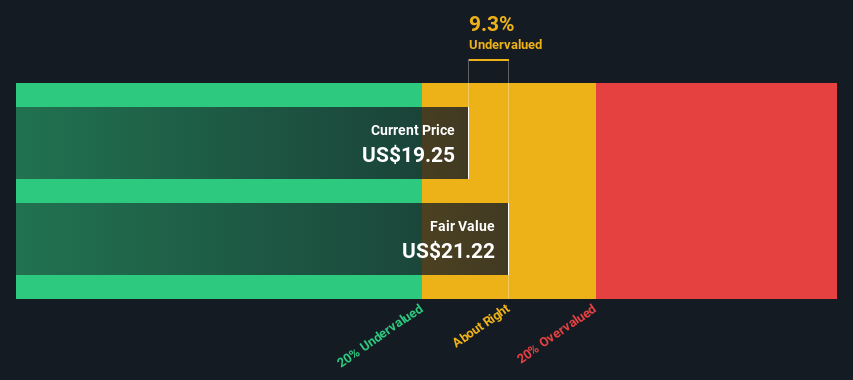

WEBTOON Entertainment (NasdaqGS:WBTN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: WEBTOON Entertainment focuses on digital comics and storytelling, operating primarily in the motion pictures segment with a market capitalization of $1.35 billion.

Operations: With revenue primarily from motion pictures, WEBTOON Entertainment reported $1.35 billion in the latest period. The company experienced a gross profit margin fluctuation, peaking at 25.26% and reaching a low of 23.04%. Operating expenses have varied significantly, with notable increases in general and administrative costs impacting overall profitability.

PE: -6.6x

WEBTOON Entertainment, a company with a focus on webcomic platforms, is experiencing revenue growth despite its current unprofitability and reliance on external borrowing. For the first quarter of 2025, sales reached US$325.71 million but resulted in a net loss of US$22.39 million. The firm anticipates Q2 revenue between US$335 million and US$345 million. Recent product updates aim to enhance user engagement through AI-driven recommendations and new content formats, potentially boosting future growth prospects despite financial challenges.

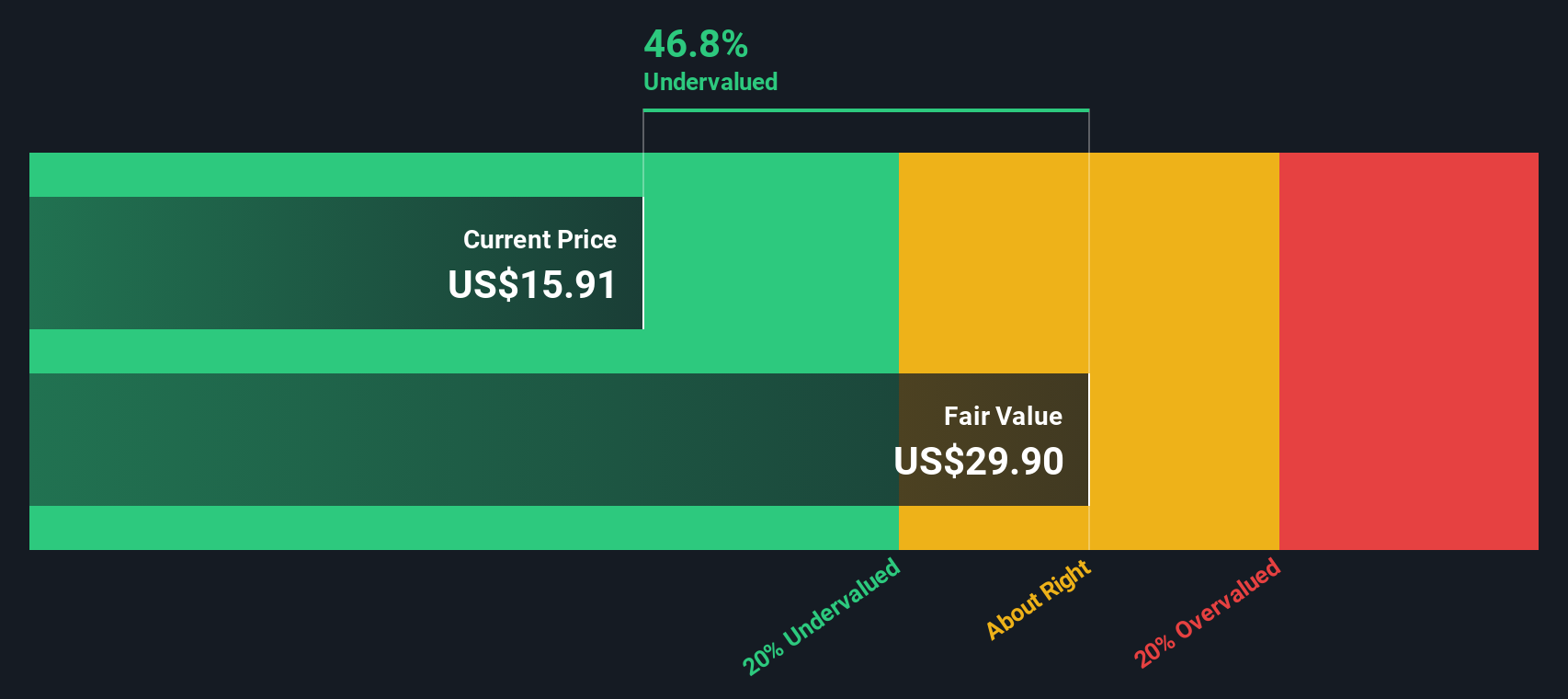

Montrose Environmental Group (NYSE:MEG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Montrose Environmental Group operates in the environmental services industry, focusing on remediation and reuse, measurement and analysis, and assessment, permitting and response, with a market cap of approximately $1.52 billion.

Operations: Montrose Environmental Group generates revenue through three main segments: Remediation and Reuse, Measurement and Analysis, and Assessment, Permitting and Response. The company's gross profit margin has shown an upward trend from 28.64% in December 2018 to 40.18% by March 2025.

PE: -8.4x

Montrose Environmental Group, a key player in environmental solutions, has shown insider confidence with recent share purchases. Despite reporting a net loss of US$19.36 million for Q1 2025, sales increased to US$177.83 million from the previous year. The company is actively addressing PFAS contamination and expanding its footprint with projects like the $4 million contract in Australia's Bowen Basin. A new buyback program worth up to US$40 million signals potential value recognition by the company itself.

TXO Partners (NYSE:TXO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: TXO Partners is involved in the exploration and production of oil, natural gas, and natural gas liquids with a market capitalization of approximately $2.5 billion.

Operations: The company generates revenue primarily from exploration and production activities in oil, natural gas, and natural gas liquids. It experienced fluctuations in net income margin, with a notable peak at 34.21% in early 2023 before declining to -61.27% by mid-2024. Gross profit margin showed variability as well, reaching a high of 69.67% at the end of 2021 but decreasing to around 46.79% by early 2025.

PE: 53.4x

TXO Partners, a small player in the energy sector, has shown mixed financial performance recently. While revenue for Q1 2025 rose to US$84.33 million from US$67.44 million the previous year, net income dropped to US$2.42 million from US$10.27 million. The company completed a follow-on equity offering of US$175 million in May 2025, which may indicate strategic expansion plans despite high-risk funding through external borrowing only. Leadership changes include appointing new co-CEOs and board members with extensive industry experience as of April 2025, potentially steering future growth and stability amidst evolving market dynamics.

Where To Now?

- Click through to start exploring the rest of the 101 Undervalued US Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEBTOON Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WBTN

WEBTOON Entertainment

Operates a storytelling platform in the United States, Korea, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives