- United States

- /

- Professional Services

- /

- NYSE:LDOS

The Bull Case For Leidos Holdings (LDOS) Could Change Following Launch of Imperium AI Platform – Learn Why

Reviewed by Sasha Jovanovic

- Leidos Holdings and VML recently announced the launch of Imperium, an AI-driven technology platform developed over three years to enhance U.S. information operations with faster planning, advanced analytics, and real-time compliance tracking.

- This initiative showcases how Leidos' integration of Trusted Mission AI with VML's communications expertise is actively driving innovation in national security technology.

- We’ll explore how the introduction of Imperium expands Leidos’ AI capabilities and impacts its investment narrative moving forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Leidos Holdings Investment Narrative Recap

To own shares in Leidos Holdings, an investor typically needs to believe in continuing multi-year government contract growth, digital modernization initiatives, and the company’s ability to lead in advanced AI-powered national security solutions. The launch of Imperium strengthens Leidos’ positioning in AI analytics for information operations, but it does not materially alter the short-term catalyst for the stock, which remains the pace and stability of U.S. federal funding. The biggest risk, continued heavy reliance on U.S. government contracts, is also unchanged by this news.

The recent 19-year contract to modernize Kazakhstan’s air traffic control system is particularly interesting, as it demonstrates Leidos’ international market reach beyond core U.S. defense and intelligence programs. While this supports pipeline diversification, the company’s operational momentum and most immediate catalysts remain closely tied to the scale, renewal, and funding of major U.S. government contracts in defense, health, and intelligence.

However, despite the progress, investors should be aware of the potential implications if government spending priorities shift or contract volumes slow...

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings' outlook anticipates $18.6 billion in revenue and $1.5 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 3.0% and an increase in earnings of $0.1 billion from the current $1.4 billion.

Uncover how Leidos Holdings' forecasts yield a $198.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

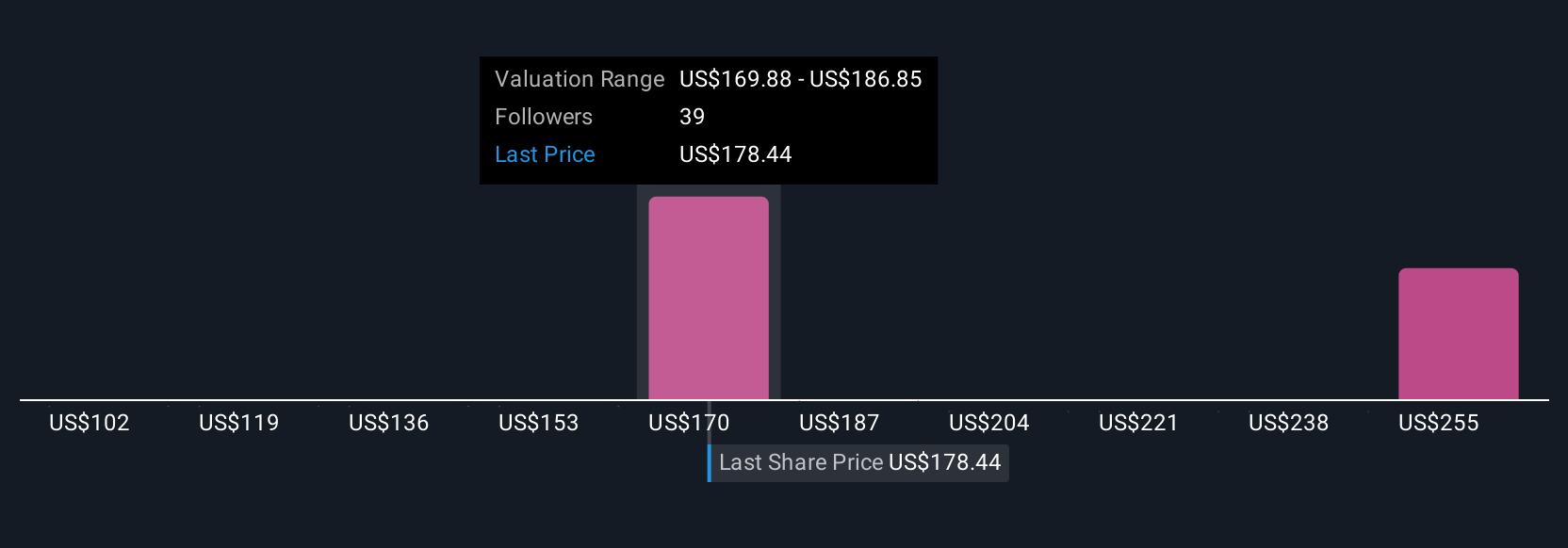

Seven members of the Simply Wall St Community have set fair value estimates for Leidos ranging between US$128.85 and US$309.24, showing a wide spread of views. Many are watching the pace of U.S. government contract wins, which can directly influence both near-term momentum and the company’s revenue stability.

Explore 7 other fair value estimates on Leidos Holdings - why the stock might be worth as much as 62% more than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives