- United States

- /

- Professional Services

- /

- NYSE:LDOS

Leidos Holdings (LDOS): Evaluating Valuation After Strong Backlog Growth and New Digital Health Joint Venture

Reviewed by Kshitija Bhandaru

Leidos Holdings (LDOS) recently formed the Purple Sky joint venture, with the aim of enhancing digital and AI capabilities for federal health agencies. In addition, a large and growing order backlog has continued to keep investors interested.

See our latest analysis for Leidos Holdings.

Leidos Holdings has kept its business momentum going, with the past year’s 18% total shareholder return reflecting both steady execution and a string of positive developments, including a soaring order backlog, strong earnings, and the new Purple Sky joint venture. With sustained institutional interest and continued contract wins, investor sentiment appears upbeat as the company leans into digital transformation and AI for government customers.

Wondering where else the smart money is going? If Leidos’s momentum caught your attention, it might be the perfect moment to discover other fast-growing stocks with high insider ownership. Broaden your perspective with fast growing stocks with high insider ownership

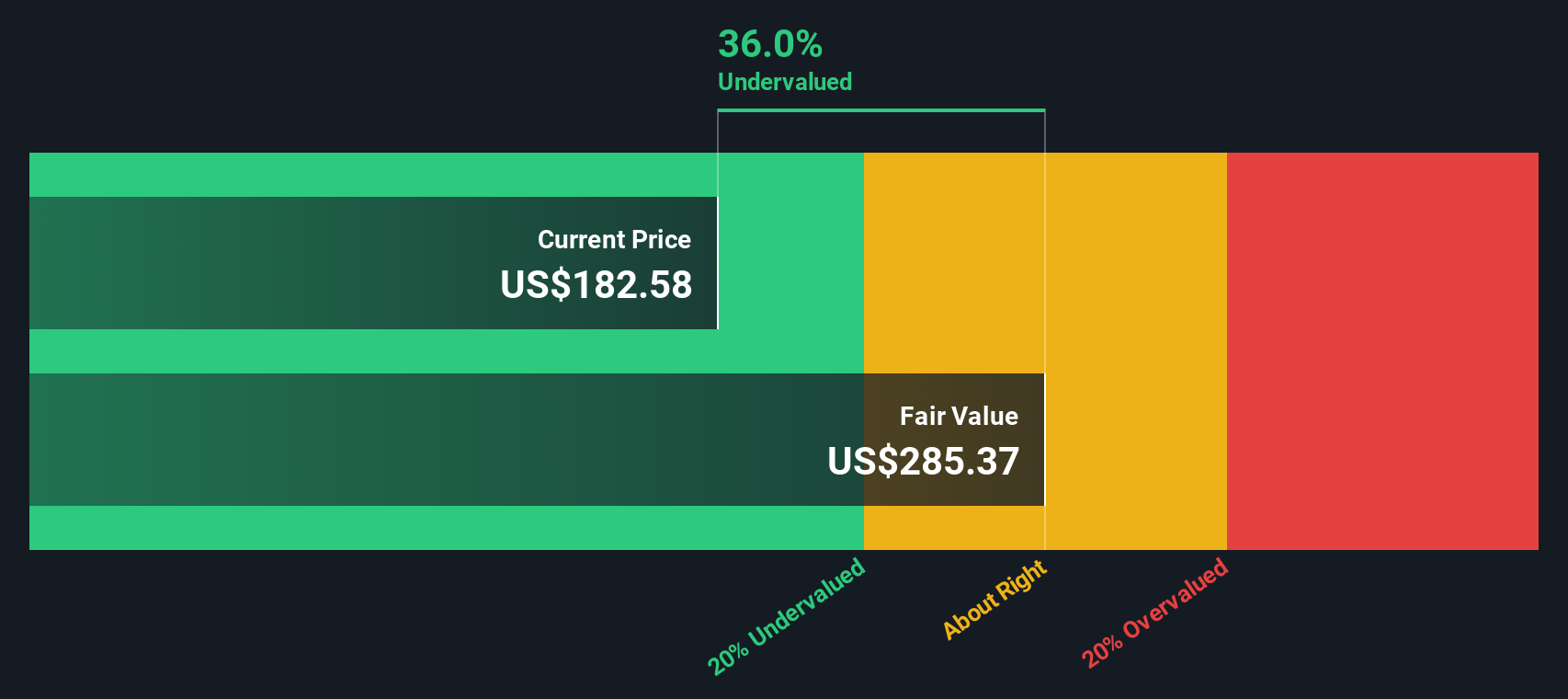

But with the stock up more than 40% over the past six months and trading near analysts’ price targets, investors now face a key question: is Leidos still undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: Fairly Valued

Leidos Holdings traded last at $192.89, almost identical to the narrative’s fair value estimate of $192.66. This signals a rare consensus between market price and the dominant view, setting the stage for a deeper dive into what is powering this alignment.

Accelerating customer demand for digital modernization, AI-powered solutions, and autonomous systems in defense, healthcare, and intelligence plays to Leidos' strengths and is leading to higher-quality, higher-margin contracts that improve net margins, as these capabilities command premium pricing and are in areas of secular growth.

Want to know what fuels such confidence? The narrative is built around aggressive upgrades in digital, healthcare, and automation, hinting at bold financial targets and margin assumptions that could surprise skeptics. Find out which big shifts the narrative expects to turn heads and why the predicted numbers are causing buzz among followers.

Result: Fair Value of $192.66 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened reliance on government contracts and the threat of increased competition could quickly undermine Leidos’s growth assumptions if current trends change.

Find out about the key risks to this Leidos Holdings narrative.

Another View: The SWS DCF Model Suggests Undervaluation

While the market and analysts see Leidos Holdings as fairly valued around $192, our discounted cash flow (DCF) model offers a different perspective. The SWS DCF analysis estimates fair value at $306.74, suggesting the stock could be trading at a significant discount. Could this divergence reveal a hidden opportunity, or is the market pricing in risks that the model might not consider?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Leidos Holdings Narrative

If you see the story differently or want to test your own ideas, it takes just a few minutes to craft your own perspective. Do it your way

A great starting point for your Leidos Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t just settle for one opportunity when so many others are on the table. Broaden your portfolio and catch tomorrow’s growth stories before everyone else.

- Unlock potential in the digital realm by targeting tomorrow’s leaders with these 24 AI penny stocks, where artificial intelligence meets growth.

- Capture income and stability by reviewing these 19 dividend stocks with yields > 3%, filled with companies delivering strong yields above market averages.

- Spot undervalued gems overlooked by the crowd using these 907 undervalued stocks based on cash flows, offering fresh ideas based on tangible cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives