- United States

- /

- Professional Services

- /

- NYSE:LDOS

Examining Leidos Stock After Recent 5% Drop and Strong 2025 Growth Prospects

Reviewed by Bailey Pemberton

Trying to figure out what to do with your Leidos Holdings stock? You are not alone. This is a name that has been getting attention, with a story that is far more nuanced than a glance at the price chart might reveal. While the stock stumbled 5.0% in the last week, it is still up an impressive 28.7% year-to-date and an eye-catching 129.6% over five years. That steady climb has come alongside a wave of broader market optimism in tech and defense, where Leidos is a key player.

Some of the recent price jitters might be tied to shifting sentiment around the entire defense sector, as debates over government contract spending make headlines. But even with these bumps, the long-term trajectory has been strong, fueled by the company’s role in critical security and technology projects that are hard to replicate. Investors weighing the next move are, frankly, right to pause. Leidos Holdings looks different depending on your time horizon and risk appetite.

The real question, though, is whether that impressive performance is justified by the company’s fundamental value. According to our valuation scorecard, Leidos earns a 5 out of 6, a clear mark that it is undervalued across nearly every measure we track. Up next, we are going to dig into those valuation approaches and, even more importantly, explore a method that offers a smarter way to cut through the noise at the end of the analysis.

Approach 1: Leidos Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts those projections back to today's value. This helps investors estimate what the business is really worth based on its ability to generate cash in the future.

For Leidos Holdings, the latest reported Free Cash Flow stands at $1.27 Billion. According to analyst forecasts and Simply Wall St's further extrapolations, Free Cash Flow is expected to rise steadily, reaching $2.28 Billion by 2035. This steady growth reflects confidence in Leidos's capacity to expand its earnings over the long term.

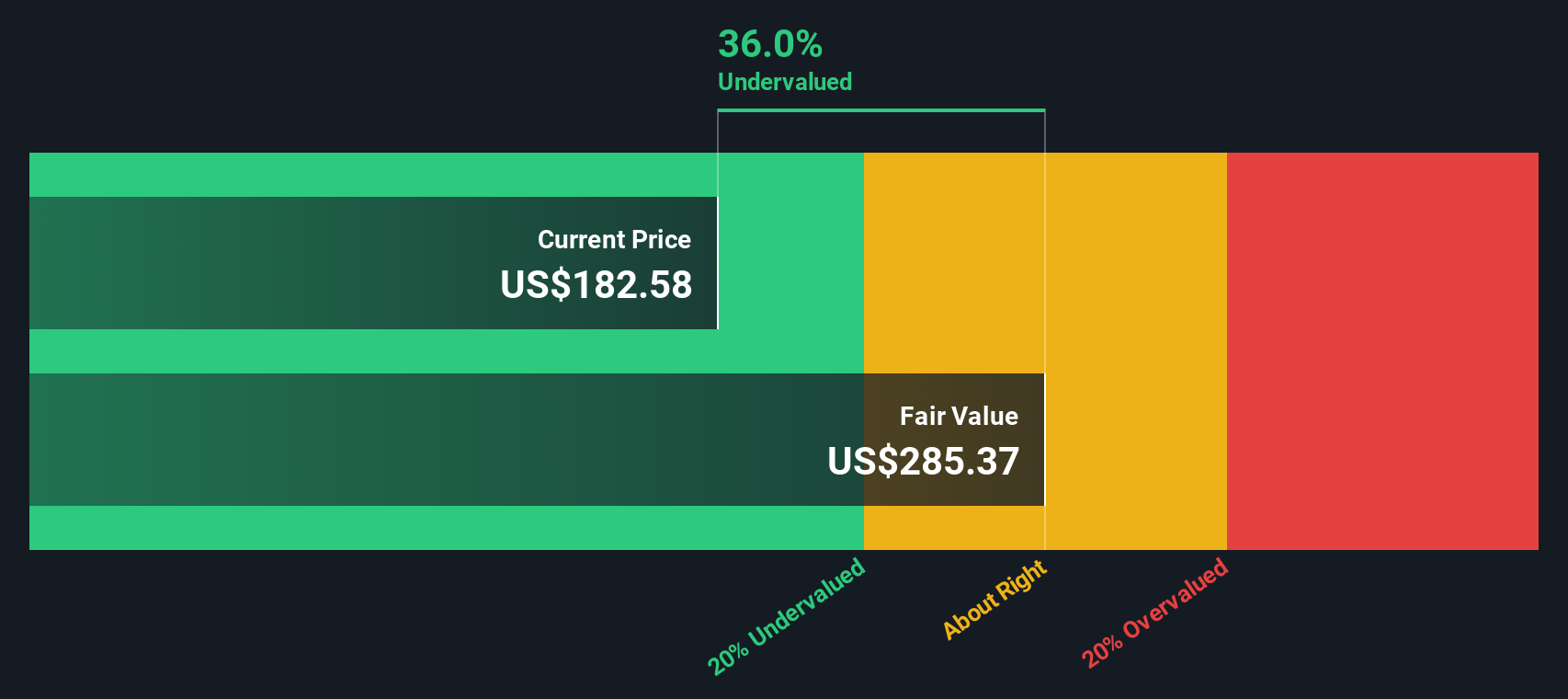

After crunching the numbers through a two-stage Free Cash Flow to Equity approach, the DCF valuation model assigns Leidos an intrinsic value of $307.53 per share. Compared to the current market price, this implies the stock is trading at a 40.0% discount to its fair value. In other words, the market is underestimating the company’s future profit potential based on these cash flow trends.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Leidos Holdings is undervalued by 40.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Leidos Holdings Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is often the preferred valuation tool for companies like Leidos Holdings that are profitable and generate steady earnings. It helps investors quickly compare how much they are paying for each dollar of current profits, offering a direct way to assess value when the business is consistently generating net income.

In the world of PE ratios, expectations around a company’s growth prospects and risks play a big role in what is considered “normal.” A higher PE might be justified for a business with strong future earnings growth or limited risks, while a lower PE often appears when growth is slow or there are significant uncertainties on the horizon.

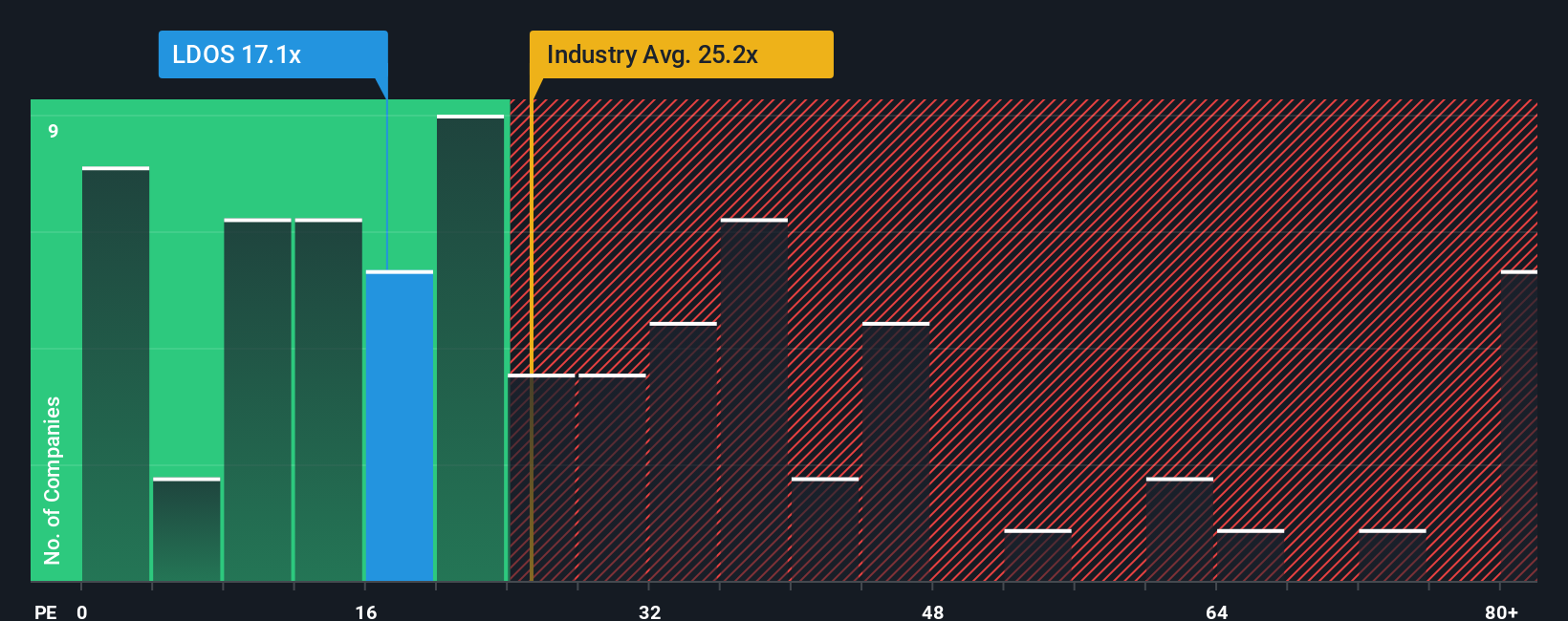

Leidos Holdings is currently trading at a PE ratio of 16.88x. This is notably below the Professional Services industry average of 24.75x, and also well under the peer average of 41.26x. At first glance, this suggests the market is being somewhat conservative about Leidos’s future earnings power, especially compared to its sector rivals.

But there is more to the story than just industry and peer comparisons. Simply Wall St’s proprietary “Fair Ratio” metric calculates the PE that would be justified for Leidos based on its own earnings growth outlook, risks, profit margins, industry dynamics and market cap. In this case, Leidos’s Fair Ratio is 26.02x, which means that, factoring in its specific fundamentals and risk profile, it deserves a PE multiple quite a bit higher than where it currently trades.

Unlike industry or simple peer comparisons, the Fair Ratio provides a customized benchmark, better capturing the company’s individual qualities and threats. It goes beyond the headlines to show what the market should be paying for Leidos, adjusted for its actual prospects and scale.

Given that the Fair Ratio (26.02x) is considerably above the current PE (16.88x), it suggests Leidos Holdings is undervalued on this respected metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Leidos Holdings Narrative

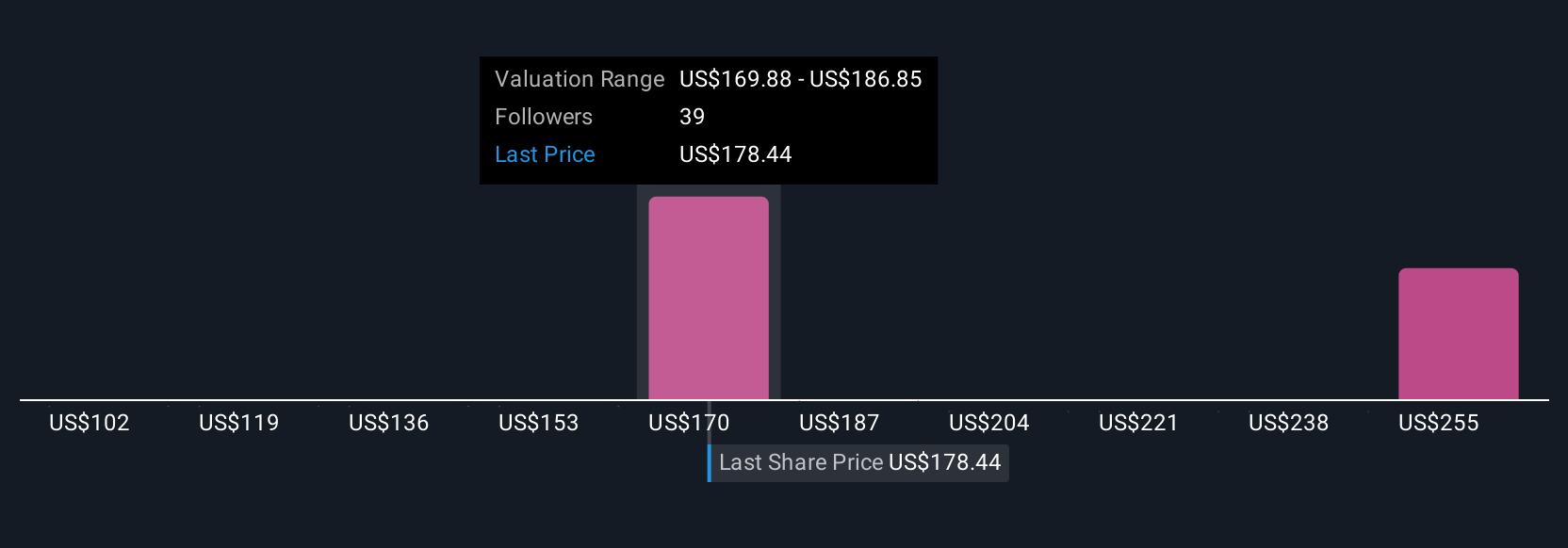

Earlier, we mentioned there is a smarter way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story, your unique perspective about what you think is driving Leidos Holdings' future, linking your expectations for revenue, earnings, and margins to an estimated fair value behind the numbers.

With Narratives, you move beyond static metrics by connecting a company’s big-picture story directly to a dynamic financial forecast, and then to a real, actionable fair value. This approach helps you clearly see if Leidos appears undervalued, overvalued, or just right for your goals. Narratives are built to be easy and accessible. On Simply Wall St’s Community page, millions of investors create and update their Narratives as news or earnings are released, ensuring your decision-making tools are always up to date.

Here is how it works: Imagine one investor believes in strong, long-term government funding and digital transformation for Leidos, creating a future fair value of $210 per share. Another investor sees risks around margin pressure and assigns just $164 as fair value. By comparing these Narratives to the current price, you gain a powerful sense of whether the stock aligns with your own view of the business.

Do you think there's more to the story for Leidos Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LDOS

Leidos Holdings

Provides services and solutions for government and commercial customers in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives