- United States

- /

- Professional Services

- /

- NYSE:KBR

How the Loss of the Global Household Goods Contract at KBR (KBR) Has Changed Its Investment Story

Reviewed by Simply Wall St

- On June 20, 2025, KBR announced that the U.S. Transportation Command had terminated HomeSafe Alliance's involvement in the Global Household Goods Contract, which has prompted a law firm investigation into whether the company issued misleading business information.

- This development raises significant concerns about KBR's exposure to legal and financial risks tied to major government contracts and associated disclosures.

- We'll look at how the potential for securities litigation following a major contract loss challenges KBR's broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

KBR Investment Narrative Recap

KBR shareholders typically look for the company’s ability to secure and maintain recurring high-value government contracts, particularly those tied to national security and advanced technology services, as a primary investment case. The termination of the HomeSafe Alliance’s role in the Global Household Goods Contract significantly impacts short-term growth catalysts, increasing near-term headline risk and uncertainty around revenue stability, while also placing heightened focus on the risk of future contract losses or legal proceedings affecting overall business predictability.

Among recent announcements, KBR's $2.459 billion NASA contract win in August 2025 stands out. This is relevant because it underscores the company’s continued success in clinching marquee government work, offering a timely offset to the loss of a single contract but underlining the core risk: KBR’s fortunes remain closely tied to its pipeline of major government deals subject to shifting customer requirements and potential legal scrutiny.

By contrast, investors should also consider the elevated legal and contract risk now clouding KBR’s near-term outlook...

Read the full narrative on KBR (it's free!)

KBR's narrative projects $9.4 billion revenue and $664.3 million earnings by 2028. This requires 5.4% yearly revenue growth and a $264.3 million earnings increase from $400.0 million today.

Uncover how KBR's forecasts yield a $60.71 fair value, a 23% upside to its current price.

Exploring Other Perspectives

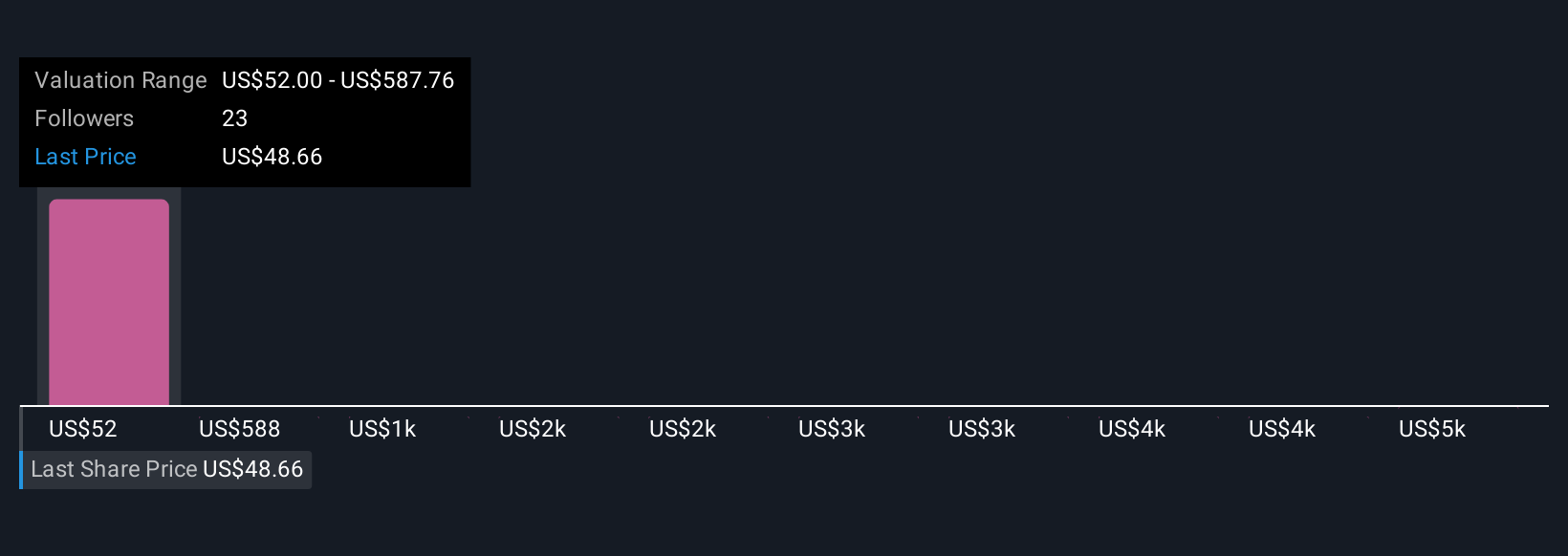

Six members of the Simply Wall St Community placed KBR’s fair value between US$52 and as high as US$5,409.58. Against such a wide spectrum, the risk highlighted by the recent HomeSafe Alliance contract termination brings fresh questions about the company’s ongoing earnings visibility and resilience, making it crucial to weigh multiple viewpoints when assessing future opportunities or risks.

Explore 6 other fair value estimates on KBR - why the stock might be worth just $52.00!

Build Your Own KBR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KBR research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KBR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KBR's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KBR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBR

KBR

Provides scientific, technology, and engineering solutions to governments and commercial customers worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives