- United States

- /

- Commercial Services

- /

- NYSE:KAR

OPENLANE’s Profitable Quarter and Lower Guidance Might Change the Case for Investing in KAR

Reviewed by Sasha Jovanovic

- OPENLANE, Inc. recently released its third quarter 2025 results, reporting year-over-year growth in revenue to US$498.4 million and net income to US$47.9 million, while also updating earnings guidance for the full year.

- An important detail is that despite higher net income and stronger analyst sentiment, the company revised its full-year per-share outlook to reflect an expected loss from continuing operations.

- We'll explore how OPENLANE's revised earnings guidance and profitable quarter affect its long-term growth and valuation outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

OPENLANE Investment Narrative Recap

OPENLANE’s long-term thesis rests on the digital shift in wholesale vehicle auctions and the company’s ability to leverage technology for market share gains. The recent downward revision to per-share earnings guidance, despite a profitable third quarter, raises short-term uncertainty about the impact of items like dilution or accounting adjustments, but does not appear to materially alter the core digital adoption catalyst or the key competitive risks to the business.

Among the latest announcements, OPENLANE’s updated 2025 guidance is most relevant, as a projected full-year loss per share contrasts with improved net income figures. While this adjustment warrants close attention from shareholders, it does not fundamentally disrupt the trajectory of digital- and AI-driven product innovations, which remain critical to future performance and valuation.

On the other hand, investors should not overlook ongoing share dilution risk tied to the remaining Series A preferred shares, as this could...

Read the full narrative on OPENLANE (it's free!)

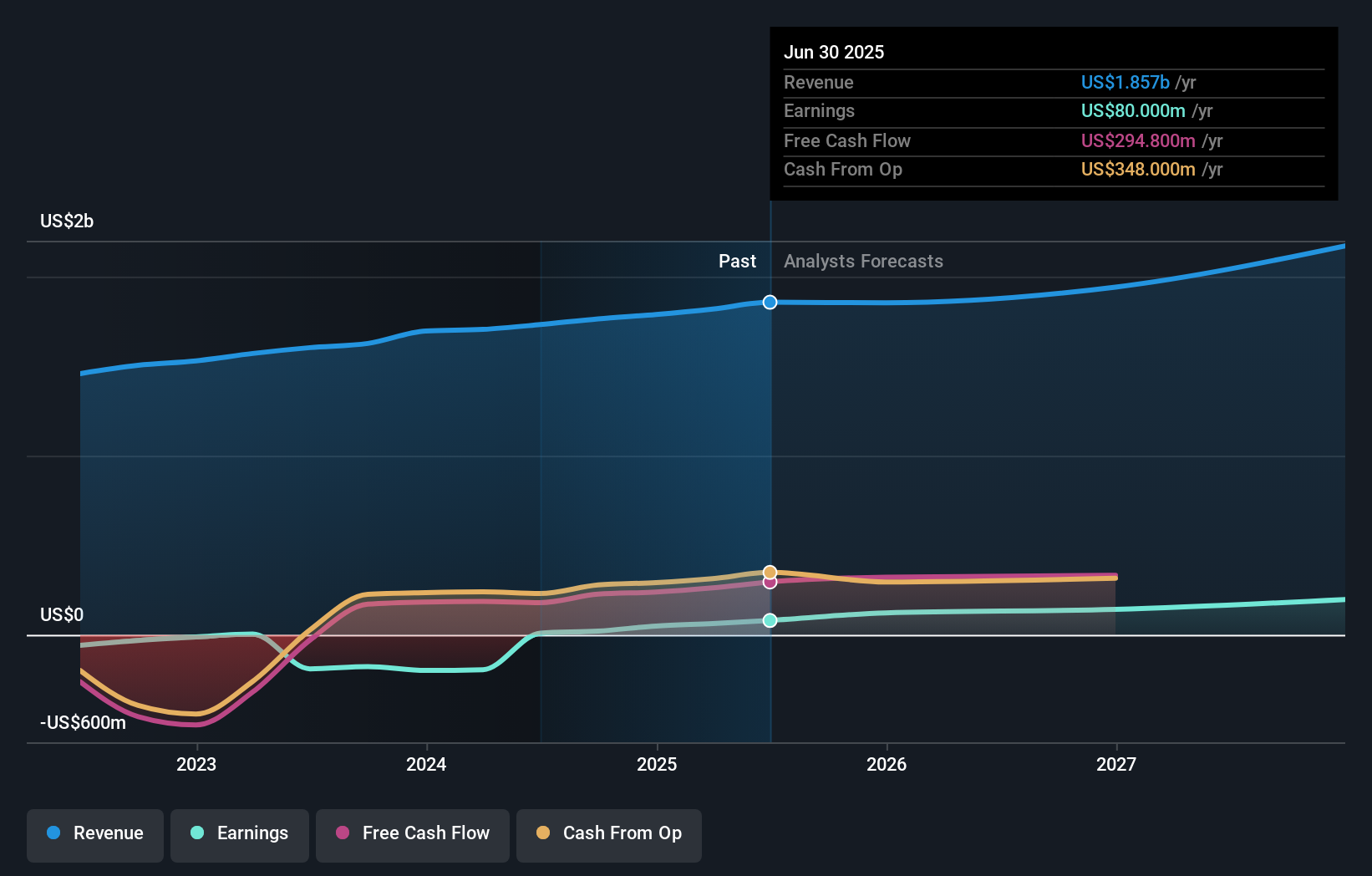

OPENLANE's narrative projects $2.2 billion in revenue and $230.6 million in earnings by 2028. This requires 5.0% yearly revenue growth and a $150.6 million increase in earnings from $80.0 million today.

Uncover how OPENLANE's forecasts yield a $31.81 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community’s single fair value estimate stands at US$22.70, indicating a narrow consensus among contributing members. While analyst forecasts highlight accelerating digital growth, you may want to compare different viewpoints for a fuller picture of OPENLANE’s potential.

Explore another fair value estimate on OPENLANE - why the stock might be worth as much as $22.70!

Build Your Own OPENLANE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OPENLANE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPENLANE's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAR

OPENLANE

Operates as a digital marketplace for used vehicles, which connects sellers and buyers in the United States, Canada, Continental Europe and the United Kingdom.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives