Should You Rethink Jacobs Solutions Stock After 17% Year to Date Surge in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Jacobs Solutions stock? You are not alone. After all, with the stock up 16.6% year-to-date and nearly doubling over the past five years, it is only natural to wonder if there is still room to run, or if it is time to take some profits off the table. The past month alone saw shares buoyed by 6.6%, and just in the past week, they notched another 4.4% gain. Clearly, something is keeping investor optimism alive and well.

Looking at the longer-term trajectory, Jacobs Solutions has delivered an impressive 93.2% return over the last five years, and a strong 14.6% gain over the past year. The stock's steady upward climb seems to reflect market confidence in the company’s strategy and its position in sectors like infrastructure and sustainable solutions, both of which have seen increased investment and attention as governments and businesses adapt to evolving global priorities. While not every market development makes headlines, Jacobs Solutions continues to benefit from these broad industry tailwinds.

But now comes the tough question: does the current stock price make sense, or are we in overvalued territory? According to a composite value score (where a company earns a point for each of six checks it passes for being undervalued), Jacobs Solutions currently scores a 0. In other words, it does not get credit for being undervalued by any of these standard measures. Before you let that alarm you, let us dig deeper. The real story lies in how these valuation methods work and, even more importantly, what might be an even better way to look at the company’s true value, something we will get to by the end of this article.

Jacobs Solutions scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Jacobs Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company's shares should be worth based on projections of how much cash the business will generate in the future, with those future cash flows adjusted to today's dollars. For Jacobs Solutions, the DCF calculation uses actual and forecasted Free Cash Flow (FCF) figures in $ and discounts them according to a 2 Stage Free Cash Flow to Equity approach.

Currently, Jacobs Solutions generates about $380 million in free cash flow. Analyst estimates suggest annual FCF could reach $830 million by fiscal 2026. Beyond analyst-provided forecasts, additional projections from Simply Wall St show FCF continuing to climb, albeit more gradually, over the coming decade. By 2035, the company could be producing around $857 million in free cash flow.

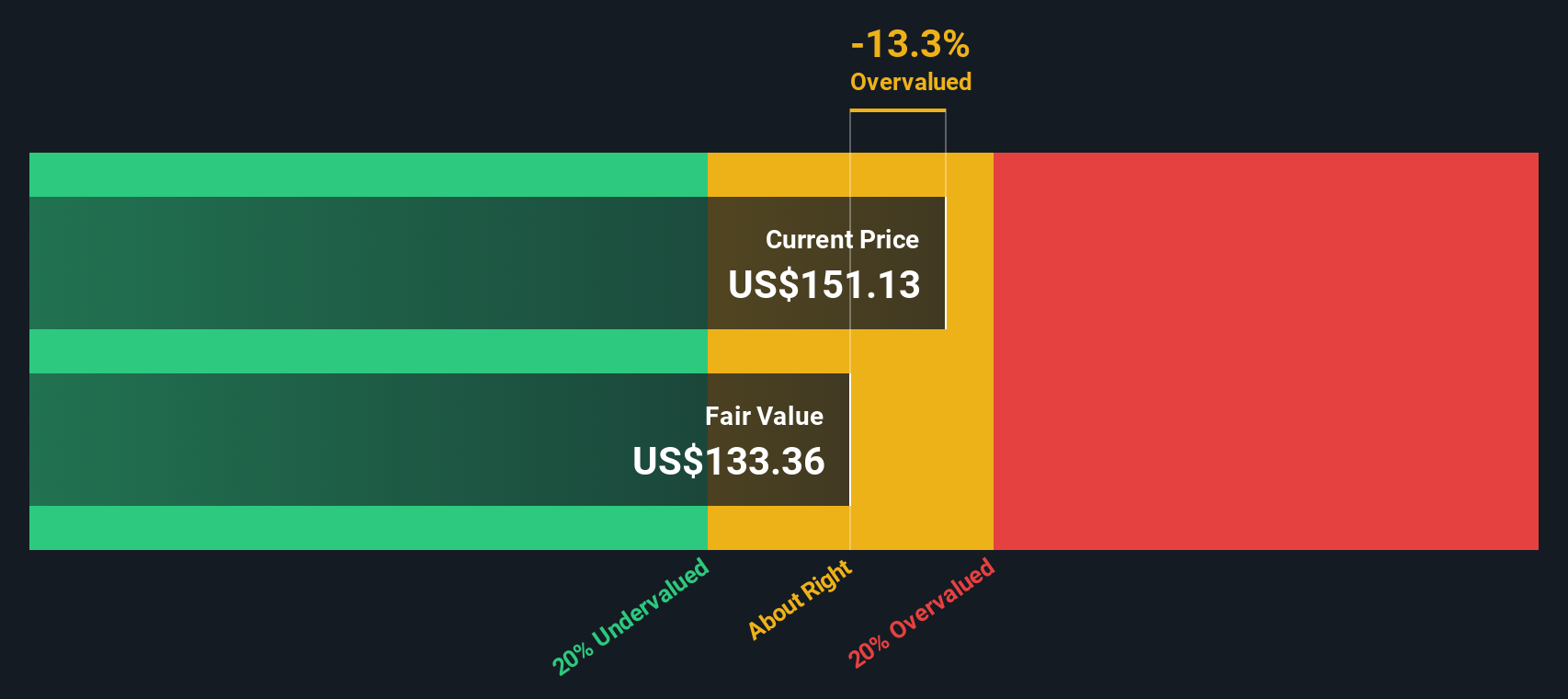

This DCF approach results in an estimated intrinsic value of $133.40 per share. Comparing this to Jacobs Solutions’ current share price, the stock appears to be roughly 16.2% above what the DCF model considers fair. In simple terms, based on projected cash flows, the shares look overvalued at current levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Jacobs Solutions may be overvalued by 16.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Jacobs Solutions Price vs Earnings

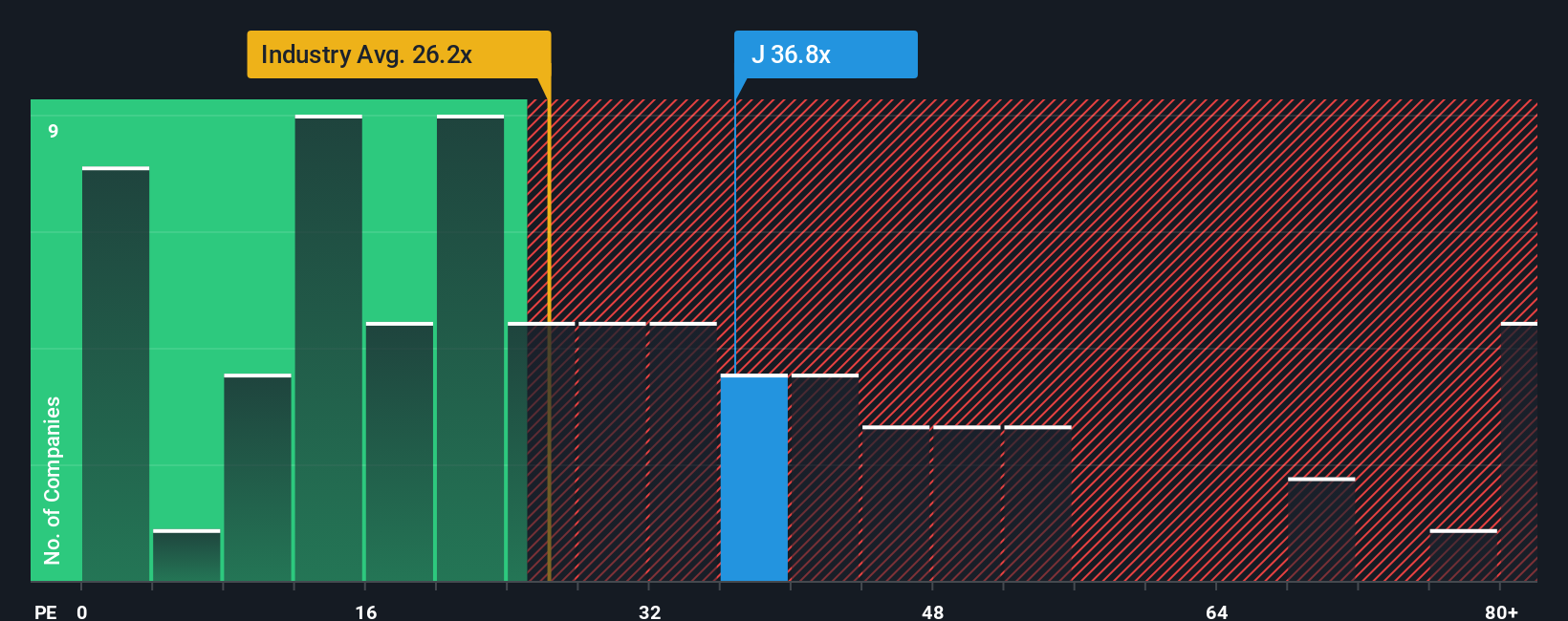

For profitable businesses like Jacobs Solutions, the Price-to-Earnings (PE) ratio is often seen as one of the best ways to value the stock. It compares the share price to earnings per share, helping investors gauge how much they are paying for each dollar of profit today.

The "normal" or fair PE ratio for any given stock depends heavily on expectations for future earnings growth and the risks facing the business. Higher growth companies tend to trade at higher PE multiples. In contrast, greater risks or lower growth usually mean lower PE ratios are justified.

At the moment, Jacobs Solutions trades at 38.21x earnings. That is higher than the average for both its industry, Professional Services, which sits at 26.66x, and its immediate peers, averaging 36.87x. However, a deeper view comes from the Simply Wall St “Fair Ratio,” which considers not just peers and industry factors, but also how Jacobs’ specific growth outlook, profitability, market cap, and risks compare to others. For Jacobs Solutions, this Fair Ratio is 34.74x.

Because the current PE ratio (38.21x) is moderately above the Fair Ratio, the shares appear slightly overvalued by this measure. The Fair Ratio provides the clearest perspective as it takes into account all the important variables for a business like Jacobs. This is more comprehensive than relying solely on rough industry comparisons.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jacobs Solutions Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personalized story about a company, combining your perspective on its future prospects, estimates for revenue and profits, and what you believe the share price should be. Narratives connect the dots between the company’s business realities, your financial forecasts, and a clear fair value, making complex investment decisions more intuitive.

On Simply Wall St’s platform, Narratives are easy for anyone to use and available within the Community page, where millions of investors share their stories and see others’ viewpoints. Narratives help investors make informed decisions by comparing each story’s Fair Value with the current share price, quickly flagging when it might be time to buy or sell. They update dynamically whenever new information, such as earnings or company news, is released so your investment thinking always stays current.

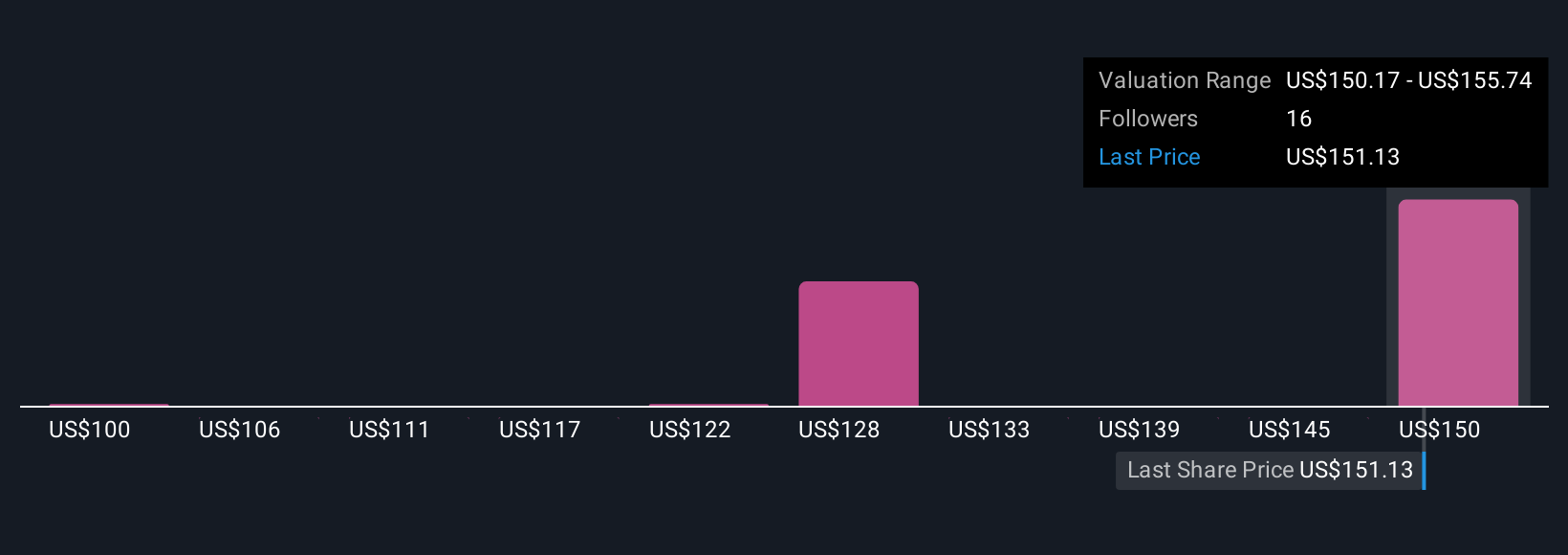

For Jacobs Solutions, some investors see robust growth in technology and consulting services and believe the fair value is as high as $175.00. Others focus on risks and set their fair value much lower, at $132.63. Narratives make it simple to compare these perspectives and decide which story best matches your view and investment strategy.

Do you think there's more to the story for Jacobs Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives