Earnings Tell The Story For Jacobs Solutions Inc. (NYSE:J)

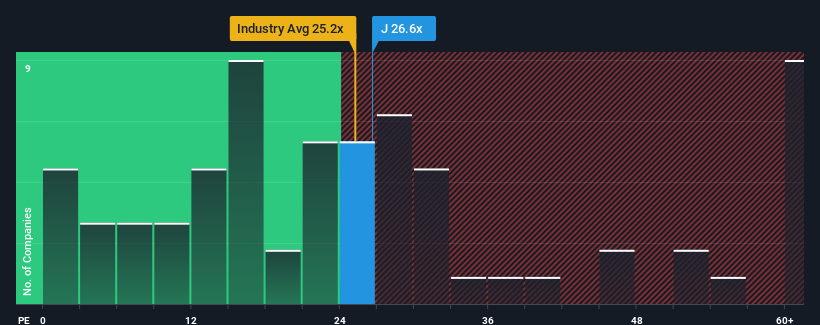

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Jacobs Solutions Inc. (NYSE:J) as a stock to avoid entirely with its 26.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Jacobs Solutions as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Jacobs Solutions

How Is Jacobs Solutions' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Jacobs Solutions' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 24% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 27% per year as estimated by the eleven analysts watching the company. With the market only predicted to deliver 10.0% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Jacobs Solutions' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Jacobs Solutions' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Jacobs Solutions maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Jacobs Solutions with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:J

Jacobs Solutions

Engages in the infrastructure and advanced facilities, and consulting businesses in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives