- United States

- /

- Professional Services

- /

- NYSE:FCN

FTI Consulting (FCN): Revisiting Valuation After AI-Focused Hires, Partnerships and Leadership Moves

Reviewed by Simply Wall St

FTI Consulting (FCN) has been busy, and the stock is reacting to a clear theme: a coordinated push into AI driven, tech heavy consulting through new talent, strategic partnerships, and expanded digital capabilities.

See our latest analysis for FTI Consulting.

Those AI focused hires and partnerships seem to be resonating with investors, with the latest 1 month share price return of 9.53% helping offset a weaker year to date move and leaving the 5 year total shareholder return at a solid 60.68%.

If FTI’s shift toward higher tech work has your attention, this is also a good moment to see what other high growth tech and AI names are setting up interestingly via high growth tech and AI stocks.

With shares rebounding but still down year to date and now trading above the average analyst target, the key question becomes whether FTI is quietly undervalued or if the market is already pricing in its AI powered growth.

Most Popular Narrative: 6.4% Overvalued

With FTI Consulting closing at $176.70 against a narrative fair value of $166.00, the story leans toward a mildly stretched valuation driven by steady fundamentals.

The analysts have a consensus price target of $185.0 for FTI Consulting based on their expectations of its future earnings growth, profit margins and other risk factors.

Want to see what powers that upside gap? This narrative leans on disciplined revenue expansion, firmer margins, and a future earnings multiple that implies quiet confidence. Curious which assumptions really move the fair value dial? Explore the full roadmap behind these projections to understand the details.

Result: Fair Value of $166 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising AI driven automation and tougher competition could undercut FTI’s pricing power, pressuring margins and challenging the current growth assumptions.

Find out about the key risks to this FTI Consulting narrative.

Another Angle on Value

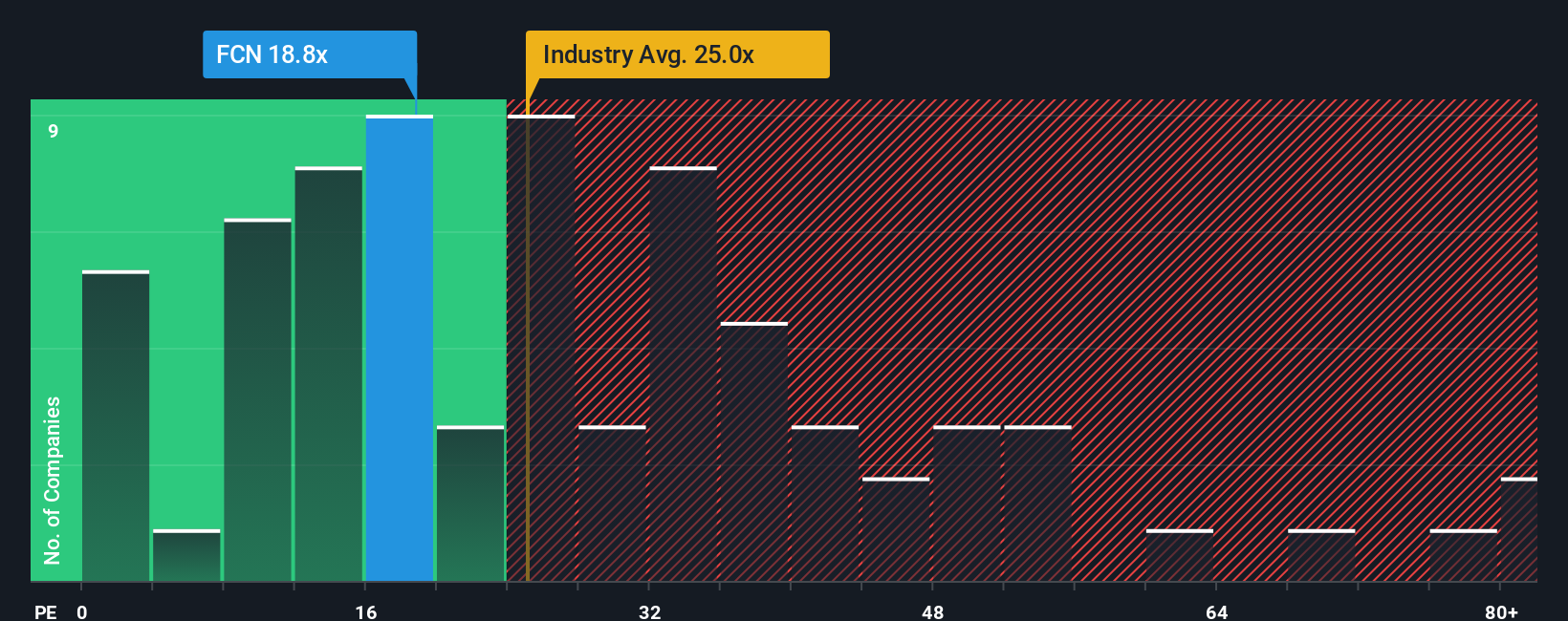

While the narrative fair value suggests FTI Consulting is about 6.4% overvalued, its 20.1x price to earnings ratio still sits below both the US Professional Services industry at 24.6x and peers at 21.8x, and under a 23.9x fair ratio, hinting at some valuation cushion. Is the market underestimating its staying power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTI Consulting Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for more investment ideas?

Before markets move without you, use the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy and sharpen your next investing decision.

- Capture early stage potential by scanning these 3639 penny stocks with strong financials that pair smaller market caps with serious financial strength.

- Target next wave innovators by focusing on these 26 AI penny stocks positioned at the center of rapid AI adoption.

- Lock in value driven opportunities by filtering for these 909 undervalued stocks based on cash flows where cash flow strength is not yet fully recognized in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion