- United States

- /

- Professional Services

- /

- NYSE:FCN

Does FTI Consulting’s (FCN) Senior-Hire Push Reveal a Deeper Shift in Its Advisory Strategy?

Reviewed by Sasha Jovanovic

- In early December 2025, FTI Consulting, Inc. expanded its leadership bench by appointing Jason Leow as a Senior Managing Director in Asia and adding four senior professionals to its London Transformation practice, deepening expertise in areas such as M&A, ESG, operational due diligence and digital transformation.

- These hires reinforce FTI Consulting’s push to grow higher-value advisory and analytics capabilities across key international markets, while promoting more integrated, multidisciplinary solutions for complex client challenges.

- Next, we’ll examine how this push to bolster senior talent in Asia and London may influence FTI Consulting’s broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

FTI Consulting Investment Narrative Recap

To own FTI Consulting, you generally need to believe the firm can keep winning complex, higher-value mandates as regulatory scrutiny and corporate crises stay elevated worldwide. The latest senior hires in Asia and London appear directionally supportive of that thesis, but they do not materially change the near term picture, where the key catalyst remains the shift toward tech enabled, multidisciplinary work and the biggest risk is cost and margin pressure if new talent is slow to ramp.

Among recent developments, the four senior appointments to FTI’s London Transformation practice stand out, because they tie directly into private equity transactions, operational due diligence and digital transformation work that underpin higher value, analytics rich mandates. How effectively these leaders convert their experience into sustained fee activity will influence whether FTI’s investment in talent supports earnings growth faster than the drag from higher compensation and integration costs.

Yet while FTI is clearly investing in premium people and tools, investors should still be aware of the risk that...

Read the full narrative on FTI Consulting (it's free!)

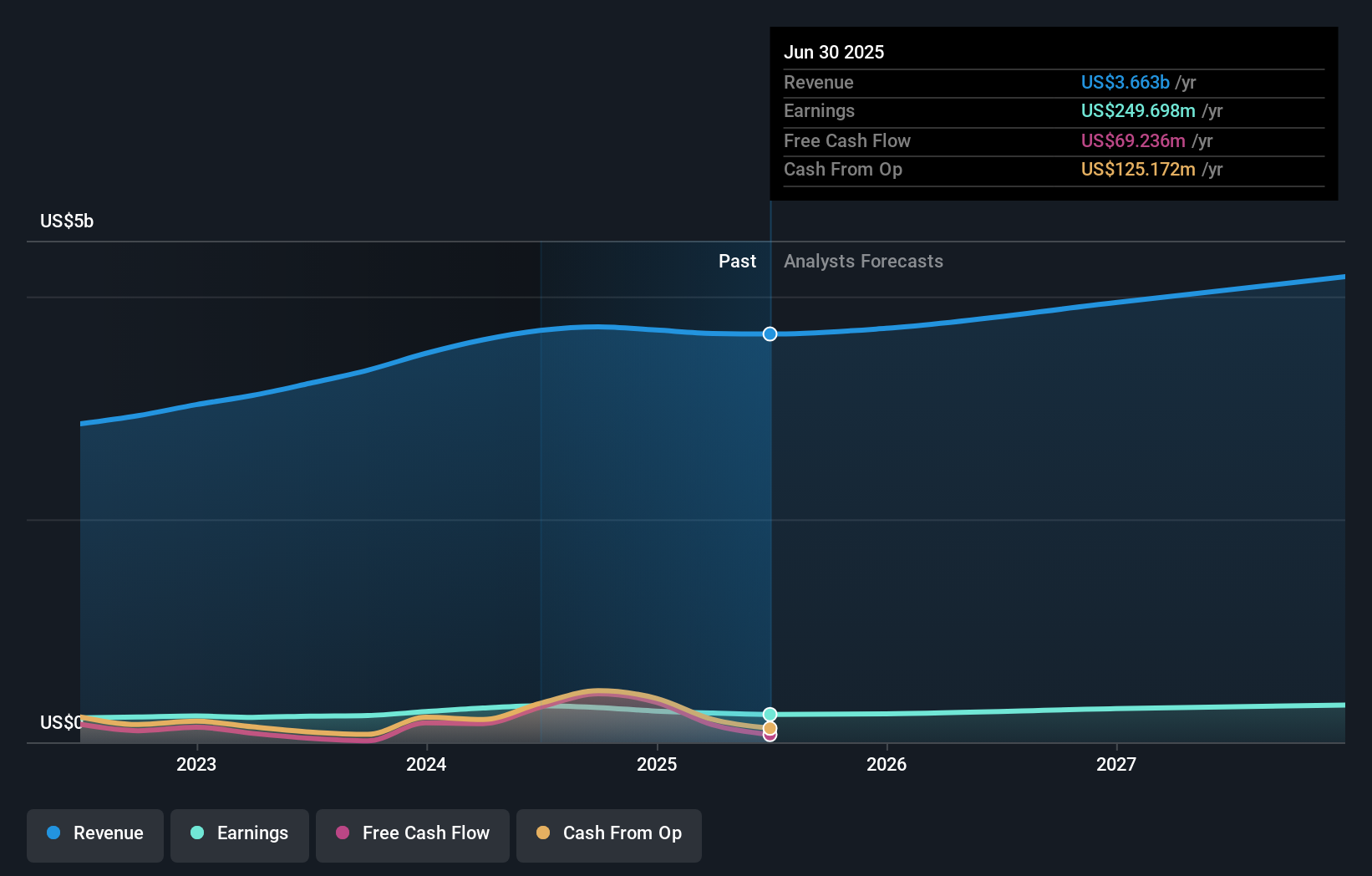

FTI Consulting’s narrative projects $4.3 billion revenue and $358.3 million earnings by 2028. This requires 5.3% yearly revenue growth and around a $108.6 million earnings increase from $249.7 million today.

Uncover how FTI Consulting's forecasts yield a $166.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community has shared a fair value estimate for FTI Consulting, at US$166 per share, so you are seeing a very narrow band of opinion. Set that against the company’s heavy push into higher value digital and transformation work and it is worth exploring several alternative viewpoints on how such investments might affect margins and longer term performance.

Explore another fair value estimate on FTI Consulting - why the stock might be worth as much as $166.00!

Build Your Own FTI Consulting Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTI Consulting research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FTI Consulting research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTI Consulting's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026