- United States

- /

- Professional Services

- /

- NYSE:FCN

Did New Senior Hires Just Shift FTI Consulting’s (FCN) Investment Narrative?

Reviewed by Simply Wall St

- Earlier this month, FTI Consulting appointed Eva Tomlinson as Senior Managing Director and Breck Heidlberg as Managing Director within its Forensic and Litigation Consulting segment, adding over 40 years of combined expertise in global trade strategy, compliance, and national security.

- Their leadership is expected to strengthen FTI Consulting’s ability to help clients address increasingly complex geopolitical and regulatory demands in the global marketplace.

- We’ll explore how the addition of deep trade compliance expertise could influence FTI Consulting’s long-term investment outlook.

FTI Consulting Investment Narrative Recap

Shareholders in FTI Consulting need confidence in the company’s ability to leverage expertise in regulatory, trade, and risk consulting across an increasingly complex global environment. The recent appointments of Eva Tomlinson and Breck Heidlberg add meaningful trade compliance depth, but this is unlikely to move the needle in the very near term, as the biggest short-term catalyst remains increased regulatory scrutiny, while the most significant risk is ongoing headcount declines in the economic consulting segment.

Among the latest announcements, the appointment of Natasha Passley as Senior Managing Director in Cybersecurity stands out, further supporting FTI’s momentum in high-demand specialist areas. Strengthening these practices aligns with the company’s focus on expanding its Forensic and Litigation Consulting segment, which is the business most likely to benefit from evolving global regulations, helping to counterbalance short-term headwinds from other segments.

However, investors should pay attention to the risk that employee departures within key consulting teams could limit revenue rebound, especially if industry competition for talent intensifies...

Read the full narrative on FTI Consulting (it's free!)

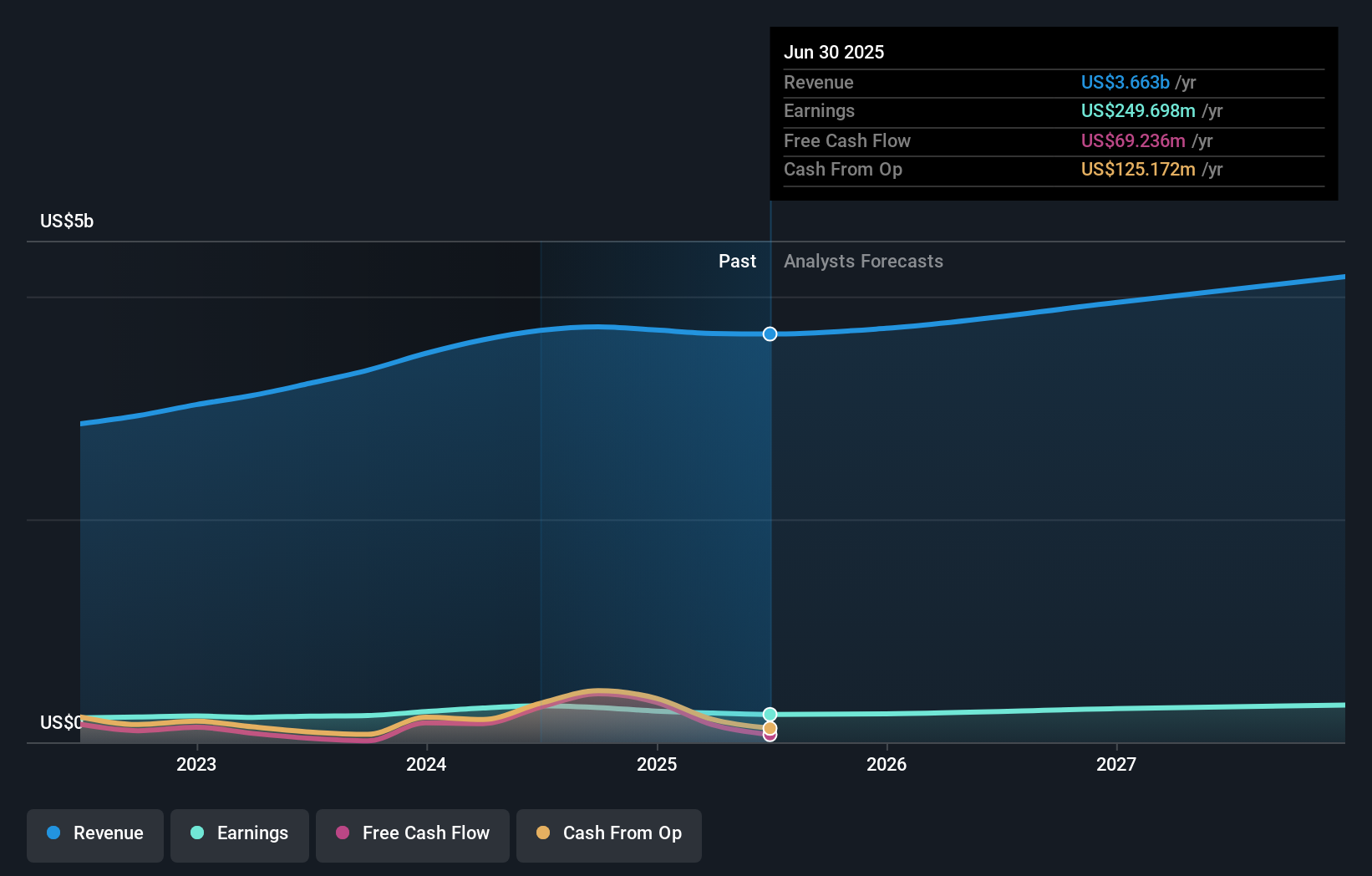

FTI Consulting's narrative projects $4.2 billion in revenue and $350.3 million in earnings by 2028. This requires 4.7% yearly revenue growth and an earnings increase of about $88 million from the current earnings of $261.9 million.

Uncover how FTI Consulting's forecasts yield a $171.29 fair value, a 4% upside to its current price.

Exploring Other Perspectives

All fair value estimates from the Simply Wall St Community place the stock at US$171.29, based on one participant’s analysis. With recent leadership hires reinforcing regulatory services, your view on FTI’s long-term value may depend on your outlook for talent retention and headcount stability.

Build Your Own FTI Consulting Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTI Consulting research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FTI Consulting research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTI Consulting's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives