- United States

- /

- Professional Services

- /

- NYSE:FCN

Did FTI Consulting's (FCN) Senior Hires Signal a Shift in Its Global Advisory Ambitions?

Reviewed by Simply Wall St

- FTI Consulting recently announced the appointment of several senior leaders to key practices, including new Senior Managing Directors in cybersecurity, healthcare business transformation, corporate finance in Asia, and economic consulting in Australia.

- These high-profile hires enhance FTI Consulting's expertise across critical sectors and regions, reflecting a continued investment in expanding its global capabilities and multidisciplinary advisory services.

- We’ll explore how the addition of seasoned leaders, particularly in cybersecurity and economic consulting, could influence FTI Consulting’s investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

FTI Consulting Investment Narrative Recap

At its core, the FTI Consulting investment story hinges on the belief that demand for high-value advisory work, especially in risk, cyber, and regulatory-driven consulting, will outpace competitive and technological pressures. Recent leadership hires, including in cybersecurity, reinforce FTI’s focus on building differentiated expertise but are unlikely to materially shift the near-term catalyst of persistent regulatory and cyber risks, nor do they mitigate the immediate concern of margin pressure from new talent integration costs.

The appointment of Keith Wojcieszek, a veteran in threat intelligence, directly strengthens FTI's Forensic & Litigation Consulting capabilities at a time when cyber threats continue to boost demand for incident response and compliance work. This move may help FTI capture more specialized, tech-enabled mandates, a stated catalyst for future growth, but successful integration and cost control remain critical watchpoints.

Yet, while these high-profile additions may enhance client offerings, investors should not lose sight of the growing risk that...

Read the full narrative on FTI Consulting (it's free!)

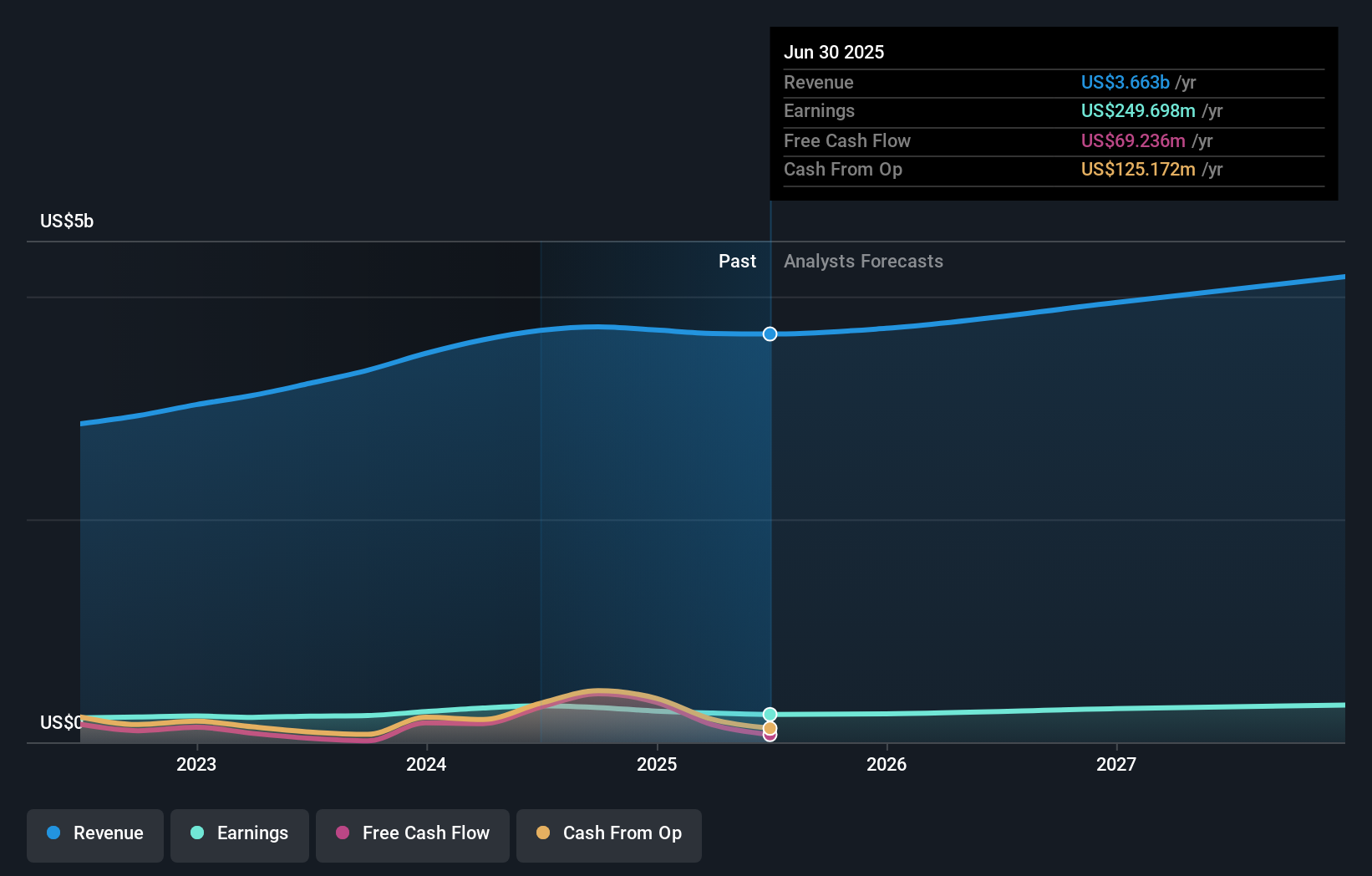

FTI Consulting's outlook anticipates $4.3 billion in revenue and $358.3 million in earnings by 2028. This scenario relies on annual revenue growth of 5.3% and an earnings increase of $108.6 million from the current $249.7 million.

Uncover how FTI Consulting's forecasts yield a $185.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

All ten fair value estimates from the Simply Wall St Community cluster at US$185. While some expect ongoing regulatory complexity to drive demand, the full impact of FTI’s recent hires on earnings and profitability may hinge on careful execution and integration. Consider these differences as you review alternative outlooks.

Explore another fair value estimate on FTI Consulting - why the stock might be worth as much as 13% more than the current price!

Build Your Own FTI Consulting Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTI Consulting research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FTI Consulting research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTI Consulting's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCN

FTI Consulting

Provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives