- United States

- /

- Professional Services

- /

- NYSE:EFX

Does Equifax’s (EFX) Century-Long Dividend Streak Reflect Enduring Strength or Shift in Capital Strategy?

Reviewed by Sasha Jovanovic

- Equifax announced that its Board of Directors declared a quarterly dividend of US$0.50 per share, payable December 15, 2025, to shareholders of record as of November 24, marking more than 100 consecutive years of dividend payments.

- This longstanding commitment to shareholder returns coincides with new consumer credit data showing US consumer debt rising above US$18 trillion and certain delinquency rates indicating evolving economic pressures.

- We'll assess how Equifax's dividend affirmation highlights its financial stability as we consider implications for the company's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Equifax Investment Narrative Recap

To own Equifax stock, investors need conviction in the company's ability to deliver steady returns by leveraging its leading data and analytics platforms amidst a complex credit environment. While the latest dividend declaration reinforces Equifax’s financial stability and a century-long history of shareholder payouts, it does not materially change the short-term risk profile, with legal costs and margin pressures remaining the main concerns. The biggest near-term catalyst continues to be new product adoption driving organic growth, but current legal and regulatory spend still weighs on margins.

Among recent announcements, Equifax’s launch of the Power of Attorney Manager, a centralized, digital solution for managing unemployment claim processes, stands out. This innovation reflects Equifax's ongoing expansion into technology-enabled compliance solutions, closely linked to the company’s goal of broadening its value proposition and driving greater employer adoption. Such offerings may help mitigate cyclical revenue risks by increasing resilience in key government and employer segments.

By contrast, investors should be aware that even with ongoing product launches and innovation, escalating legal expenses could still...

Read the full narrative on Equifax (it's free!)

Equifax's narrative projects $7.8 billion revenue and $1.3 billion earnings by 2028. This requires 9.9% yearly revenue growth and a $660 million earnings increase from $639.7 million today.

Uncover how Equifax's forecasts yield a $272.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

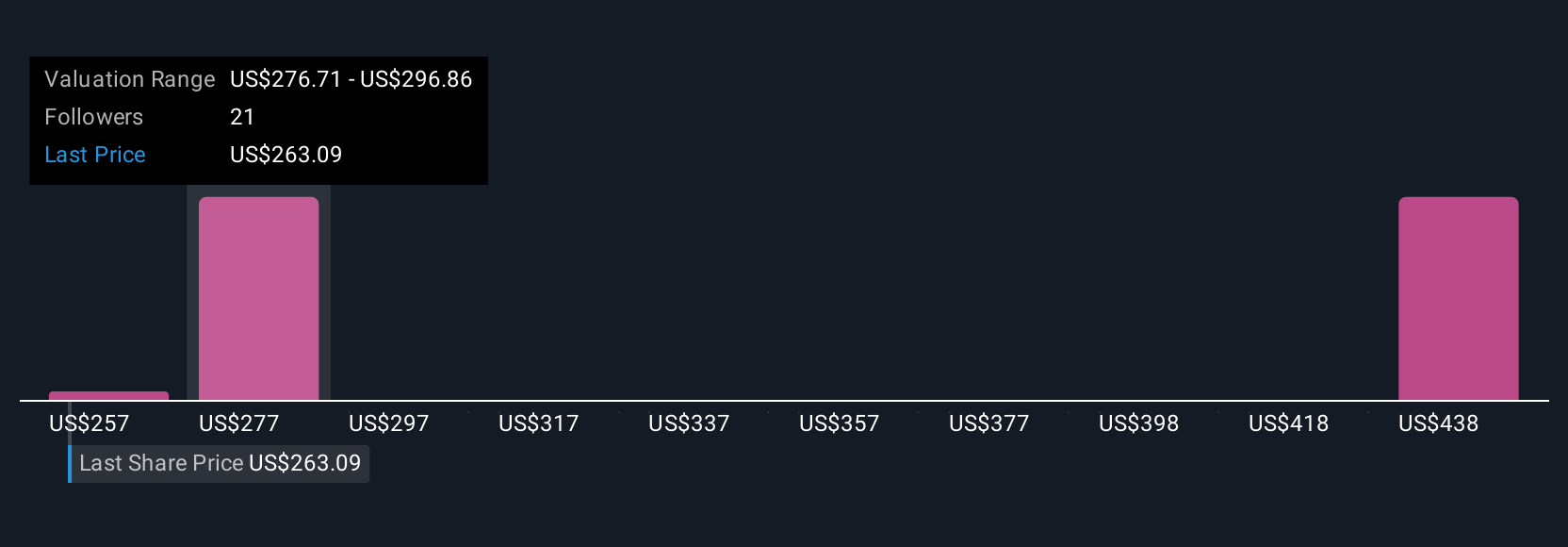

Six fair value estimates from the Simply Wall St Community range from US$256.57 to US$279.78 per share, highlighting a broad spread of opinion. In light of persistent legal and compliance cost risks cited by analysts, now could be the time to compare your outlook with other investors’ views of Equifax’s long-term prospects.

Explore 6 other fair value estimates on Equifax - why the stock might be worth just $256.57!

Build Your Own Equifax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equifax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equifax's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives