- United States

- /

- Professional Services

- /

- NYSE:EFX

Does Equifax’s 19% Slide Signal Opportunity or Further Risks for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Equifax stock is a hidden bargain or due for another setback? Let’s dig into whether its recent numbers stack up to its price tag.

- Despite a strong long-term run, the stock has slipped by 2.8% over the past week and is down 19.4% in the last year. This indicates that market sentiment has shifted and growth expectations may be getting reassessed.

- After a string of product launches and increased attention around data privacy regulation, investors have been weighing fresh opportunities against possible regulatory challenges. These headlines have influenced the stock’s recent volatility and could help shape its direction in the near term.

- Currently, Equifax has a valuation score of 3 out of 6, suggesting it passes half of our key undervaluation checks. The following sections will break down what’s factored into this score using traditional valuation approaches, and offer a fresh perspective on value that few investors consider.

Find out why Equifax's -19.4% return over the last year is lagging behind its peers.

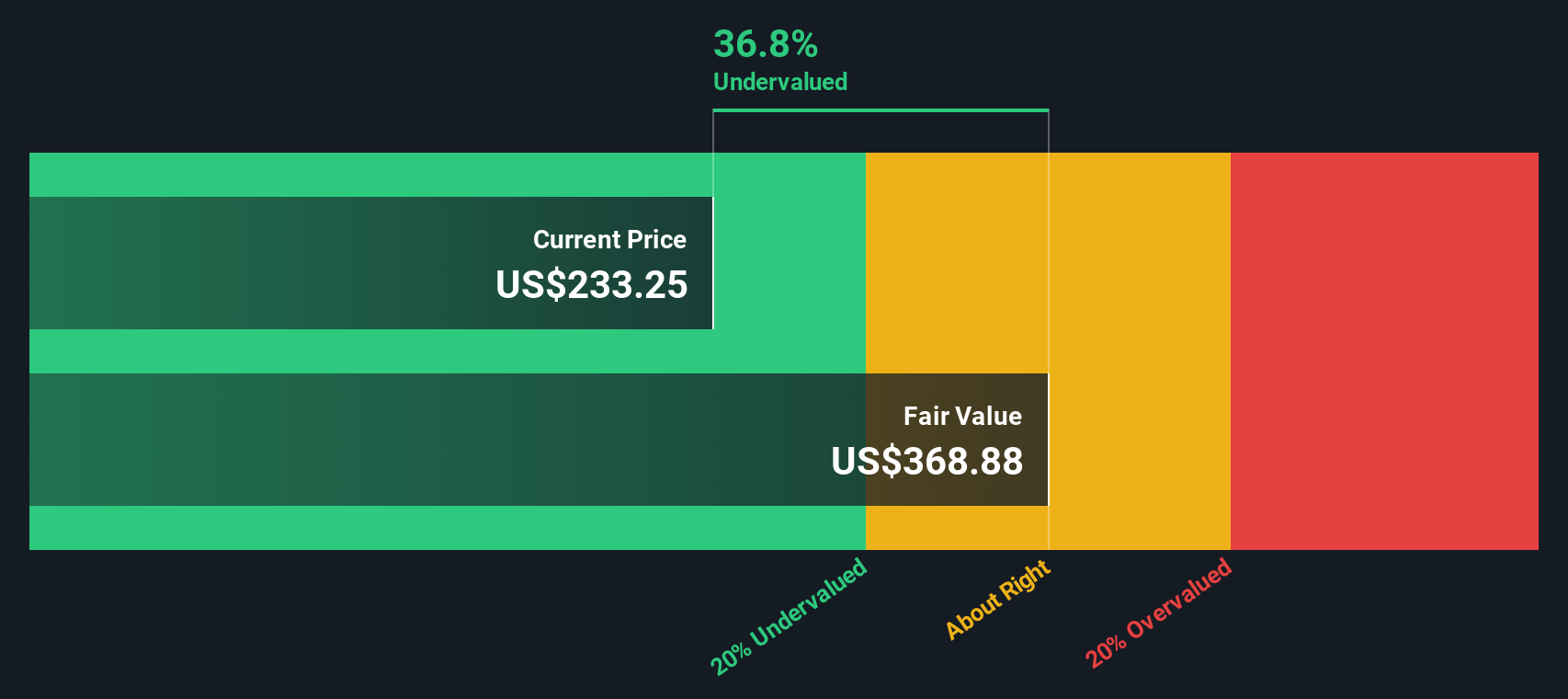

Approach 1: Equifax Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting them to today’s value. This approach gives investors a sense of the intrinsic value of Equifax based on expected cash generation, rather than just the current market sentiment.

For Equifax, the latest reported Free Cash Flow (FCF) stands at $891.95 Million. Looking ahead, analysts forecast a significant increase, with projections rising to $1.94 Billion in annual FCF by 2028. Beyond the next five years, further growth estimates are extrapolated, with FCF expected to reach over $4.1 Billion by 2035, according to Simply Wall St’s extended modeling.

Taking all these factors into account, the DCF model estimates Equifax’s intrinsic value at $540.33 per share. This figure represents an implied discount of 61.3 percent compared to its current market price, suggesting the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equifax is undervalued by 61.3%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

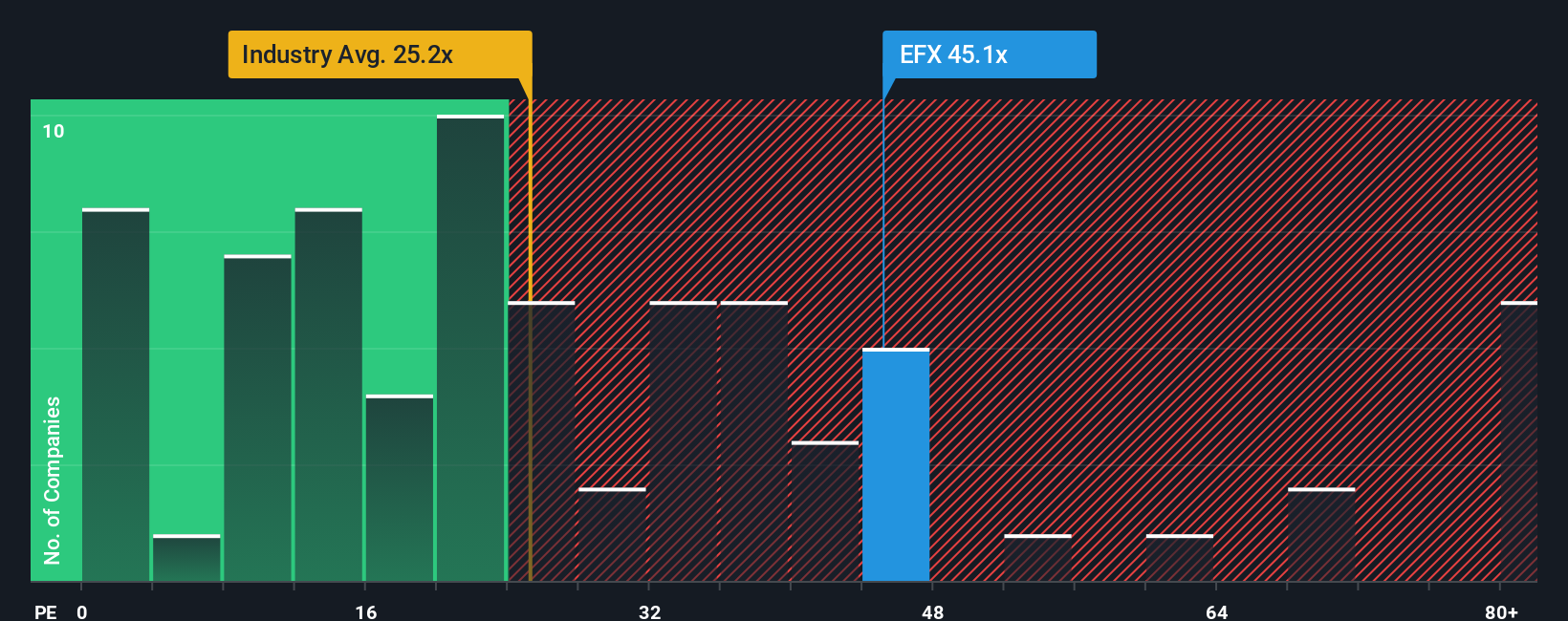

Approach 2: Equifax Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular and practical metric for valuing established and profitable companies like Equifax. It compares a company’s share price to its earnings per share, giving investors a quick snapshot of how much they are paying for each dollar of profit.

What constitutes a “fair” PE ratio often depends on how quickly a company is growing and how risky its future profits appear. High-growth or lower-risk companies can command higher PE ratios, while businesses facing slowdowns or greater uncertainty typically trade at lower multiples.

Currently, Equifax trades at a PE ratio of 38.83x. This is higher than the Professional Services industry average of 24.15x and marginally above the average PE ratio of its closest peers at 35.87x. The proprietary Simply Wall St “Fair Ratio” for Equifax, calculated based on factors such as its expected growth, risk profile, profit margins, industry, and size, is 33.51x.

By focusing on the Fair Ratio rather than just industry or peer averages, investors get a clearer sense of what is priced in for Equifax specifically. This tailored approach accounts for the company’s unique strengths and weaknesses that general benchmarks might miss.

Comparing Equifax’s current PE ratio of 38.83x to its Fair Ratio of 33.51x, the stock appears to be trading at a premium relative to what its underlying fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

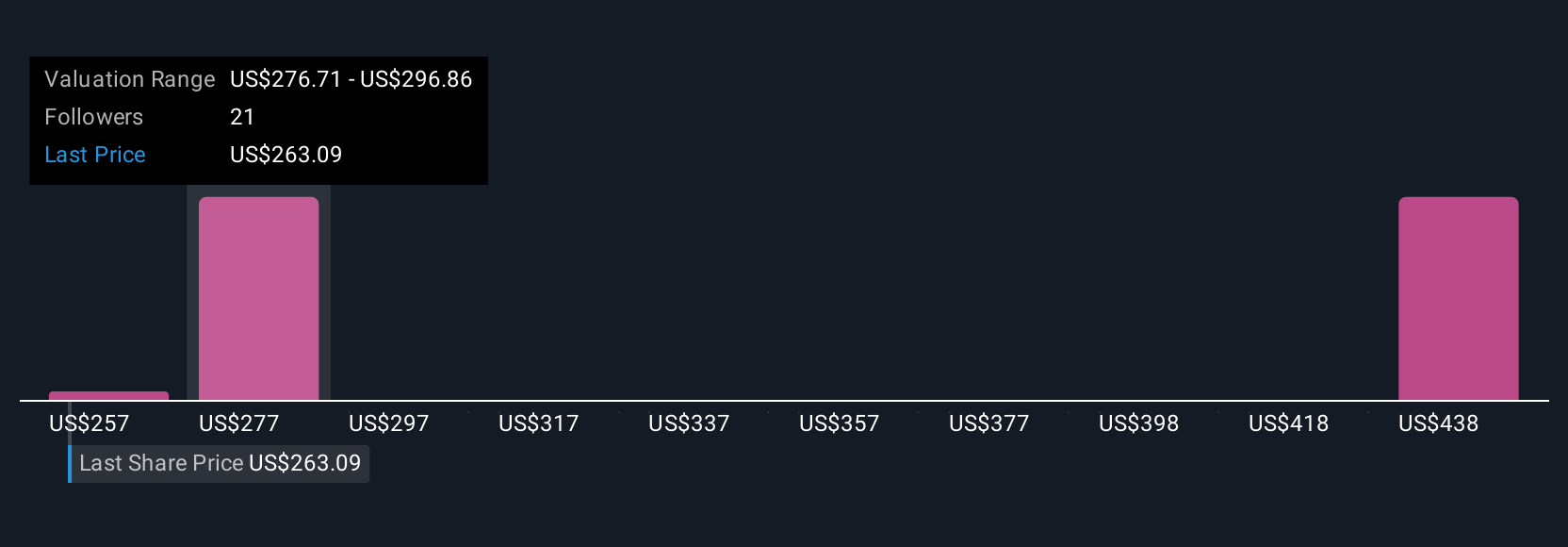

Upgrade Your Decision Making: Choose your Equifax Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a way for investors to connect a story or personal perspective about a company with the financial assumptions behind the numbers, such as future revenue, earnings, profit margins, and even a tailored Fair Value. Instead of just relying on static ratios, a Narrative links what you believe about Equifax, including the business trends, risks, and catalysts you see on the horizon, to a dynamic financial forecast and a clear price target.

This approach is easy and approachable, and available directly within Simply Wall St’s Community page, used by millions of investors. Narratives help you decide when to buy or sell by comparing your Fair Value to the latest market price, while auto-updating whenever new information comes in, such as earnings releases or breaking news.

For example, some Equifax Narratives in the Community are built around bullish views, highlighting the company’s high entry barriers and data moat to justify a Fair Value of $300 per share. Others flag rising competitive pressures and regulatory risks, leading to a more cautious Fair Value of $240. Narratives empower you to align your investment decisions with your outlook, all supported by transparent numbers and real-time updates.

Do you think there's more to the story for Equifax? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equifax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFX

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026