- United States

- /

- Food

- /

- NasdaqGS:JBSS

Top Dividend Stocks On US Exchanges For November 2024

Reviewed by Simply Wall St

As the U.S. stock market navigates mixed signals ahead of key inflation data, with the Dow Jones Industrial Average recently surpassing 45,000 points for the first time, investors are keenly focused on how these developments might influence their portfolios. In such a dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.31% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.54% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.51% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.67% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.51% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.31% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

John B. Sanfilippo & Son (NasdaqGS:JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States with a market cap of approximately $995 million.

Operations: The company's revenue primarily comes from selling various nut and nut-related products, totaling $1.11 billion.

Dividend Yield: 3.7%

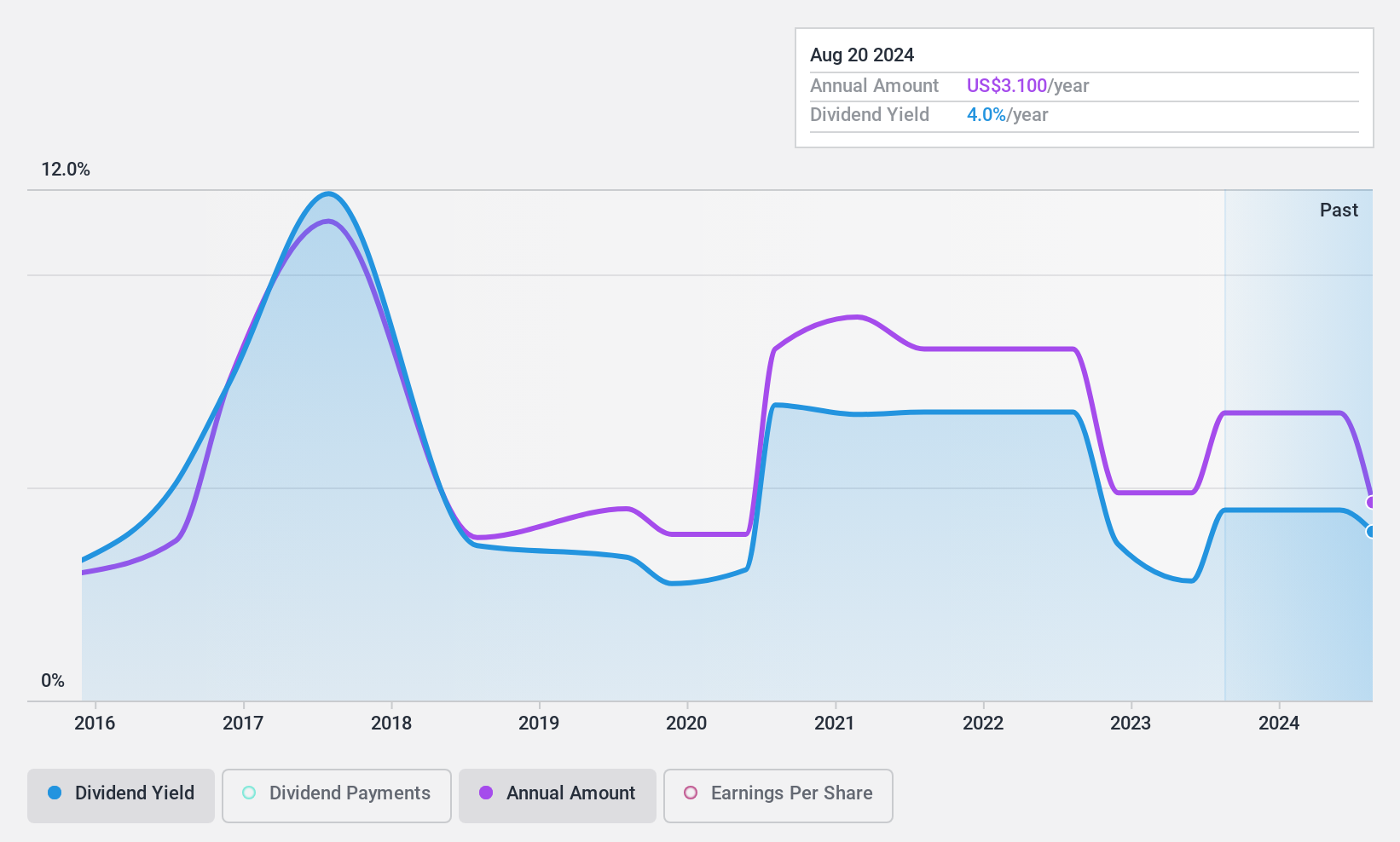

John B. Sanfilippo & Son's dividend yield of 3.69% is below the top 25% of US dividend payers, but its low payout ratio of 18.2% suggests dividends are well-covered by earnings. Despite a volatile and unreliable dividend history over the past decade, recent growth in payments indicates some improvement. The company's price-to-earnings ratio of 17.9x is attractive compared to the US market average, and dividends are sustainably covered by cash flows with a cash payout ratio of 66%.

- Click here and access our complete dividend analysis report to understand the dynamics of John B. Sanfilippo & Son.

- According our valuation report, there's an indication that John B. Sanfilippo & Son's share price might be on the expensive side.

XP (NasdaqGS:XP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: XP Inc. offers financial products and services in Brazil and has a market cap of approximately $8.61 billion.

Operations: XP Inc.'s revenue from its brokerage segment amounts to R$15.89 billion.

Dividend Yield: 7.7%

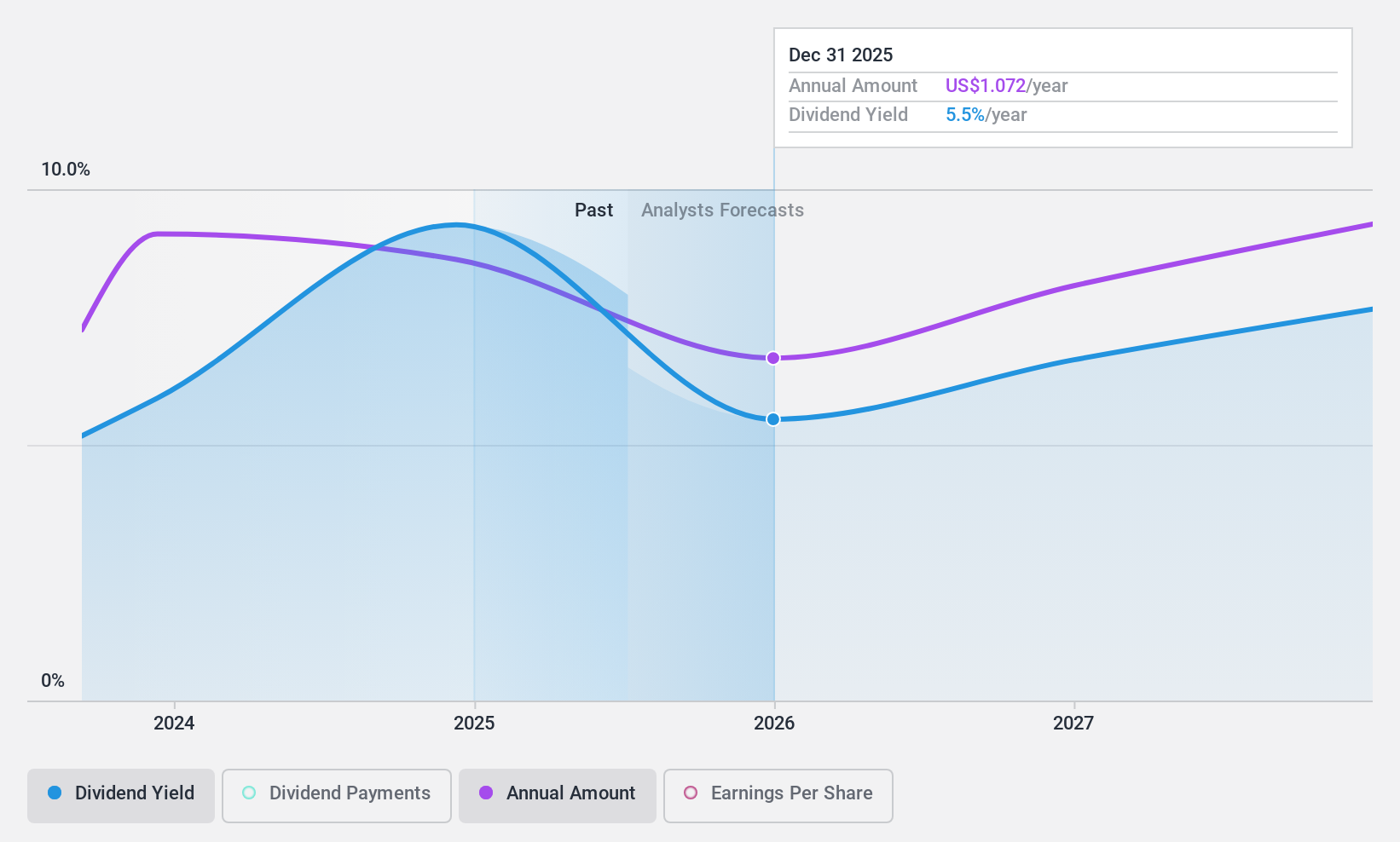

XP Inc.'s dividend yield of 7.73% ranks in the top 25% among US dividend payers, supported by a low payout ratio of 41.7%, indicating dividends are well-covered by earnings and cash flows. Recent earnings growth further strengthens its financial position, with net income rising to BRL 1.19 billion for Q3 2024. The company has announced a USD$0.65 per share dividend and initiated a share repurchase program worth BRL 1 billion, enhancing shareholder value potential.

- Click to explore a detailed breakdown of our findings in XP's dividend report.

- The valuation report we've compiled suggests that XP's current price could be quite moderate.

Ennis (NYSE:EBF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ennis, Inc. manufactures and sells business forms and other business products in the United States, with a market cap of approximately $549.98 million.

Operations: Ennis, Inc. generates revenue primarily from its Print segment, which accounts for $404.20 million.

Dividend Yield: 4.7%

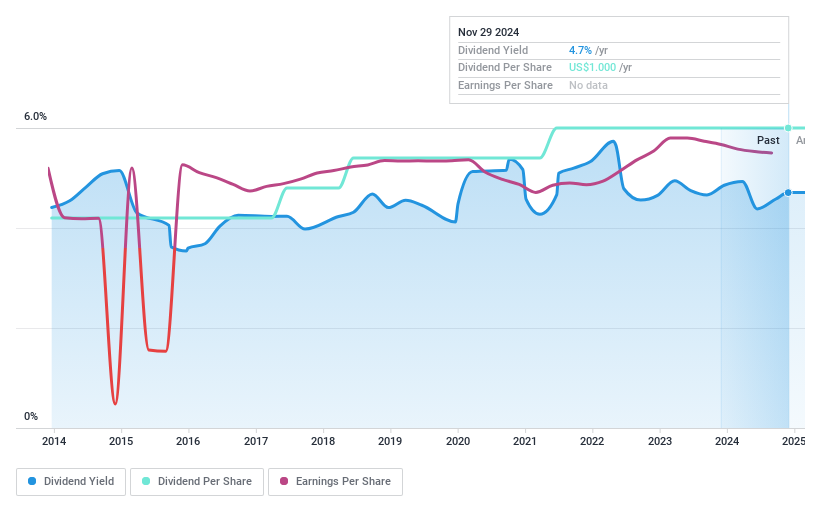

Ennis offers a dividend yield of 4.69%, placing it in the top 25% of US dividend payers, with dividends well-covered by earnings and cash flows (payout ratios: 63.2% and 41.5%, respectively). The company has maintained stable and growing dividends over the past decade. Recent financials show a slight decline in sales and net income, but Ennis announced a special $2.50 per share dividend, reflecting its commitment to returning value to shareholders.

- Navigate through the intricacies of Ennis with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Ennis is trading behind its estimated value.

Key Takeaways

- Dive into all 135 of the Top US Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBSS

John B. Sanfilippo & Son

Through its subsidiary, JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives