- United States

- /

- Professional Services

- /

- NYSE:DNB

Some Shareholders Feeling Restless Over Dun & Bradstreet Holdings, Inc.'s (NYSE:DNB) P/S Ratio

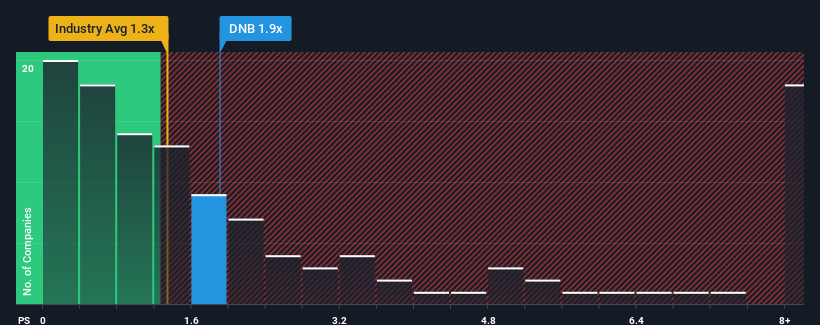

When close to half the companies in the Professional Services industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, you may consider Dun & Bradstreet Holdings, Inc. (NYSE:DNB) as a stock to potentially avoid with its 1.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Dun & Bradstreet Holdings

How Has Dun & Bradstreet Holdings Performed Recently?

Dun & Bradstreet Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dun & Bradstreet Holdings.Is There Enough Revenue Growth Forecasted For Dun & Bradstreet Holdings?

In order to justify its P/S ratio, Dun & Bradstreet Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.0% last year. The latest three year period has also seen an excellent 33% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 5.3% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.1% each year, which is not materially different.

With this information, we find it interesting that Dun & Bradstreet Holdings is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Dun & Bradstreet Holdings' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Dun & Bradstreet Holdings currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware Dun & Bradstreet Holdings is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNB

Dun & Bradstreet Holdings

Provides business to business data and analytics in North America and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives