- United States

- /

- Commercial Services

- /

- NYSE:CXW

CoreCivic (CXW) Valuation in Focus After New CEO Announcement and Major ICE Contract Win

Reviewed by Simply Wall St

If you've been tracking CoreCivic (CXW) lately, the latest headlines probably made you sit up and take notice. The company just announced that CEO Damon T. Hininger plans to step down at the start of next year, making way for longtime executive Patrick Swindle to take over as CEO. That news was released almost simultaneously with CoreCivic's award of a major new ICE contract to reopen the West Tennessee Detention Facility, which is expected to provide a substantial revenue increase once operations ramp up. For investors considering their next steps, these developments raise the stakes and introduce new questions about how the market is evaluating both stable leadership and a rise in long-term contracted revenues.

CoreCivic shares have shown significant movement, surging about 53% over the past year and more than doubling over the past three years, despite shares being relatively flat in recent months. The stock's year-to-date performance is down slightly, yet a series of meaningful earnings growth and new contract wins suggest momentum may be shifting. The leadership transition and facility reopening both come at a time when investor attention is closely focused on CoreCivic's ability to leverage operational changes for continued earnings growth amidst evolving government partnerships and contract structures.

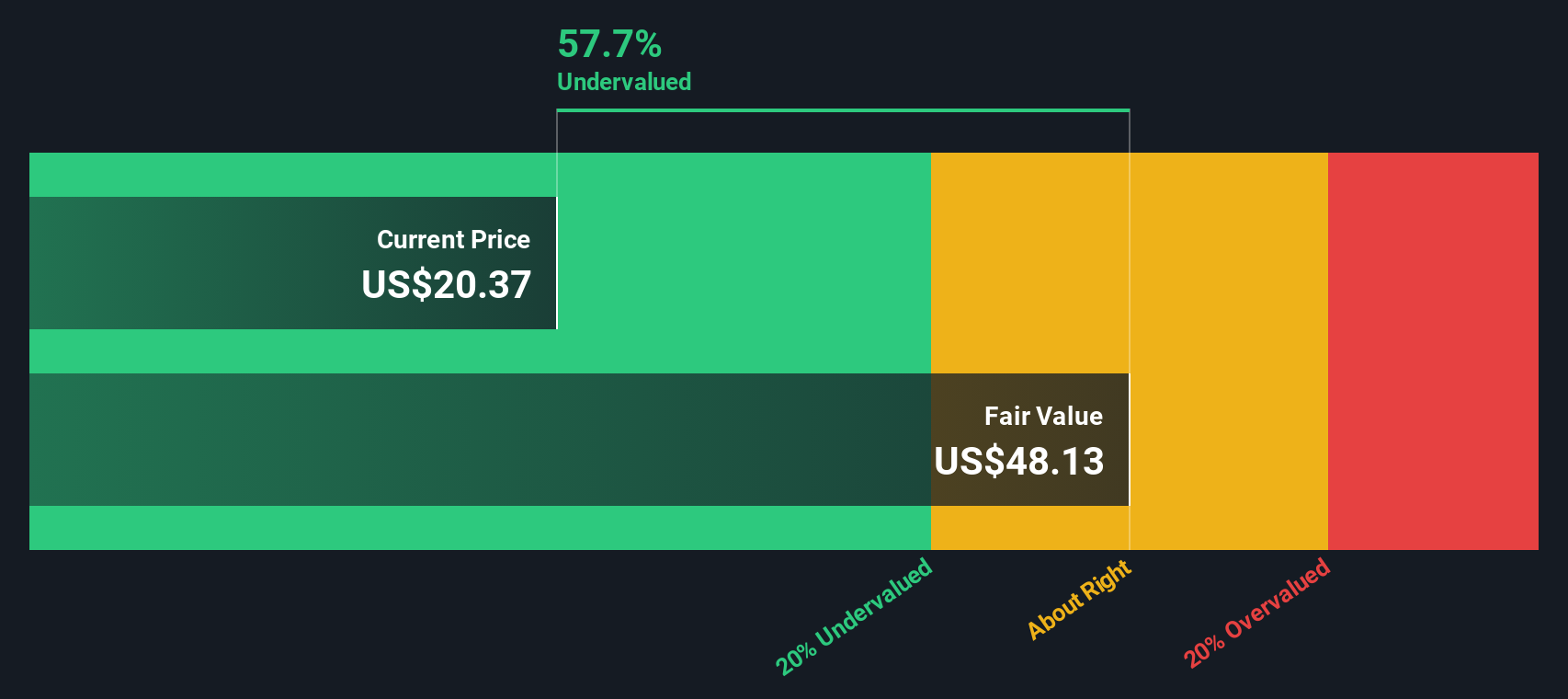

After this year's rally and a series of headline-making announcements, some investors may wonder if CoreCivic represents a missed opportunity, or if the stock could still be trading at a value that does not fully reflect its future growth potential.

Most Popular Narrative: 34% Undervalued

According to the community narrative, CoreCivic is currently trading at a steep discount to its fair value. Analysts believe the market is undervaluing future earnings, stable recurring revenues, and new contract catalysts.

“The unprecedented increase in mandatory government funding for federal detention and border security (notably, $75 billion for ICE and multi-year appropriations through 2029) is catalyzing rapid contracting activity, reactivation of idle facilities, and will significantly boost CoreCivic's recurring revenue and occupancy rates in future quarters.”

Want to know why CoreCivic’s next chapter could surprise even seasoned investors? Discover the bold growth predictions and the pivotal profit margins that underpin this bullish forecast. This is not your typical value case. Find out what financial levers might transform the company’s trajectory.

Result: Fair Value of $31.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in federal policy or contract renewals could derail the bullish outlook. There could be a significant revenue impact if major agreements change unexpectedly.

Find out about the key risks to this CoreCivic narrative.Another View: The DCF Perspective

While some rely on earnings-based estimates to judge CoreCivic's value, our DCF model takes a different approach by focusing on projected cash flows. It also sees the shares as undervalued. Would this more conservative method change your view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreCivic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreCivic Narrative

If you have your own perspective or want to dig into the details independently, you can put together your own outlook on CoreCivic in just a few minutes. do it your way.

A great starting point for your CoreCivic research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with CoreCivic? Unlock your next smart investment move by tapping into some of the best opportunities the market has to offer. Hand-picked themes make it easy to find companies that match your goals. Here are three unmissable places to start right now:

- Boost your portfolio’s yield by focusing on sustainable income with picks from dividend stocks with yields > 3%.

- Get ahead of the curve by researching disruptive businesses transforming healthcare through artificial intelligence, all featured in healthcare AI stocks.

- Catalyze growth with fast-rising names in artificial intelligence by visiting AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXW

CoreCivic

Owns and operates partnership correctional, detention, and residential reentry facilities in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives