- United States

- /

- Commercial Services

- /

- NYSE:CXW

Assessing CoreCivic After a 13.8% Drop and Policy Headlines in 2025

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or sell CoreCivic stock? You are not alone, especially after the swings we have seen lately. The stock closed at $18.02 most recently, and it is fresh off a one-year return of 30.4%. That is an impressive showing, but it is only part of the bigger story. If you look at a longer period, the stock is actually up over 200% in the last five years. This hints at a long-term growth trend that is hard to ignore.

Yet over the past month CoreCivic's share price has slid by 13.8%, and it is down 17.1% so far this year. While some of this can be attributed to changing risk perceptions in the private corrections sector or shifting investor sentiment, several headlines have put CoreCivic in the spotlight. Recent moves by lawmakers to reevaluate incarceration policy and contracts have kept volatility high. At the same time, new state-level agreements have underlined the company’s ability to secure long-term revenue streams. These macro and policy developments have influenced short-term moves, but the underlying numbers continue to draw attention.

Here is where things get interesting for value-focused investors: CoreCivic racks up a perfect 6 out of 6 on our valuation scorecard, which tallies the number of key metrics suggesting the stock is undervalued. In other words, by many traditional measures, this is a company that may be flying under the radar.

If you are wondering how we arrive at that score, and whether valuation ratios paint the whole picture, let us dig into the detailed checks used to crunch those numbers. Stay with me, because there might be an even better way to evaluate CoreCivic before you make your next move.

Approach 1: CoreCivic Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by forecasting its future cash flows and discounting them back to today's value. This method helps investors gauge whether a stock is trading below or above its true worth based on expected cash generation.

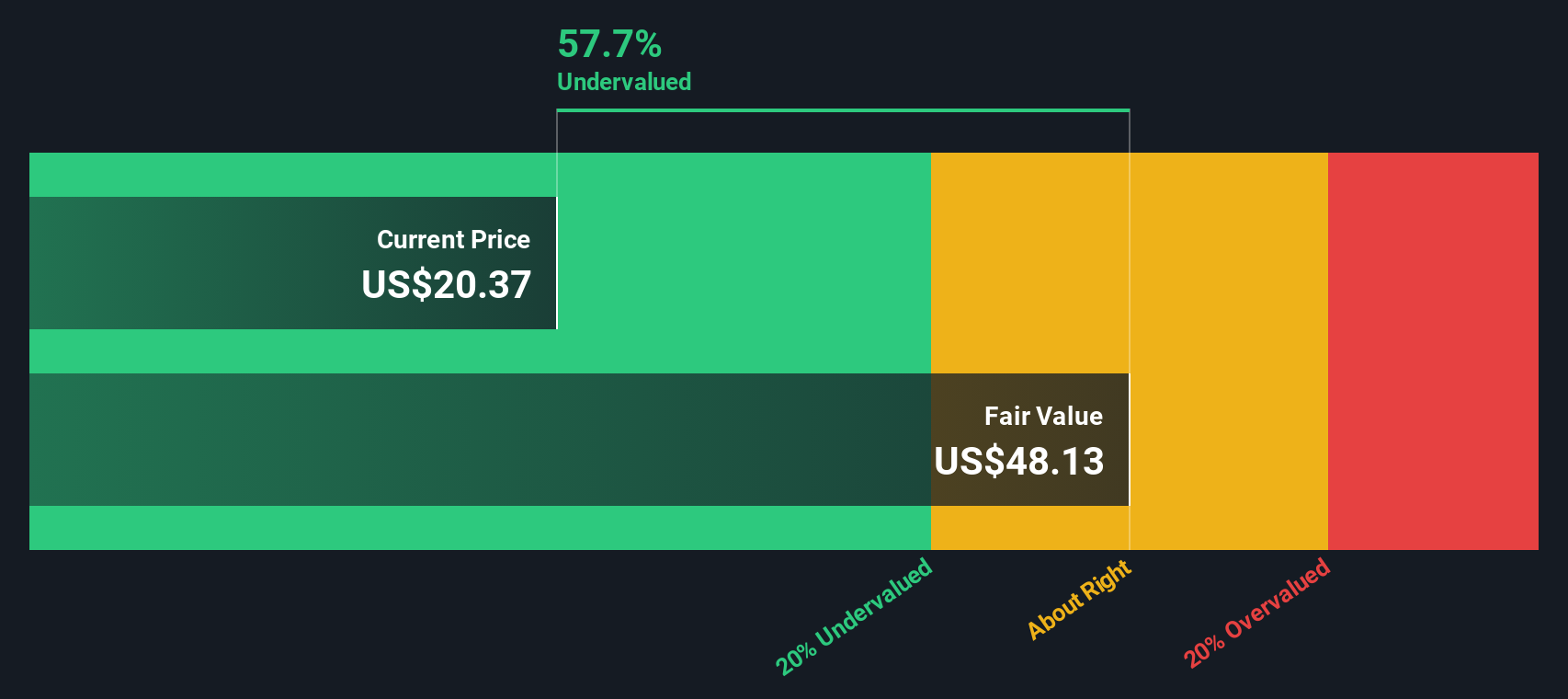

For CoreCivic, the current Free Cash Flow stands at $186.2 Million. Analysts project annual growth, with near-term estimates growing about 10.7% into 2026 and tapering off to approximately 3.4% by 2035. Over the next decade, forecasted Free Cash Flow rises to $318.2 Million in 2035. Projections beyond five years are extrapolated for illustration. All figures are expressed in US dollars.

According to this two-stage DCF approach, the estimated intrinsic value for CoreCivic is $46.35 per share. With the recent stock price at $18.02, the model suggests a 61.1% discount to fair value. This indicates the stock is significantly undervalued using mainstream valuation principles.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CoreCivic is undervalued by 61.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CoreCivic Price vs Earnings

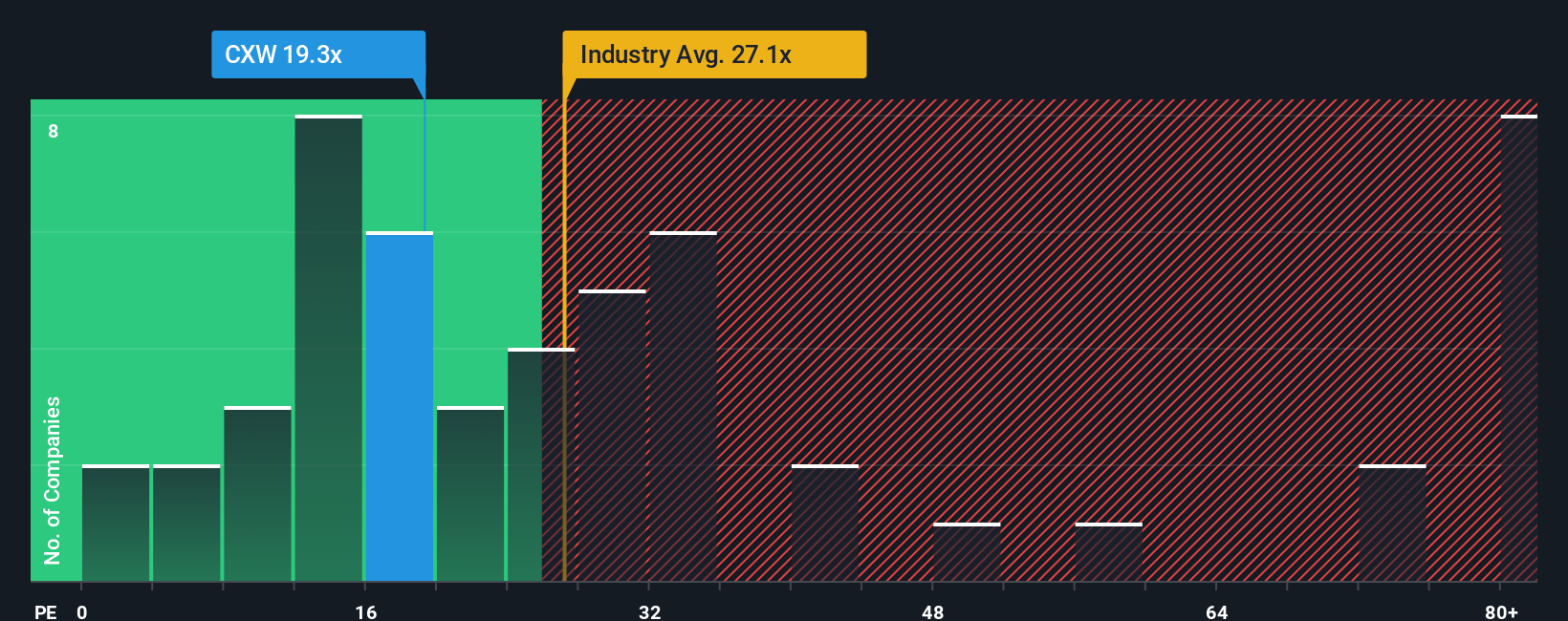

The Price-to-Earnings (PE) ratio is commonly used for valuing profitable companies, as it relates a company’s current share price to its per-share earnings. This makes it useful for comparing companies within the same sector, especially when earnings are stable and positive, as is the case with CoreCivic.

It is important to remember that a “normal” or “fair” PE ratio is influenced by growth expectations and perceived risk. Generally, higher growth and lower risk warrant a higher multiple. In contrast, lower growth or higher risk should see a lower multiple placed on earnings.

CoreCivic currently trades at a PE ratio of 18.5x. By comparison, the commercial services industry averages a higher PE of 26.7x, and CoreCivic’s peers average 22.7x. On the surface, this suggests CoreCivic might be undervalued versus its sector and competitors.

However, Simply Wall St's "Fair Ratio" goes beyond these raw comparisons. The Fair Ratio of 29.3x reflects the multiple that best fits CoreCivic after factoring in key details, such as its earnings growth, risk profile, profit margins, industry positioning, and market capitalization. Unlike industry or peer averages, this proprietary benchmark is tailored to CoreCivic’s specific circumstances and provides a more robust gauge of valuation.

Comparing the Fair Ratio of 29.3x with the actual PE ratio of 18.5x, CoreCivic appears materially undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CoreCivic Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is essentially your personal story or perspective about a company. It connects your unique assumptions about CoreCivic’s future revenue, earnings, and profit margins to a transparent financial forecast and ultimately a fair value for the stock.

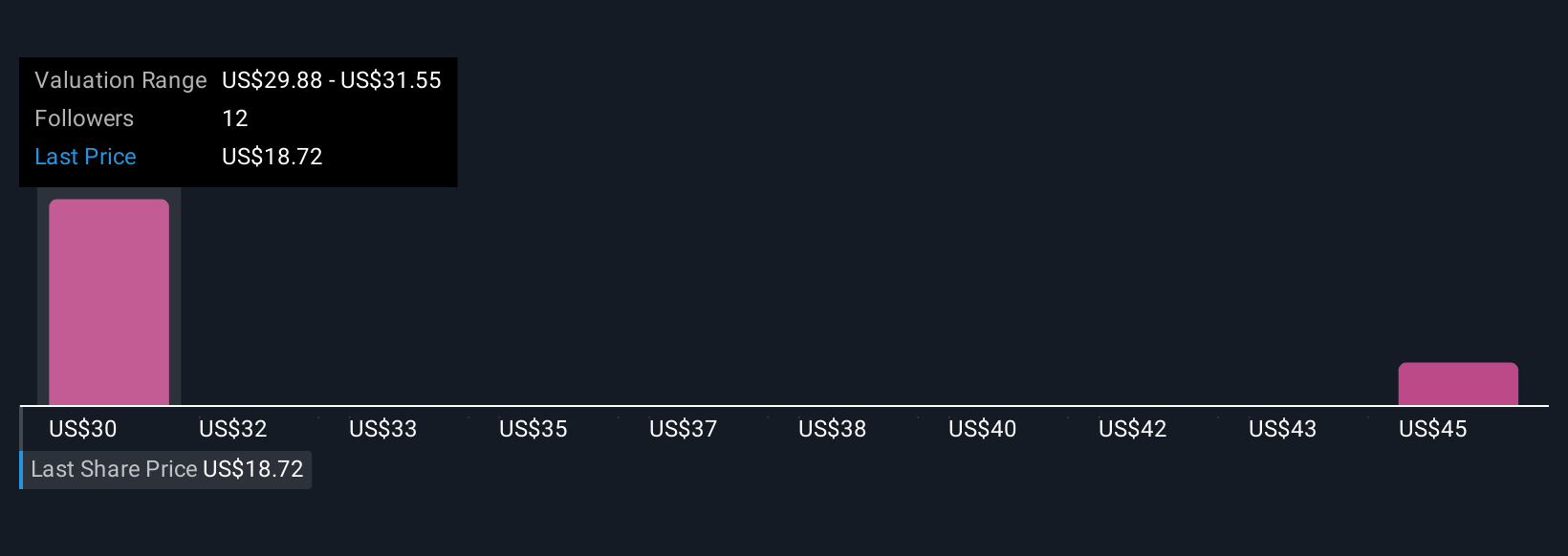

Rather than just relying on static ratios or analyst consensus, Narratives let you express and track your own reasoning, making investing more dynamic and personalized. On Simply Wall St’s Community page, millions of investors use Narratives to link what’s happening in the business, industry trends, and their expectations directly to fair value calculations. This allows investors to visualize if CoreCivic’s current stock price offers an attractive opportunity.

What makes Narratives especially powerful is that they update automatically whenever new information, such as earnings results or major news, is released. This helps you stay current without drowning in data. Say you’re optimistic about CoreCivic’s long-term government contracts and expect earnings to keep rising. Your Narrative might support a higher fair value, closer to $38.00 per share. If you are more cautious about policy risks and ESG pressures, your perspective could point to a much lower fair value around $28.00. No matter your view, Narratives make it easy to compare your logic to the crowd and decide when to buy, hold, or sell.

Do you think there's more to the story for CoreCivic? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXW

CoreCivic

Owns and operates partnership correctional, detention, and residential reentry facilities in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives