- United States

- /

- Commercial Services

- /

- NYSE:CVEO

Civeo Corporation's (NYSE:CVEO) Prospects Need A Boost To Lift Shares

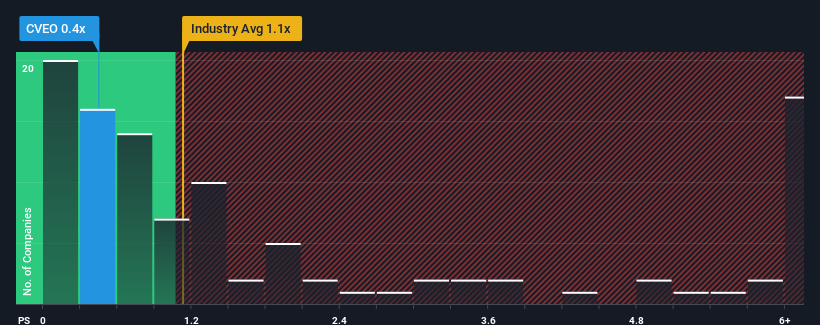

You may think that with a price-to-sales (or "P/S") ratio of 0.4x Civeo Corporation (NYSE:CVEO) is a stock worth checking out, seeing as almost half of all the Commercial Services companies in the United States have P/S ratios greater than 1.1x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Civeo

What Does Civeo's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Civeo's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Civeo.Do Revenue Forecasts Match The Low P/S Ratio?

Civeo's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 2.4% per year over the next three years. With the industry predicted to deliver 8.8% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Civeo's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Civeo's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Civeo maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Civeo's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It is also worth noting that we have found 3 warning signs for Civeo that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CVEO

Civeo

Provides hospitality services to the natural resource industry in Canada, Australia, and the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives