- United States

- /

- Commercial Services

- /

- NYSE:CLH

Why Clean Harbors (CLH) Is Up 7.0% After Landing Major PFAS Filtration Deal At Pearl Harbor

Reviewed by Sasha Jovanovic

- Clean Harbors, Inc. recently announced it secured US$110 million in contracts over three years to expand PFAS water filtration at Joint Base Pearl Harbor-Hickam, where it will now filter about 4.2 million gallons of water daily using regenerative carbon and resin systems.

- An interesting aspect of this development is Clean Harbors’ end-to-end role at the base, co-designing, installing, and fully operating a custom PFAS treatment system in collaboration with V2X and NAVFAC, which highlights its integrated technical capabilities in a complex defense infrastructure setting.

- We’ll now examine how this expanded PFAS filtration role at Joint Base Pearl Harbor-Hickam may influence Clean Harbors’ long-term investment narrative and risk profile.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Clean Harbors Investment Narrative Recap

To own Clean Harbors, you need to believe environmental regulation will keep driving demand for complex hazardous and PFAS treatment where specialized operators can justify their capital intensity. The US$110 million Pearl Harbor PFAS contracts reinforce this thesis, but do not materially change the near term catalyst, which still centers on monetizing its PFAS capabilities at scale, or the key risk around heavy ongoing capex and compliance costs pressuring free cash flow if growth slows.

Against that backdrop, the company’s ongoing share repurchase activity, including roughly US$50.0 million of buybacks completed in the September 2025 quarter, is the most relevant recent announcement. It underlines management’s confidence in the existing earnings base at a time when PFAS related projects like Joint Base Pearl Harbor Hickam could influence how efficiently future capital is allocated and how much balance sheet flexibility remains for additional PFAS or disposal investments.

Yet beneath the PFAS contract headlines, investors should also be aware of the growing risk that rising regulatory and capex demands could...

Read the full narrative on Clean Harbors (it's free!)

Clean Harbors' narrative projects $7.0 billion revenue and $605.1 million earnings by 2028. This requires 5.7% yearly revenue growth and about a $220 million earnings increase from $384.8 million today.

Uncover how Clean Harbors' forecasts yield a $250.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

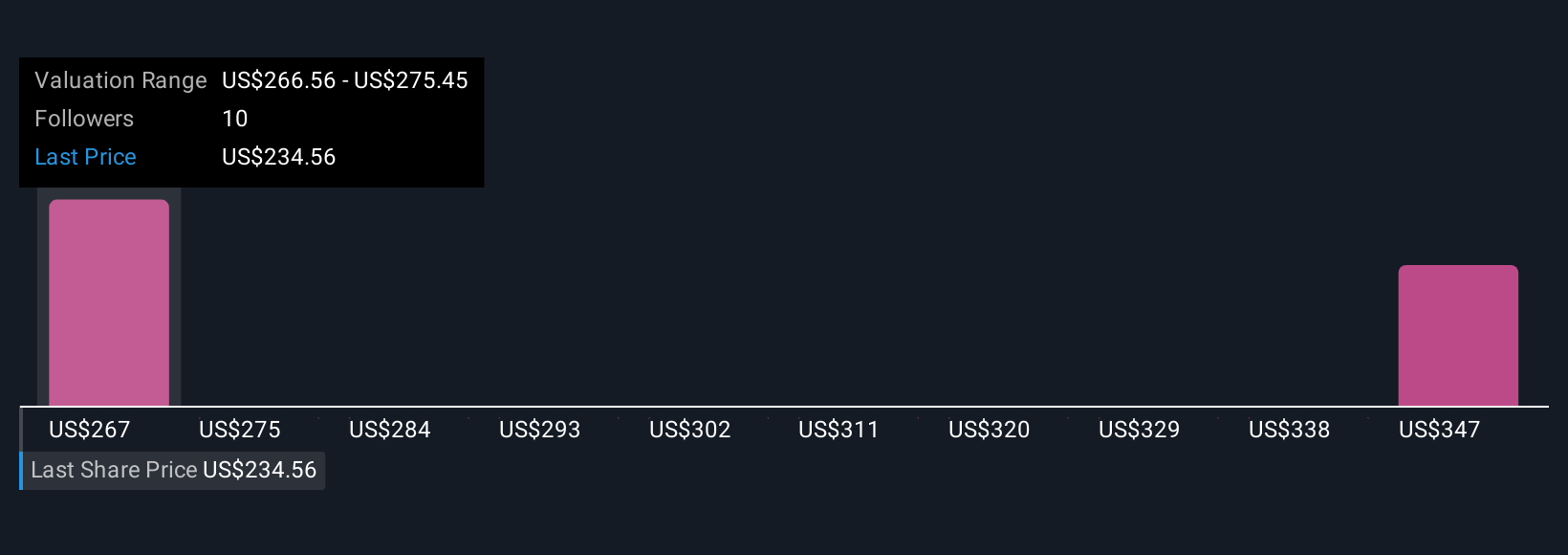

Two Simply Wall St Community fair value estimates span roughly US$250 to US$315 per share, highlighting how far apart individual views can be. As you weigh those opinions, keep in mind that Clean Harbors’ capital intensive PFAS and disposal network can support growth but may also strain free cash flow if new projects or regulations ramp faster than earnings.

Explore 2 other fair value estimates on Clean Harbors - why the stock might be worth just $250.33!

Build Your Own Clean Harbors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clean Harbors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clean Harbors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clean Harbors' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026