- United States

- /

- Commercial Services

- /

- NYSE:CLH

Does Clean Harbors Offer Value After Three Years of Triple Digit Share Growth?

Reviewed by Bailey Pemberton

Thinking about what to do with your Clean Harbors shares? You are not alone. For investors weighing whether to hold, buy, or move on, Clean Harbors is one of those stocks that keeps people curious. On the surface, it has been a mixed ride recently, with a small dip of 0.5% over the past week and 1.7% over the last month. Year to date, the stock is up 1.2%, and if you look back over the past year, it is actually down 5.8%. But when you take a broader view, you get a much different picture: over the last three years, Clean Harbors has surged by an impressive 102.4%, and the five-year return is nearly 287%. Those are the kinds of numbers that don’t happen by accident.

Some of this long-term growth reflects bigger changes in the market’s view of environmental services and sustainability, as well as Clean Harbors’ ability to benefit from new regulatory trends and demand for safer waste management. But does this mean the stock is still undervalued at its current price of $232.28? According to classic valuation checks, Clean Harbors passes 3 out of 6 and notches a value score of 3. That is a solid mark, but it definitely invites a closer look to see how it stacks up using different methods.

Next, let’s dig into those valuation approaches and see what they can really tell us about Clean Harbors. And if you are after a simpler, even more actionable way to judge value, stick around for the end as it might just change how you think about stock analysis.

Why Clean Harbors is lagging behind its peers

Approach 1: Clean Harbors Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to their present value. This helps investors understand what the company's operation is really worth today, given expectations for the future.

For Clean Harbors, the most recent Free Cash Flow was $305.29 million. Analysts forecast a strong rise over the next five years, with estimates climbing to $803 million by 2029. From year six onward, projections are extended using a reasonable growth rate for the sector, which helps capture long-term trends even after analysts’ published numbers run out. All projections are denominated in US dollars.

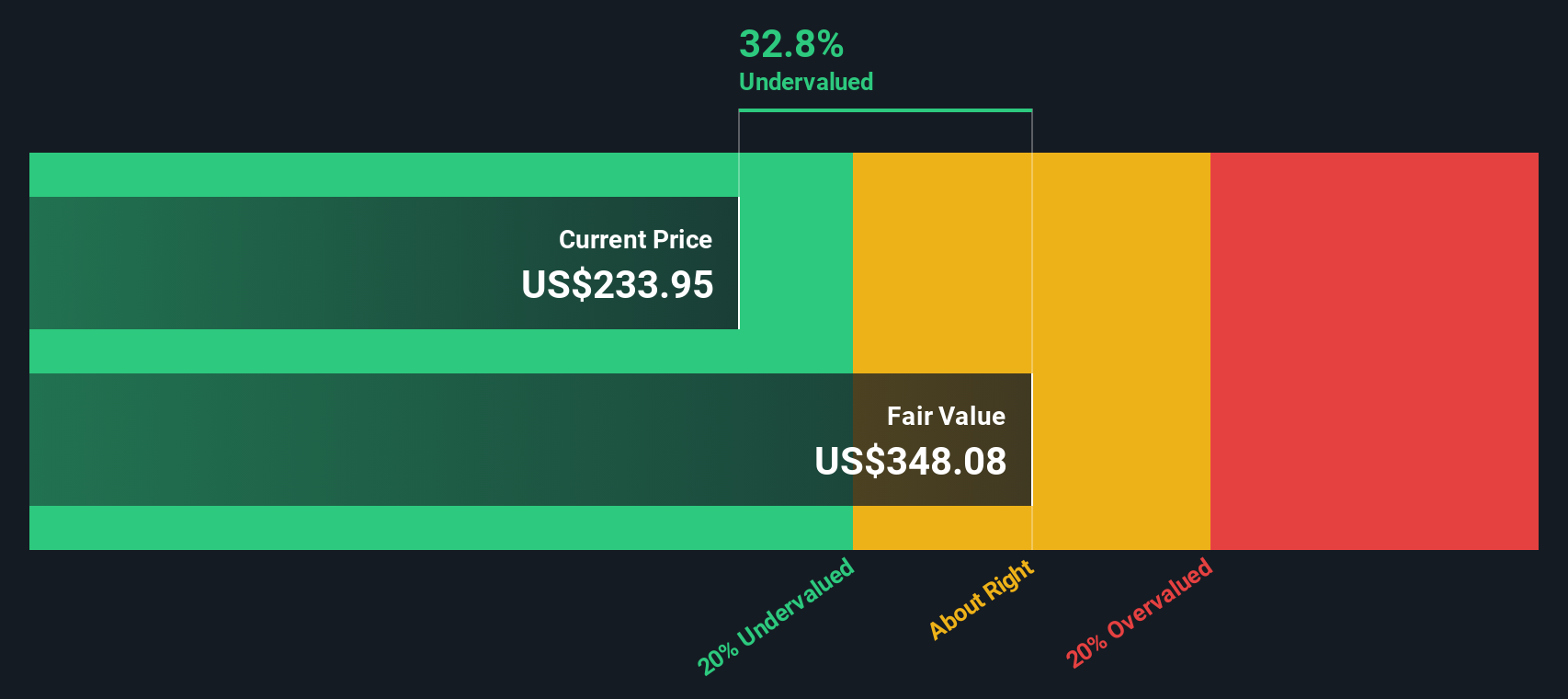

Based on these cash flow forecasts, the current fair value for Clean Harbors comes out to $346.90 per share using the DCF model. At the current price of $232.28, that means the stock is trading at roughly a 33% discount to its intrinsic value. This result suggests substantial undervaluation according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Clean Harbors is undervalued by 33.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Clean Harbors Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred valuation multiple for established, consistently profitable companies like Clean Harbors. It is a simple yet powerful way to determine whether you are paying too much for every dollar of profits the company generates. Growth expectations and risk are included in what the market considers a "normal" PE ratio. Faster-growing firms or those with steadier earnings often justify higher PE ratios, while greater risk or industry headwinds usually warrant lower ones.

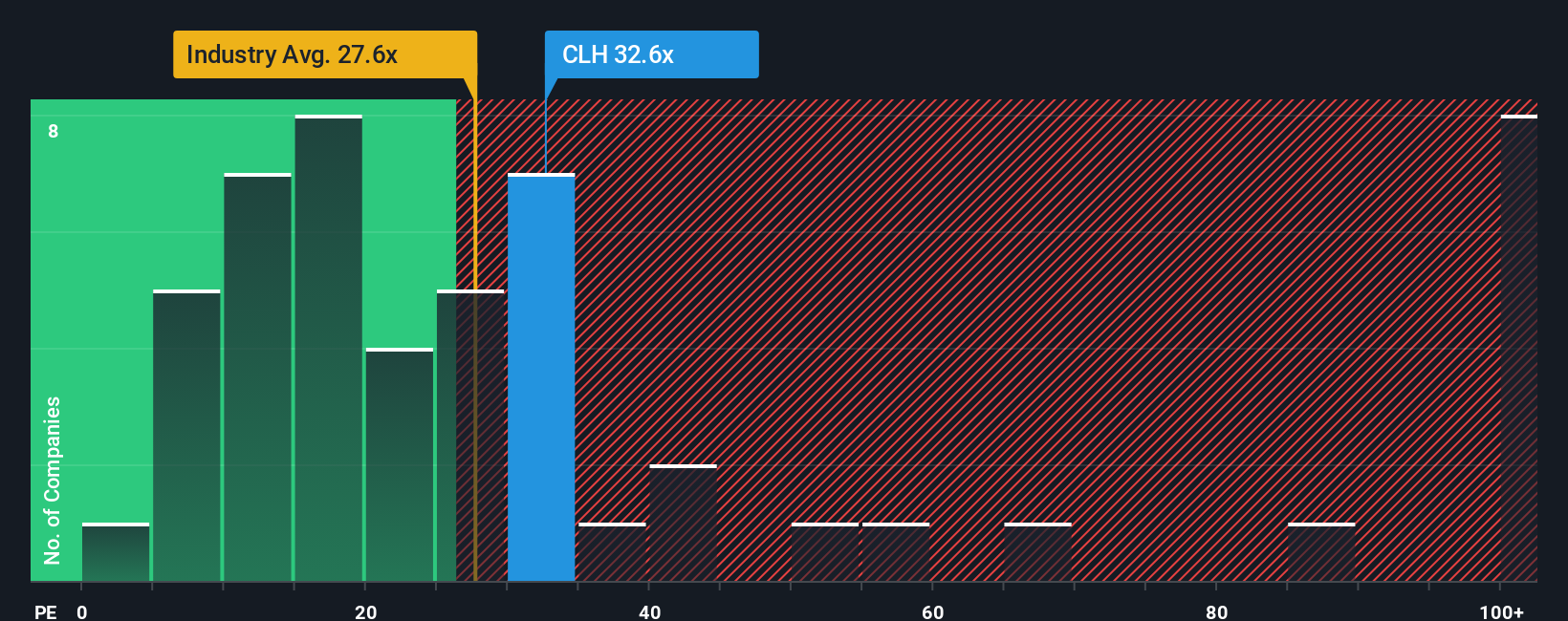

Clean Harbors currently trades at a PE ratio of 32.4x. If you compare this to the Commercial Services industry average of 28.0x and the peer group’s average of 49.5x, the stock sits above the industry norm but below that of its peers. On its own, that is informative, but it does not tell the whole story.

This is where the "Fair Ratio" comes in. It considers more than just industry averages; it factors in Clean Harbors’ specific earnings growth outlook, profit margins, market cap, and risks. In this case, Simply Wall St’s proprietary Fair Ratio model arrives at a value of 28.5x for Clean Harbors, reflecting what a rational investor might pay given the company’s unique performance characteristics and sector backdrop. This approach is more nuanced than simply lining Clean Harbors up against peers because it accounts for business-specific strengths and vulnerabilities.

Since the company’s current PE of 32.4x is slightly higher than the calculated Fair Ratio of 28.5x, Clean Harbors appears to be a bit on the expensive side based on this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Clean Harbors Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a set of numbers; it is the story you tell about a company’s future, connecting your personal perspective on its strengths, challenges, and opportunities to assumptions about revenue growth, margins, and future value. Narratives go beyond raw metrics by linking a company’s story to a tailored financial forecast and, ultimately, to your own fair value calculation.

On Simply Wall St’s Community page, millions of investors are already using Narratives as a simple, dynamic tool to express their views and instantly see how the latest news and results shift their outlook. Narratives empower you to decide when to buy, hold, or sell by comparing your calculated Fair Value to today’s market price, helping you make decisions with real context, not just ratios.

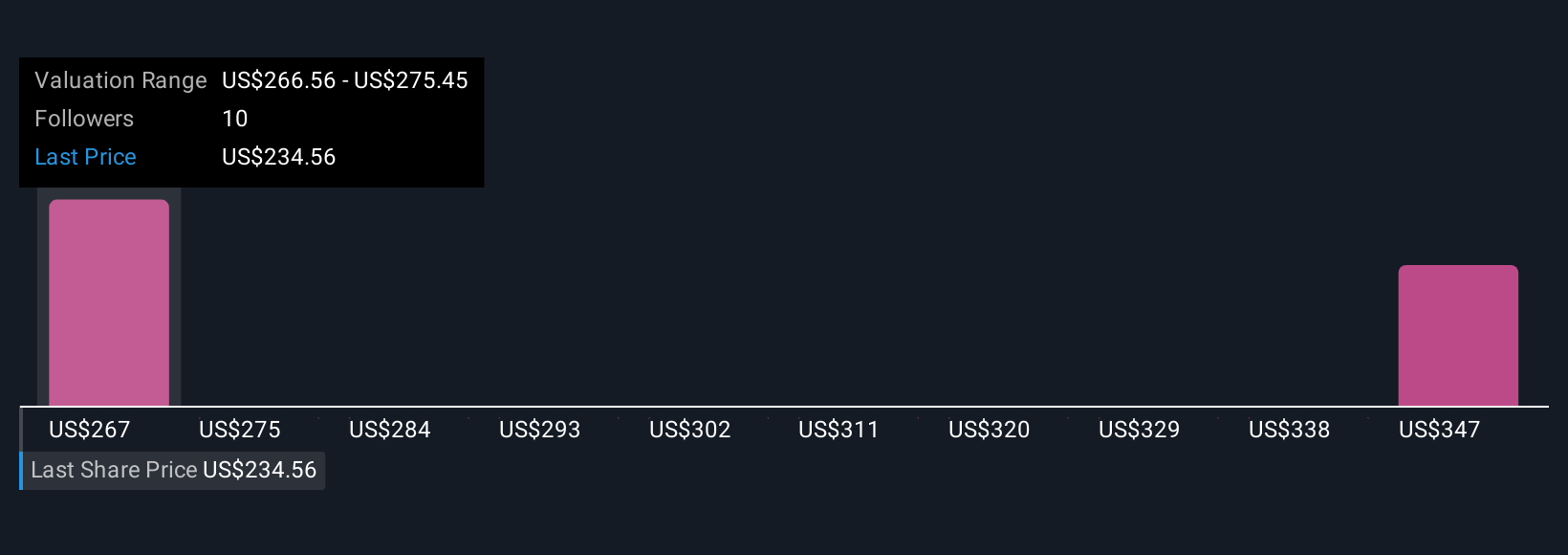

For example, some Clean Harbors investors may be highly optimistic, forecasting long-term growth from PFAS market expansion and giving the stock a Fair Value near $305, while more cautious investors factor in regulatory risks or new technologies and see Fair Value closer to $240. Narratives let you join the conversation, update your assumptions as news breaks, and invest with clear reasoning rooted in your own analysis.

Do you think there's more to the story for Clean Harbors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives