- United States

- /

- Professional Services

- /

- NYSE:CACI

Is There Still Opportunity in CACI After Its 29% Year to Date Surge?

Reviewed by Bailey Pemberton

Trying to decide what to do with shares of CACI International? You are not alone. Investors have watched the stock post a remarkable 103.0% gain over the past three years and an eye-catching 144.6% jump in five years. More recently, the stock has surged 8.6% in just the last week and is up 11.8% over the past 30 days. Year-to-date, holders are sitting on a 29.0% total return, while even the past 12 months have delivered a 4.7% increase.

These kinds of moves have not gone unnoticed. After steadily benefiting from renewed government technology spending and increased market appetite for defense and intelligence services, CACI International appears to be on the radar of both institutional buyers and private investors. Shifts in risk sentiment or optimism about the company's strategic positioning could be fueling the latest climb, but the bigger question now is whether the valuation justifies these gains or if there is still upside left on the table.

To help cut through the noise, take note of CACI's most recent value score: 5 out of 6. That means the company passes five major valuation checks signaling potential undervaluation. But are all valuation methods created equal? In the next section, we will dive into the key approaches most investors use to assess value, and later, I will share an even more powerful technique for understanding what this number really means.

Approach 1: CACI International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a favored valuation approach because it extrapolates a company's expected future cash flows and discounts them back to today's value. This reflects the present worth of all future profits. For CACI International, this model factors in long-term cash flow projections and assesses whether the current share price matches the company's true financial potential.

Currently, CACI International reports Free Cash Flow of $474.6 million. Analysts anticipate continued growth, with projections showing annual Free Cash Flow reaching $795.9 million by 2028. While most estimates extend up to five years, Simply Wall St extrapolates these forecasts to build out the decade-long trajectory. This helps capture longer-term trends and value drivers that may appear beyond the near term.

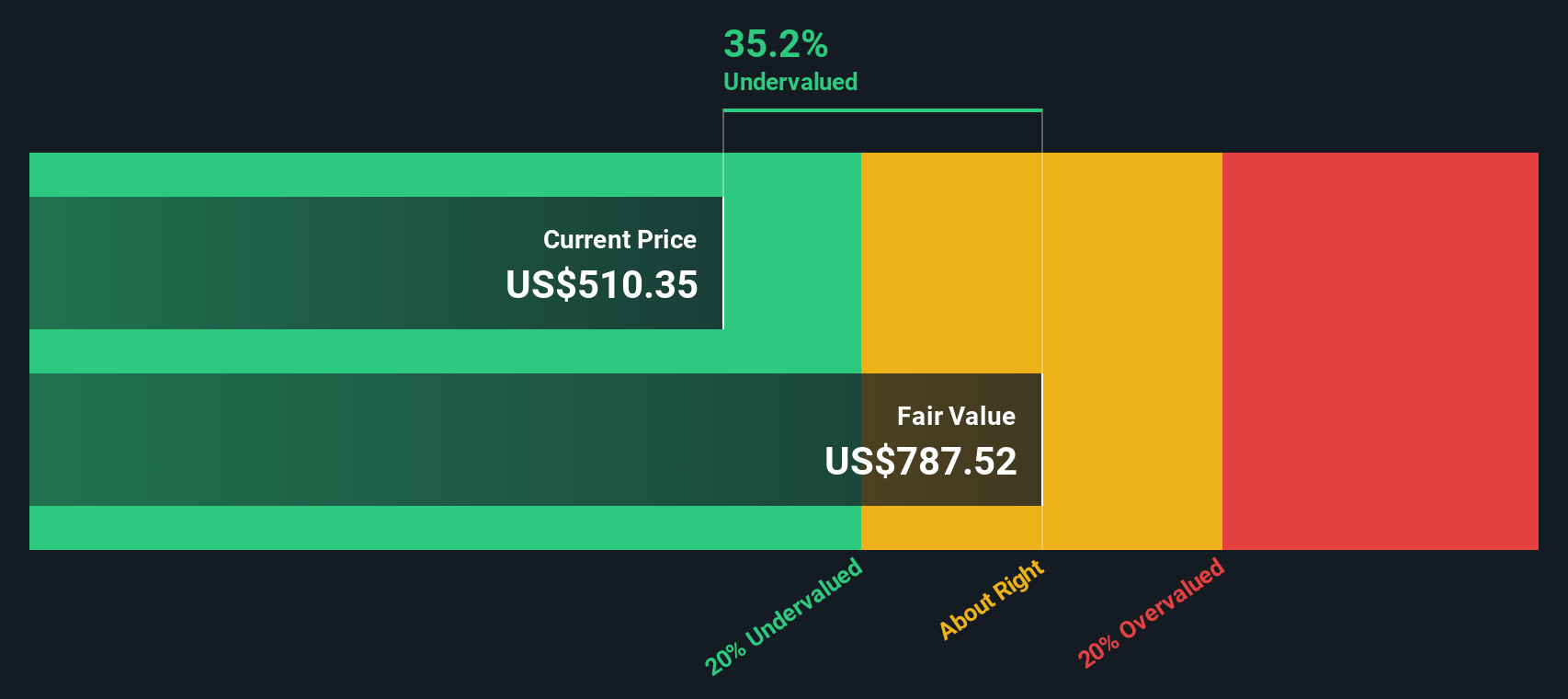

Based on this model, the estimated intrinsic value for CACI International stands at $792.35 per share. This represents a calculated discount of 33.1% relative to the current market price, suggesting that the stock is trading below its underlying worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CACI International is undervalued by 33.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CACI International Price vs Earnings (P/E)

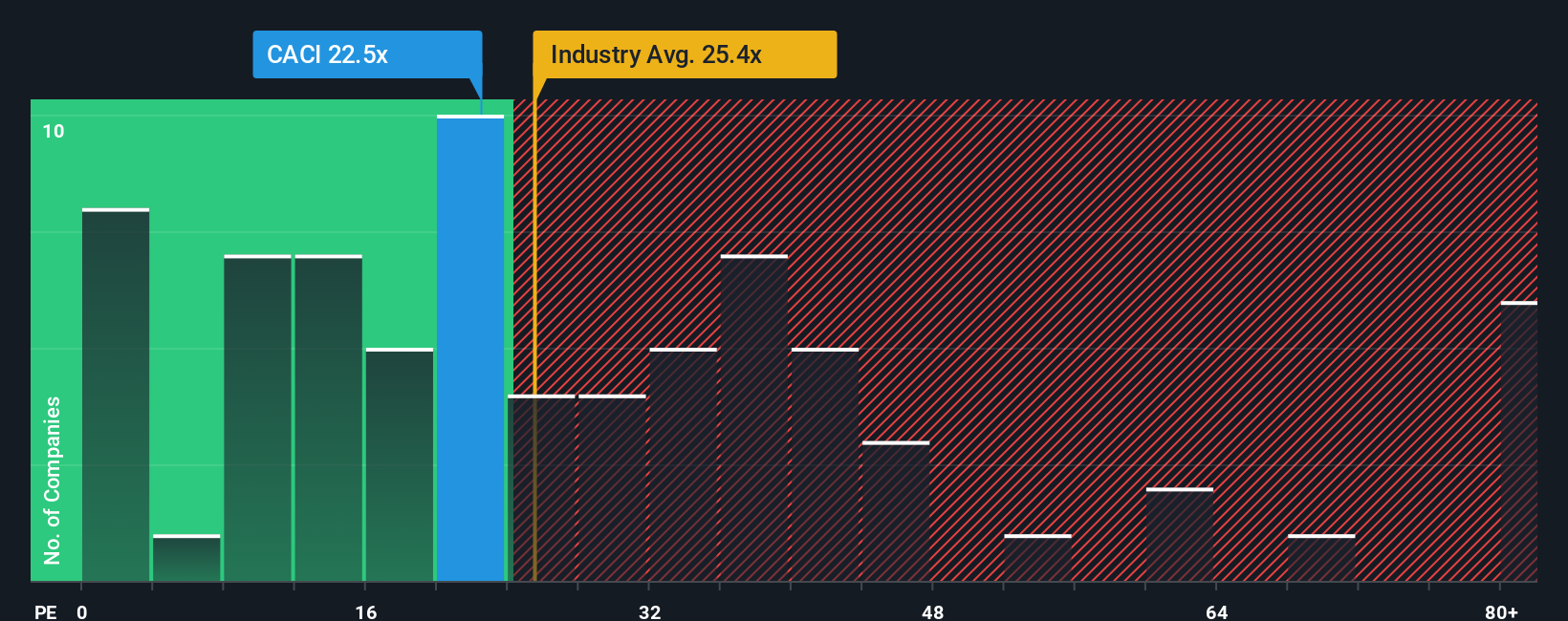

The price-to-earnings (P/E) ratio is widely accepted as a useful valuation tool for profitable companies. This metric tells you how much investors are willing to pay today for a dollar of the company’s earnings, shining a light on how the market values current profitability.

Interpreting the P/E ratio requires some context. Growth expectations and perceived risk play a big role in what investors view as a “normal” or “fair” P/E. A higher P/E can be justified if the company is expected to deliver above-average earnings growth, has stable margins, or faces lower risk. In contrast, a lower P/E ratio may reflect limited growth or heightened uncertainty.

Right now, CACI International trades at a P/E of 23.3x, which is below both the industry average of 26.8x and the peer average of 33.2x. However, instead of just relying on those broad benchmarks, Simply Wall St’s “Fair Ratio” provides a more tailored approach by considering CACI’s specific growth, profitability, risk profile, industry, and market cap. In this case, the Fair Ratio is 26.0x, which is a step above the company’s current multiple. This suggests that, relative to its fundamentals, CACI International may currently be undervalued based on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CACI International Narrative

Earlier, we mentioned there’s an even smarter way to approach stock valuation, so let’s introduce you to Narratives. A Narrative is your story, connecting your personal view of CACI International’s business drivers with forecasts for its revenue, earnings, and profit margins, ultimately shaping what you believe is a fair value for the stock.

This approach doesn’t just rely on the numbers. It links the company’s story, such as why you believe CACI will outperform or where it might face setbacks, to the actual valuation. This creates a bridge between current events, future outlook, and price targets.

Narratives are available and easy to use on Simply Wall St’s Community page, where millions of investors share and compare perspectives. By building your own Narrative for CACI International, you can see clearly when your forecasted fair value is above or below today’s price, helping you make more confident decisions about buying or selling.

What’s more, Narratives are dynamic. They update automatically as soon as new news or earnings reports are released, letting your view stay current. For example, one investor might see CACI’s defense technology focus and strong government funding and set a fair value of $569.42. Another investor, more cautious about risks from government spending cycles or competition, might set a lower fair value near $479.62.

Do you think there's more to the story for CACI International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CACI

CACI International

Through its subsidiaries, provides expertise and technology solutions in the United States, the United Kingdom, rest of Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives