- United States

- /

- Commercial Services

- /

- NYSE:BV

BrightView Holdings (BV): Valuation Insights as EVP Reduces Stake and Hedge Funds Boost Positions

Reviewed by Kshitija Bhandaru

BrightView Holdings (BV) recently saw Executive Vice President Amanda Marie Orders sell 70,000 shares, sharply reducing her stake. At the same time, several hedge funds have been increasing their holdings in the company.

See our latest analysis for BrightView Holdings.

The latest insider selling by BrightView’s EVP and increased stakes from hedge funds have put the spotlight on the company’s recent momentum shifts. After a tough stretch, reflected in a 1-year total shareholder return of -20.22%, the stock is attempting to find its footing following a period of institutional repositioning. While longer-term holders still sit on a 58.6% three-year total shareholder return, this year’s more cautious tone shows investors are recalibrating their expectations as the market digests management’s moves and wider sector pressures.

If you’re curious about what markets are favoring lately, now is a prime time to broaden your investing search and discover fast growing stocks with high insider ownership

Given BrightView’s volatile year and significant institutional moves, the big question is whether the current share price offers untapped value for investors, or if the market has already priced in all foreseeable growth potential.

Most Popular Narrative: 29% Undervalued

With BrightView Holdings’ fair value pegged at $18.69 versus the last close of $13.18, narrative consensus suggests the market is overlooking potential upside. This sets the stage for a closer look at what is really driving this bullish stance.

"Ongoing cross-selling initiatives and the transformation of large one-off development projects into recurring maintenance contracts are already leading to higher customer retention and an anticipated boost in recurring revenue, which supports both revenue growth and improved earnings stability."

Curious about what is powering this valuation? The narrative hints at a financial leap, driven by changes in core business mix, margin expansion plans, and ambitious growth targets for both top and bottom lines. Can the company’s evolving strategy deliver? Tap into the full story to uncover the bold predictions.

Result: Fair Value of $18.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macro headwinds and potential challenges in converting project work to recurring revenue could quickly change expectations for steady growth.

Find out about the key risks to this BrightView Holdings narrative.

Another View: The Market’s Multiple

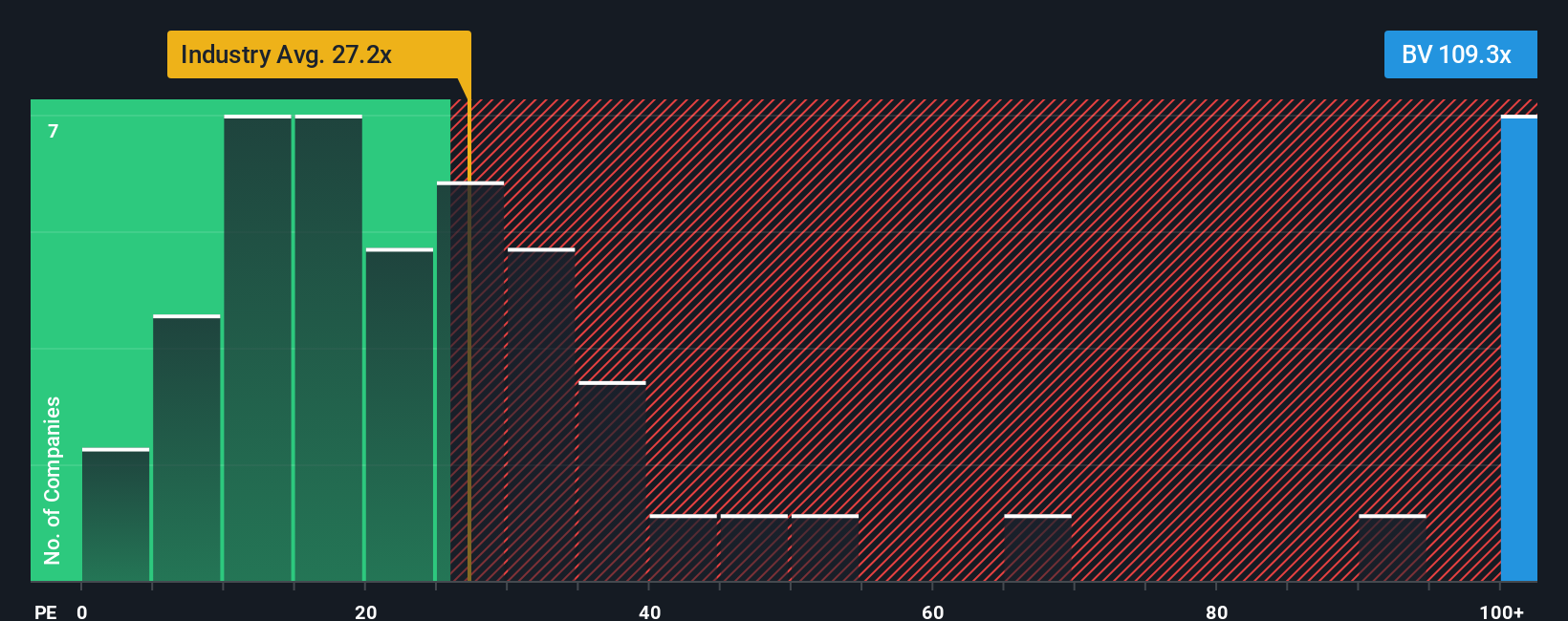

While the analyst consensus points to BrightView being undervalued, the market’s own price-to-earnings ratio tells a more cautious tale. At 108.8x earnings, BrightView trades significantly above both the industry average of 27.2x and the peer group’s 32.4x, as well as its fair ratio of 63x. This sizable gap could hint at valuation risk if expectations fall short. Could the market be getting ahead of itself, or is there a deeper story behind the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightView Holdings Narrative

If you think there’s more beneath the surface or want to dive into the numbers for yourself, it’s quick and easy to craft your own perspective in under three minutes. Do it your way

A great starting point for your BrightView Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss your chance to find tomorrow’s standouts. Let Simply Wall Street Screener lead you to fresh market opportunities you may be overlooking.

- Target bigger yields and add steady income streams to your portfolio when you check out these 18 dividend stocks with yields > 3% with attractive potential.

- Catch the surge of innovation and ride the wave of transformative disruption by scanning these 25 AI penny stocks backed by AI-driven growth.

- Start building exposure to cutting-edge financial trends as you tap into these 79 cryptocurrency and blockchain stocks shaping tomorrow’s digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightView Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BV

BrightView Holdings

Through its subsidiaries, provides commercial landscaping services in the United States.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives