- United States

- /

- Commercial Services

- /

- NYSE:BRC

Brady (BRC): Evaluating Valuation After Upbeat Results, 2026 Outlook and Dividend Increase

Reviewed by Simply Wall St

If you’re eyeing Brady (NYSE:BRC) right now, you’re not alone. The company just reported its fourth-quarter and full-year results, showing sales growth compared to last year but a small dip in net income. On top of that, management rolled out guidance for fiscal 2026, forecasting a sizable jump in GAAP earnings per share. This suggests they’re feeling optimistic about what’s ahead. For long-term holders, the latest boost to the annual dividend and steady buyback activity send a clear message: Brady’s leadership is confident in the company’s value and future earning power.

So how has all this played out for the stock? Over the past year, Brady has delivered a steady 8% return, mirroring its consistent, if unspectacular, earnings profile. Returns over the past three years have climbed to more than 92%. Momentum appears to be picking up again, with the stock rising 17% over the past 3 months as the market digested the recent string of announcements, a combination of growing sales, updated guidance, and ongoing capital returns.

The big question now is whether Brady’s recent run reflects all that future growth, or if there’s still room for upside from here. Is this a window to buy in, or is the market already looking ahead?

Most Popular Narrative: 16.5% Undervalued

According to the most widely followed narrative, Brady's current share price is seen as undervalued compared to its fair value estimate, with analysts projecting notable upside if company targets are met.

Brady's consistent and increasing investment in R&D, especially the recent record spend and focus on high-performance, engineered products (such as the i7500 industrial printer and microfluidics platform), positions the company to capture a greater share of demand from automation, IoT, and digital transformation initiatives in industrial, healthcare, and manufacturing sectors. This sets up the company for sustained organic revenue growth and higher gross margins.

How has Brady managed to earn a valuation edge over industry giants? The core of this narrative lies in bold projections for future revenue, margin expansion, and a profit multiple that is catching the market’s attention. Curious about what big financial bets are fueling this price target? Discover the forecasts and critical numbers that shape this story.

Result: Fair Value of $95.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent trade barriers or sluggish growth in Europe and Australia could reduce profitability and challenge the optimistic outlook for Brady's future gains.

Find out about the key risks to this Brady narrative.Another View: SWS DCF Model Says Undervalued Too

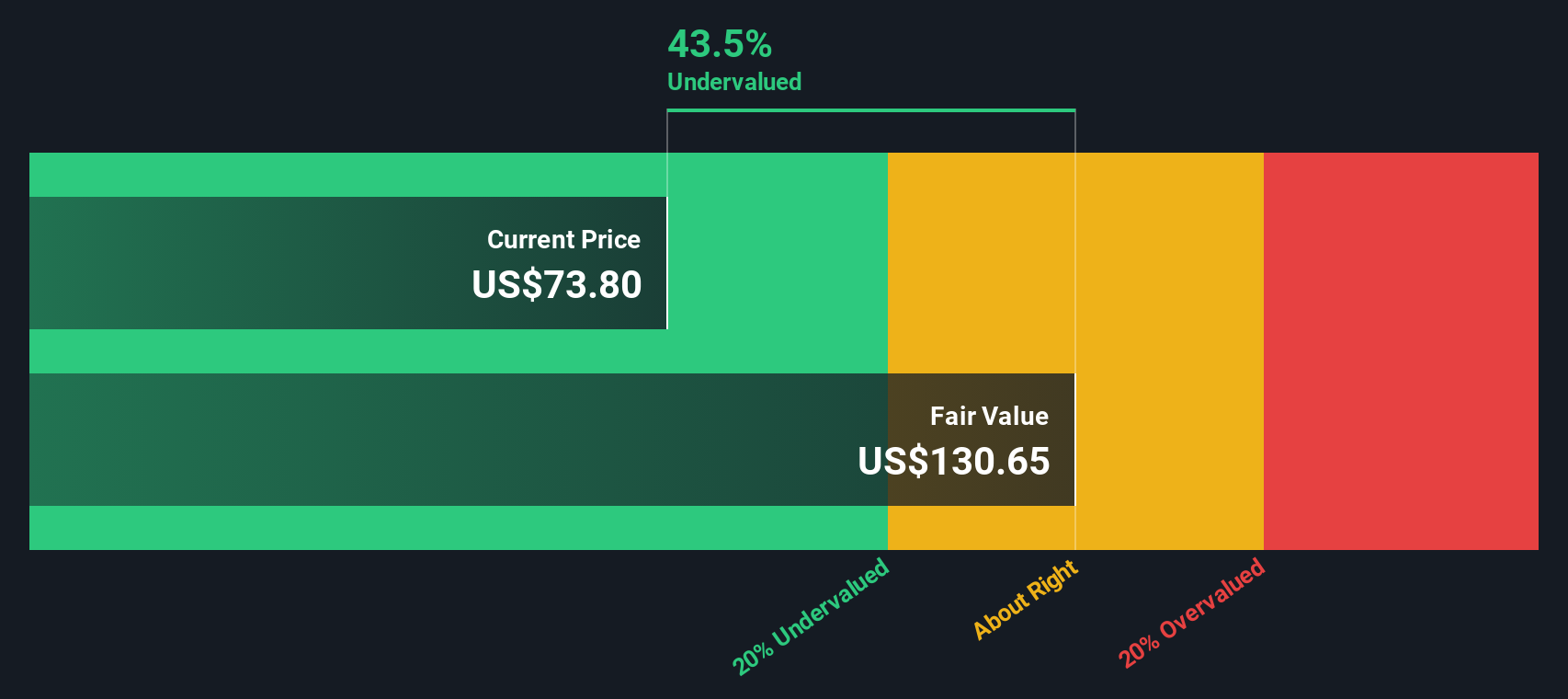

Taking a different approach, our DCF model also finds Brady undervalued based on its expected future cash flows. While the method uses different assumptions, it reaches the same broad conclusion. Could both be right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brady for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brady Narrative

If you think there's another angle, or want to dig into the numbers yourself, you can craft your own unique story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Brady.

Looking for More Smart Investment Ideas?

Don’t miss out on other standout opportunities. Expand your horizons with tailored stock ideas. The right screener can help you get ahead of the curve.

- Unlock upside potential by targeting undervalued opportunities easily with undervalued stocks based on cash flows straight from analysts' cash flow insights.

- Spot resilient income with dividend stocks with yields > 3% featuring companies that consistently deliver strong yields over 3%.

- Ride the technology wave and uncover next-gen winners with AI penny stocks driving advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brady might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRC

Brady

Manufactures and supplies identification solutions and workplace safety products that identify and protect premises, products, and people in the Americas, Asia, Europe, and Australia.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives