- United States

- /

- Professional Services

- /

- NYSE:BR

How Investors May Respond To Broadridge Financial Solutions (BR) Consecutive Dividend Hikes and Upbeat Guidance

Reviewed by Simply Wall St

- Broadridge Financial Solutions recently reported strong quarterly results, increased its annual dividend for the 19th consecutive year, and offered positive fiscal 2026 guidance, reflecting robust revenue, rising net income, and a dividend hike to US$3.90 per share.

- These developments, together with advancements in digital services and technology partnerships, highlight management’s confidence in future growth and ongoing commitment to shareholder returns.

- We'll examine how Broadridge's solid earnings and consecutive dividend increases influence its outlook for revenue growth and resilience.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Broadridge Financial Solutions Investment Narrative Recap

To believe in Broadridge Financial Solutions as a shareholder, you need confidence in its ability to harness digitization, regulatory tailwinds, and technology partnerships to drive recurring revenue and sustained shareholder returns. Recent news about robust earnings, increased dividend, and positive guidance reinforces this narrative but does not materially alter the key short-term catalyst: recurring revenue growth. The biggest risk remains potential pressure on event-driven revenues and sales cycles, which could dampen earnings momentum if macro conditions persist.

The new partnership with BMLL Technologies to offer advanced pre-trade analytics through Broadridge’s trading platforms in Japan is a prime example of the company using innovation to expand its value proposition and support its revenue growth catalyst. By integrating predictive analytics directly into workflows for global sell- and buy-side clients, Broadridge aims to deepen client engagement, which could be important for maintaining and growing its recurring revenue streams.

However, in contrast, investors should be aware that recurring revenue growth could be challenged if longer sales cycles remain persistent or if...

Read the full narrative on Broadridge Financial Solutions (it's free!)

Broadridge Financial Solutions is projected to reach $8.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a 5.3% annual revenue growth rate and a $260 million earnings increase from the current $839.5 million.

Uncover how Broadridge Financial Solutions' forecasts yield a $279.12 fair value, a 7% upside to its current price.

Exploring Other Perspectives

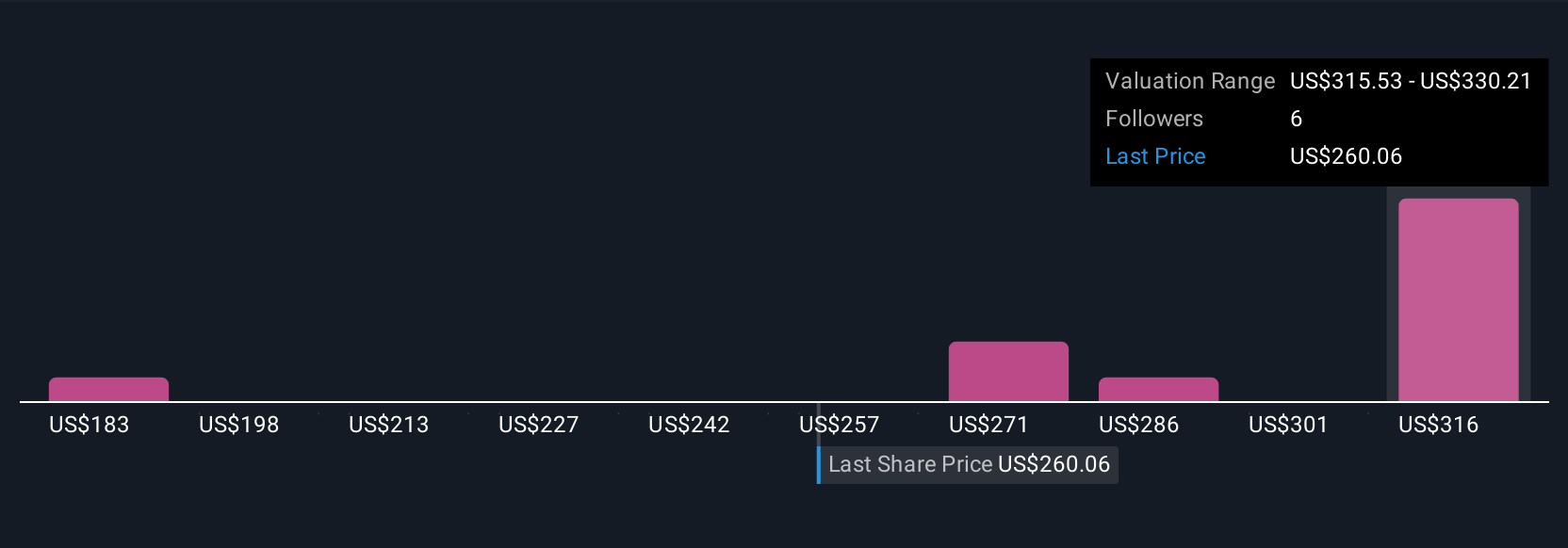

Four Simply Wall St Community members estimate Broadridge’s fair value between US$183.43 and US$330.20, reflecting substantial valuation differences. Persistent longer sales cycles in its core segments may influence these divergent outlooks and highlight why it pays to consider several perspectives.

Explore 4 other fair value estimates on Broadridge Financial Solutions - why the stock might be worth as much as 27% more than the current price!

Build Your Own Broadridge Financial Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Broadridge Financial Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadridge Financial Solutions' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives