Last Update07 Aug 25Fair value Increased 7.51%

The recent increase in Broadridge Financial Solutions' future P/E ratio, despite steady revenue growth forecasts, has contributed to a higher consensus fair value estimate, with the analyst price target rising from $259.62 to $273.50.

What's in the News

- Broadridge announced a strategic partnership and minority investment in Uptiq, integrating AI-driven workflows into its Wealth Lending Network to streamline securities-based lending and enhance credit solution access for advisors.

- The Board approved an 11% increase in the annual dividend, marking the 19th consecutive year of dividend growth.

- Broadridge completed repurchases of 422,130 shares for $100.75 million in the recent quarter, totaling 18.96% of shares since program inception.

- Fiscal 2026 guidance expects 13-18% GAAP EPS growth with closed sales projected at $290 million to $330 million.

- Broadridge reported significant adoption of its instant payments infrastructure among European banks, offering real-time settlement, high resilience, and “active-active” failover capability.

Valuation Changes

Summary of Valuation Changes for Broadridge Financial Solutions

- The Consensus Analyst Price Target has risen from $259.62 to $273.50.

- The Future P/E for Broadridge Financial Solutions has risen slightly from 33.02x to 34.66x.

- The Consensus Revenue Growth forecasts for Broadridge Financial Solutions remained effectively unchanged, moving only marginally from 5.6% per annum to 5.4% per annum.

Key Takeaways

- Growth in digital services, regulatory solutions, and SaaS models is driving more predictable, recurring revenue and supporting margin expansion.

- International expansion and technology leadership in secure, innovative platforms are positioned to boost client retention and long-term earnings resilience.

- Revenue and earnings growth face headwinds from declining event-driven revenues, macro uncertainty, competitive pressures, margin constraints, and disruptive financial technology trends.

Catalysts

About Broadridge Financial Solutions- Provides investor communications and technology-driven solutions for the financial services industry.

- The continued shift toward digitization of financial services, evidenced by Broadridge's growing double-digit digital revenue and rapid increases in digitization rates for regulatory communications (now >90% for equity proxies), positions the company to benefit from rising demand for digital investor communications and lower-cost delivery, supporting long-term recurring revenue growth and future margin expansion.

- Increasing regulatory complexity-such as new requirements in digital assets, shareholder engagement, and disclosure regimes-are creating additional high-margin compliance and governance work; Broadridge is expanding solutions like its voting choice platform (growing from 8 to 400 funds in 2 years) and adding new products in digital asset disclosure, driving sustained growth in regulatory revenue streams.

- Broadridge's leadership in secure, scalable, and innovative transaction processing (including blockchain/tokenization and AI-enabled platforms like OpsGPT and distributed ledger repo solutions) aligns with financial institutions' growing focus on security and the modernization of back-office operations, enabling new product launches, increasing switching costs, and supporting revenue growth and improved operating margins.

- Expansion into international markets, highlighted by the acquisition of Acolin and growing international client wins (e.g., new sales to leading Japanese and Canadian institutions), is expanding Broadridge's addressable market and expected to be a catalyst for top-line revenue growth over the next several years.

- The company's increasing share of SaaS and recurring subscription models, combined with consistently high client retention rates (97–98%), is enhancing the predictability and resilience of revenues and earnings, and positioning Broadridge for sustainable EPS growth and ongoing dividend increases.

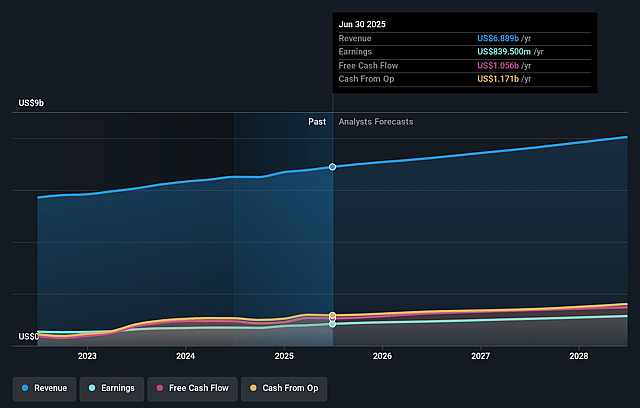

Broadridge Financial Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Broadridge Financial Solutions's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.2% today to 14.2% in 3 years time.

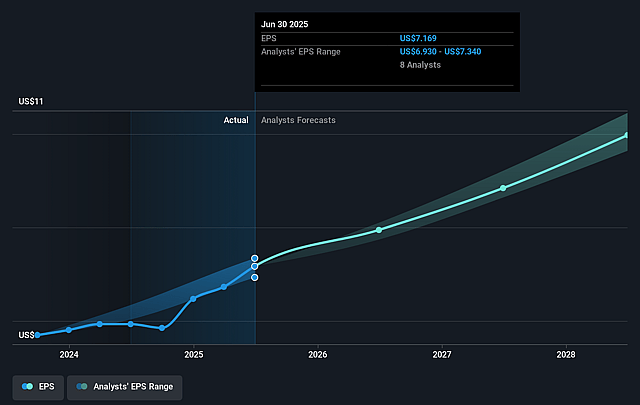

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $9.97) by about September 2028, up from $839.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.1x on those 2028 earnings, down from 35.2x today. This future PE is greater than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.2%, as per the Simply Wall St company report.

Broadridge Financial Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Event-driven revenues, which contributed a record $319 million in fiscal '25 and supported adjusted EPS growth, are expected to decline in fiscal '26, returning closer to their historical average; this presents a risk to year-over-year earnings and revenue growth.

- Longer sales cycles in key segments-particularly GTO (capital markets and wealth)-reflect ongoing macro uncertainty and client hesitancy, which may constrain new sales conversion, impacting future recurring revenue growth and backlog replenishment.

- The transition of some clients away from Broadridge's capital markets offerings, including an exit to an alternate provider causing a 1-point drag on segment growth, illustrates competitive and client concentration risks that could pressure revenue stability.

- Margin expansion may be limited due to headwinds from lower float income (as interest rates fall) and higher distribution revenues (which are low/no margin), risking net margin compression despite underlying operational efficiency.

- While tokenization and blockchain are presented as growth drivers, the broader industry trend toward direct, real-time engagement by investors (disintermediation) and the potential of next-gen financial technology could bypass traditional intermediaries like Broadridge, threatening its core proxy and processing businesses and, longer term, top-line revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $279.125 for Broadridge Financial Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $305.0, and the most bearish reporting a price target of just $240.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.0 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 35.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of $252.37, the analyst price target of $279.12 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.